Gold Price Weekly Forecast: Bears commitment will be tested near $1,930

- Uninspiring Chinese data, easing geopolitical tensions weighed on Gold this week.

- Significant support seems to have formed in the $1,925-$1,930 area.

- US October inflation data could trigger the next big action in XAU/USD.

Gold staged a deep correction this week, declining to its lowest level in nearly a month below $1,950, after several failed attempts to stabilize above $2,000 earlier this month. Next week, several high-tier data releases from the US – including the Consumer Price Index (CPI) for October – and comments from Federal Reserve (Fed) officials could drive XAU/USD’s action.

What happened last week?

The Fed’s cautious policy outlook and the disappointing October jobs data from the US forced the US Dollar (USD) to suffer heavy losses against its rivals in the previous week. In the absence of fundamental drivers on Monday, the USD managed to erase some of its losses and caused XAU/USD to edge lower.

In an interview with ABC News, Israeli Prime Minister Benjamin Netanyahu said that Israel will not allow a general ceasefire until all hostages are released by Hamas but added that he was open to “short pauses”. Meanwhile, the UN Security Council reportedly failed to reach an agreement on a draft resolution to end the conflict following a private session late Monday. Nevertheless, the conflict remained contained within the Gaza Strip and eased fears over a widespread crisis in the Middle East, limiting safe-haven demand for Gold.

On Wednesday, the benchmark 10-year US Treasury bond yield declined to 4.5% and the USD struggled to continue to outperform its rivals. XAU/USD, however, stood on the back foot as well and extended its slide. The data from China, the biggest Gold consumer in the world, showed that the trade surplus narrowed to $56.5 billion in October from $77.71 billion in September. This reading missed analysts’ estimate for a surplus of $81.9 billion and weighed on Gold.

Early Thursday, the National Bureau of Statistics of China reported that the Consumer Price Index declined by 0.1% on a monthly basis in October. This figure revived concerns over consumer activity and made it difficult for Gold to find a foothold.

The number of first time applications for unemployment benefits in the US edged lower to 217,000 in the week ending November 4 from 220,000 in the previous week, the Department of Labor reported on Thursday.

While participating at an International Monetary Fund (IMF) panel late Thursday, Fed Chairman Jerome Powell emphasized the central bank’s data-dependent approach to policy. "We are making decisions meeting by meeting, based on the totality of the incoming data and their implications for the outlook for economic activity and inflation," Powell said. He, however, noted that they were not confident that they have achieved a “sufficiently restrictive” policy stance to bring inflation down to the 2% target over time. This comment triggered a rally in US bond yields and kept Gold from retracing its weekly decline.

Next week

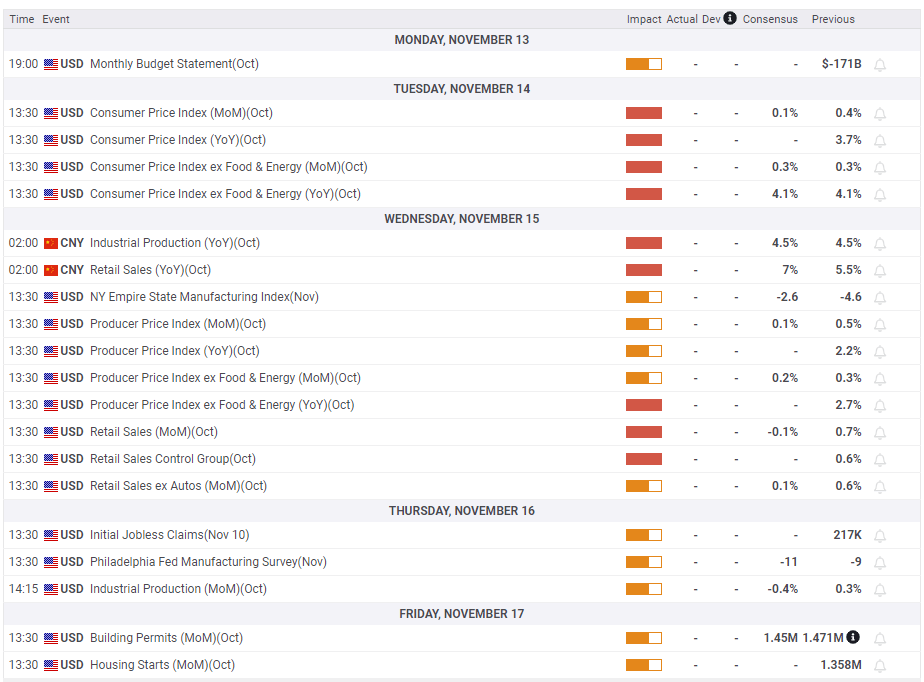

The US Bureau of Labor Statistics will release the October inflation data on Tuesday. The Consumer Price Index (CPI) is forecast to rise 0.1% on a monthly basis and the Core CPI, which excludes volatile food and energy prices, is expected to increase 0.3%. The CME Group FedWatch Tool shows that markets are pricing in a 90% probability that the Fed will leave the policy rate unchanged at 5.25%-5.5% in December. The market positioning suggests that the reaction to a stronger-than-forecast inflation reading is likely to be more severe than a soft print. In case the Core CPI rises at a faster pace than anticipated, investors could reassess the rate outlook and help the USD outperform its rivals. In this scenario, the 10-year US yield could start pushing higher and cause XAU/USD to extend its slide. On the other hand, a weak Core CPI print of 0.2% or lower could make it difficult for the USD to find demand but Gold could have a hard time gathering bullish momentum unless there is a re-escalation of geopolitical tensions.

On Wednesday, October Retail Sales data will be featured in the US economic docket. An unexpected increase of 0.5% or higher could highlight strong consumer activity and provide an additional boost to the USD mid-week.

Next week, investors will continue to pay close attention to comments from Fed officials. If policymakers adopt a dovish tone and confirm a no change in policy after inflation data, the USD could come under heavy bearish pressure. Although the market positioning suggests that such a decision is largely priced in, a clear dovish change in language could revive expectations of rate cuts in 2024 and open the door to a steady advance in XAU/USD. Conversely, the pair’s potential gains are likely to remain capped if officials reiterate data-dependency and opt to wait to see November inflation and employment data before giving further guidance on the interest rate outlook.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart retreated to 50, reflecting the loss of bullish momentum in XAU/USD. Significant support seems to have formed in the $1,925-$1,930 area, where the 200-day Simple Moving Average (SMA), 100-day SMA and the 50-day SMA converge. If Gold falls below that area and starts using it as resistance, $1,900 (psychological level, Fibonacci 38.2% retracement level of the long-term uptrend) could be set as the next bearish target before $1,875 (static level).

On the upside, $1,960 (Fibonacci 23.6% retracement) aligns as immediate resistance before $1,975 (20-day SMA). A daily close above the latter could attract buyers and open the door for an extended rebound toward $2,000 (psychological level, static level).

Gold price forecast poll

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.