Gold price remain uncertain ahead of the US election

-

Investors historically consider gold a safe-haven asset, especially during times of instability.

-

Geopolitical tensions in the Middle East, particularly Iran's threats against Israel, add another layer of uncertainty.

-

Gold prices remain uncertain, with the U.S. presidential election and various economic factors driving volatility.

The heightened political uncertainty stemming from the tight race between Kamala Harris and Donald Trump has had a noticeable impact on financial markets. This has also influenced gold prices significantly. Historically, gold is considered a safe-haven asset. Periods of political or economic instability often drive investors toward it. As the latest opinion polls reflect an unpredictable outcome, demand for gold has strengthened. Investors are seeking protection against potential volatility. The unwinding of the "Trump Trade," which has lowered U.S. Treasury bond yields, has further supported gold prices. Lower bond yields reduce the opportunity cost of holding non-yielding assets like gold. This makes gold more attractive to investors.

Moreover, the Federal Reserve's expectations of further interest rate cuts add to the upward pressure on gold. Signs of a weakening U.S. labour market have reinforced these expectations, with bets increasing on a more accommodative monetary policy. As interest rates decrease, the U.S. dollar tends to weaken, boosting gold's appeal as an alternative investment. Meanwhile, geopolitical tensions in the Middle East add another layer of uncertainty. This is mainly due to Iran's vow to respond to Israel's recent strikes. However, gold prices reached record levels at $2,790 before the US election. These overbought levels have caused prices to turn lower. Since the outcome of the US election is still unknown, gold prices may remain uncertain in the short term. These combined factors will likely keep gold prices uncertain in the short term. Investors continue to hedge against potential risks in the lead-up to the U.S. presidential election. However, if the price drops lower, it may present a good investment opportunity.

Technical outlook

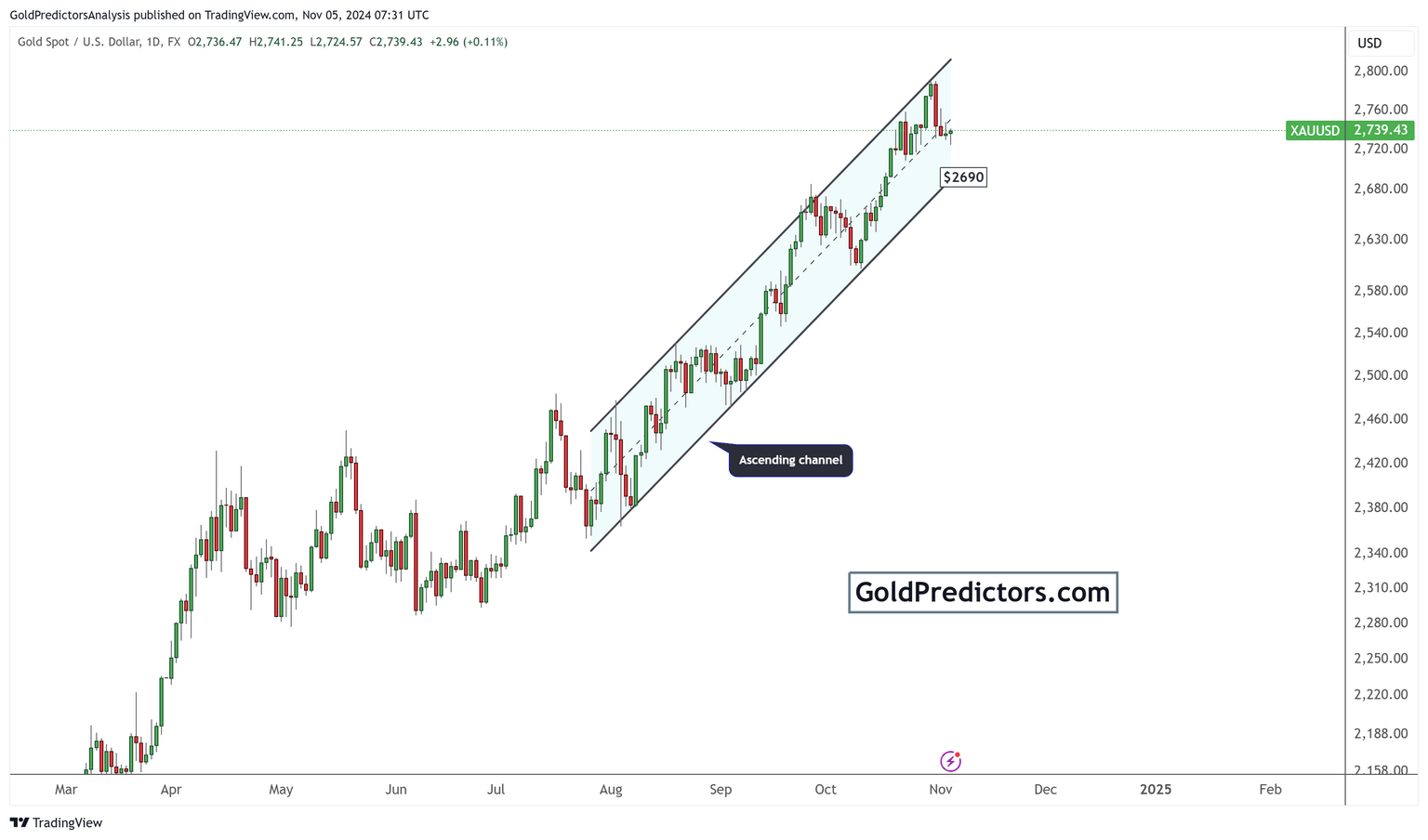

The chart patterns show that prices are trading within a strong uptrend ahead of the election outcome. This uptrend is defined by an ascending channel stretching from the August 2024 lows. The lower trend line of this ascending channel provides strong support for around $2,690. As long as this support holds, the trend remains strongly upward. However, a break below this level could lead to further price drops. The ascending channel has a price target of $2,790, which has been achieved, and the price may now continue to consolidate. The election outcome will further drive market volatility depending on which candidate wins. Each candidate's policies will impact the market in various ways.

Bottom line

In conclusion, the gold market is highly influenced by ongoing political uncertainty. The tight race between Kamala Harris and Donald Trump drives this instability. Global economic and geopolitical factors add to the impact. Demand for gold as a safe-haven asset has increased. Investors are seeking protection from potential volatility. Lower U.S. Treasury bond yields and expected interest rate cuts by the Federal Reserve amplify this demand. Weakening U.S. labour market data also contributes to this trend. Geopolitical tensions in the Middle East, especially Iran's threats to respond to Israel, put upward pressure on gold prices. Technical analysis shows gold is in a strong uptrend with significant support at $2,690. However, the election outcome remains a key driver of future volatility. Gold prices are likely to stay elevated and sensitive to these events.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.