Gold price notches another high after bullish sentiment from Mobius

Gold price rally accelerated in overnight trading as investors reacted to a bullish statement by Mark Mobius. The price soared to $1,905, a few points below its all-time high of $1,920. In a statement, the veteran emerging markets investor said that the price will continue to rise because of negative real rates, a weaker US dollar, and the recent geopolitical issues. Other analysts too have raised their target for gold. In a statement, analysts at UBS upgraded their target to $2,000 while those at Bank of America expects it to reach $3,000.

The New Zealand dollar was little changed during the Asian session as traders reacted to the mixed trade numbers. According to the statistics office, the country exported goods worth more than $5.07 billion in June. That was lower than the $5.40 billion goods it exported in the previous month. Meanwhile, the country purchased goods worth $4.64 billion in June. That was a significant increase from the previous $4.11 billion. As a result, the trade surplus narrowed to $426 million.

The British pound remained relatively stable after the fifth round of Brexit negotiations ended with no deal in sight. In statements, the chief negotiators blamed one another for being inflexible during the negotiations. The main difference is that the UK wants a Canadian style trade agreement. This agreement removes tariffs on most goods and allows the country to set its regulations. The EU has insisted on having a role on UK regulations in order to create a level playing field. Later today, we will receive retail sales and flash PMI data from the UK and the rest of Europe.

EUR/USD

The EUR/USD pair rose to an intraday high of 1.1630, the highest it has been since September 2018. On the daily chart, the price is above the 50-day and 100-day exponential moving averages while the RSI has jumped to the highest level since June. The stochastic oscillator too has moved to the overbought level. Therefore, it seems like bulls are in control, which means that the price is likely to continue rising as bulls target the next support at 1.1650.

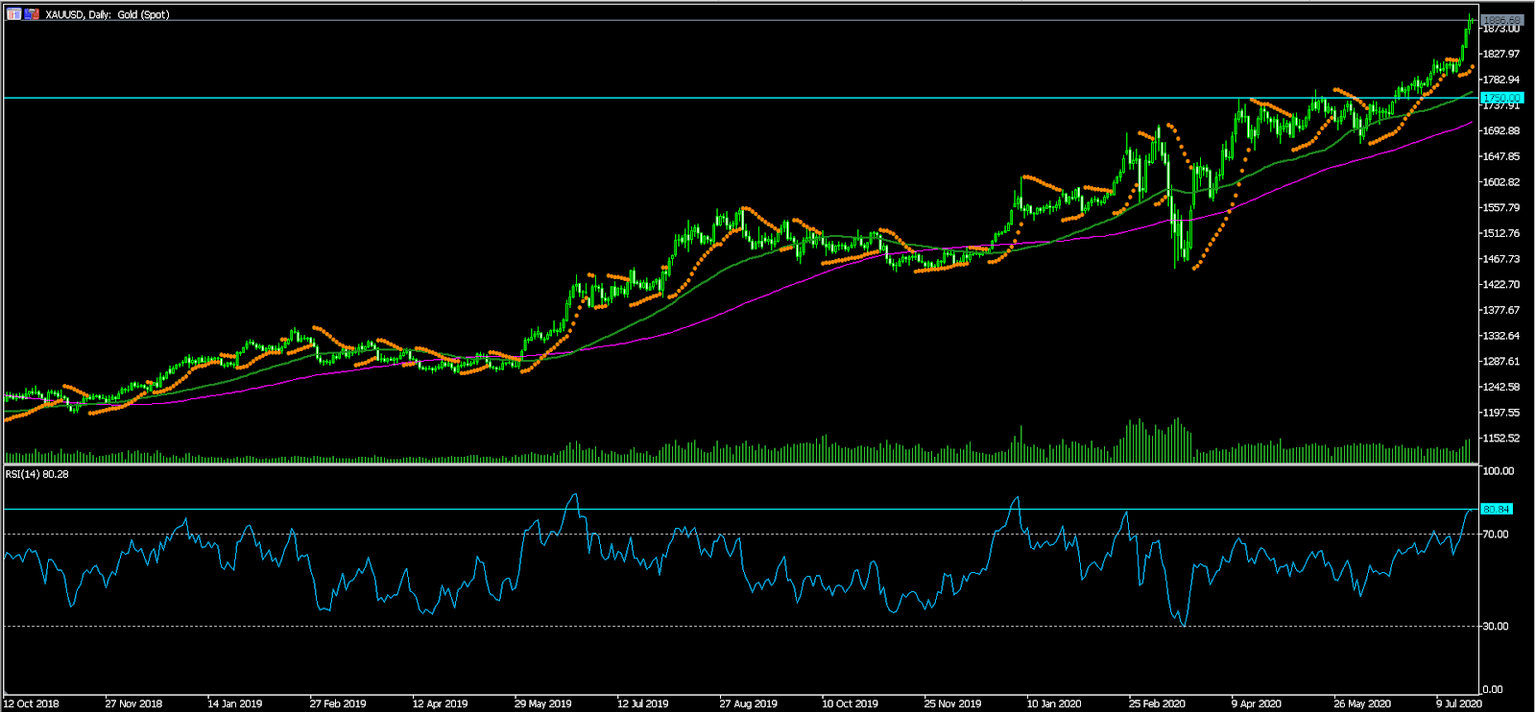

XAU/USD

The XAU/USD pair rose to a high of 1,905, which is the highest it has been since 2011. On the daily chart, the price is above the short and medium-term moving averages while the RSI has jumped to the highest level since February 24. The dots of the Parabolic SAR are still below the price, which is a bullish sign. Therefore, the price is likely to continue rallying as bulls target the all-time high of 1,920.

NZD/USD

The NZD/USD pair is little changed as investors react to mild trade numbers from New Zealand. The pair is trading at 0.6642, which is below this week’s high of 0.6690. On the daily chart, the price is above the 50-day and 100-day EMAs. Also, it is above the ascending trend line that is shown in white. It is above the important support of 0.6600. Therefore, the price is likely to remain in a bullish trend so long as it is above the support of 0.6600.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.