Gold Price Forecast: Fed Powell’s patience powers XAU/USD toward $2,000, US GDP eyed

- Gold price extends a three-day uptrend as Fed Chair Powell powers buyers.

- US Dollar licks its wounds ahead of advance Q2 GDP data, ECB decision is also critical.

- Gold price eyes more gains amid bullish RSI and impending Bull Cross on the daily chart.

Gold price is building on two back-to-back days of gains extending its upswing into a third day on Thursday. Gold price firms up, as the United States Dollar (USD) continues its corrective decline from two-week highs heading toward the US advance Gross Domestic Product (GDP) data release for the second quarter. The European Central Bank (ECB) policy announcements and President Christine Lagarde’s press conference could also stir volatility around the Gold price.

Focus shifts to ECB rate decision and US Q2 GDP

Gold price shined on Wednesday after the US Federal Reserve (Fed) policy announcements combined with Chairman Jerome Powell’s words failed to meet hawkish expectations surrounding another rate hike in September. The Fed raised rates by the widely expected 25 basis points (bps) to a 22-year high of 5.25%-5.50% following its July meeting and left doors open for more tightening this year without committing to the timing of the next lift-off.

Powell sounded upbeat on the overall economic performance amid a tighter US labor market and elevated inflation level. However, he refrained from providing any forward guidance, emphasizing a ‘data-dependent’ and ‘meeting-by-meeting’ approach. Fed President’s message was widely viewed as being patient concerning the Bank’s interest rates outlook, which weighed down on the US Dollar across its major competitors, lifting the non-interest-bearing Gold price to multi-day highs near $1,980. The benchmark 10-year US Treasury bond yields retreated from a 10-day high of 3.922% to near 3.85%, supporting Gold price further.

With the Fed event now out of the way, all eyes remain on the ECB policy announcements and the US preliminary Q2 Gross Domestic Product (GDP) data release, which could offer fresh trading impetus to Gold traders. The ECB is widely expected to hike rates by 25 bps and, therefore, President Lagarde’s presser will be closely scrutinized for any cues on a probable September rate hike. Amid the revival of recession fears in the Eurozone and sticky core inflation, Lagarde remains in a tough spot.

A dovish ECB rate hike, similar to the Fed, could provide extra legs to the ongoing uptrend in Gold price. However, upbeat US Q2 GDP data could check Gold’s flight, as resilience in the US economy could fan hawkish Fed expectations once again. Economists are expecting the US economy to expand 1.8% QoQ in Q2, compared to a 2.0% growth reported previously. Annually, US Q2 GDP is seen rising 3.0% vs. a 4.1% expansion seen in the first quarter.

Gold price technical analysis: Daily chart

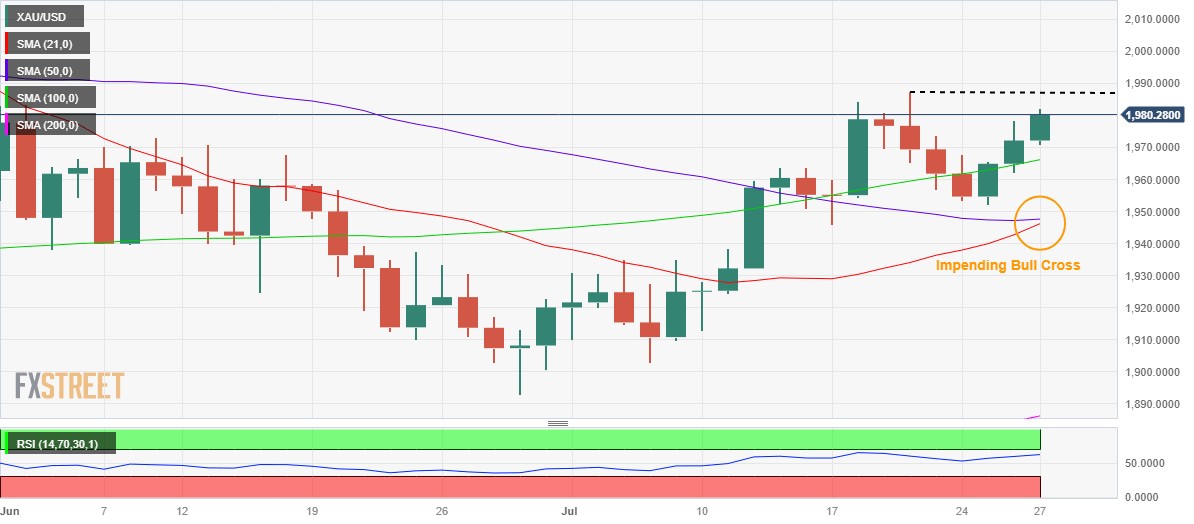

As observed on the daily chart, Gold price is extending its upbeat momentum, having recaptured the bullish 100-Daily Moving Average (DMA) support-turned-resistance, now at $1,966.

The next target for Gold buyers is envisioned at the two-month high of $1,988, above which the $2,000 threshold will be put to test.

The 14-day Relative Strength Index (RSI) points north above the midline while the upward-sloping 21 DMA is set to cross the 50 DMA for the upside, suggesting a Bull Cross.

The technical indicators remain in favor of Gold buyers in the near term.

On the flip side, immediate support awaits at the intraday low of $1,970, below which the 100 DMA of $1,966 will come into play. A sustained break below the latter will expose the confluence of the flattish 50 DMA and bullish 21 DMA at around $1,947.

A fresh downswing will be fuelled below the latter, with Gold sellers poised to challenge the $1,940 round figure thereafter.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.