- Gold Price rebounds from two-month lows but eyes worst month in seven.

- Disappointing US Q1 GDP re-ignites XAUUSD’s safe-haven appeal.

- Gold Price eyes acceptance above Fibonacci 23.6% ahead of US PCE inflation.

Gold Price is holding the higher ground above $1,900, looking to extend the recovery from over two-month lows of $1,872. Despite the renewed upside, Gold Price remains on track to book its worst month in seven on an increasingly hawkish Fed. The rebound in XAUUSD is mainly powered by reviving safe-haven appeal of the metal after the US preliminary GDP showed an unexpected 1.4% contraction in Q1.

The details in the report, however, remain robust, suggesting that the disappointing headline figure is unlikely to deter the Fed’s commitment to fighting inflation. The CME’s FedWatch tool continues to show a 96.5% probability of a 50-bps rate hike in May and an 85% probability that the world’s most powerful central bank will go for another 50-bps raise in June. The US dollar, therefore, is likely to have an upper edge across the G10 fx space, keeping any upside in Gold Price short-lived. Adding to it, the greenback will also likely benefit from looming China’s covid concerns and the EU-Russia energy crisis, courtesy of the Russian invasion of Ukraine.

That said, the fate of Gold Price will hinge on the upcoming Eurozone Q1 Preliminary GDP release while the inflation readings from both sides of the Atlantic will also have a strong bearing on the USD-priced bright metal. The Fed preferred inflation gauge, the Core PCE Index, is likely to arrive at 0.3% MoM in March and at 5.3% YoY, slightly softer than the previous prints. The US Michigan Consumer Sentiment Index for April will be also closely followed ahead of the May 4 Fed meeting. The broader market sentiment and the dollar price action will remain the main market drivers, although the month-end flows could also come into play.

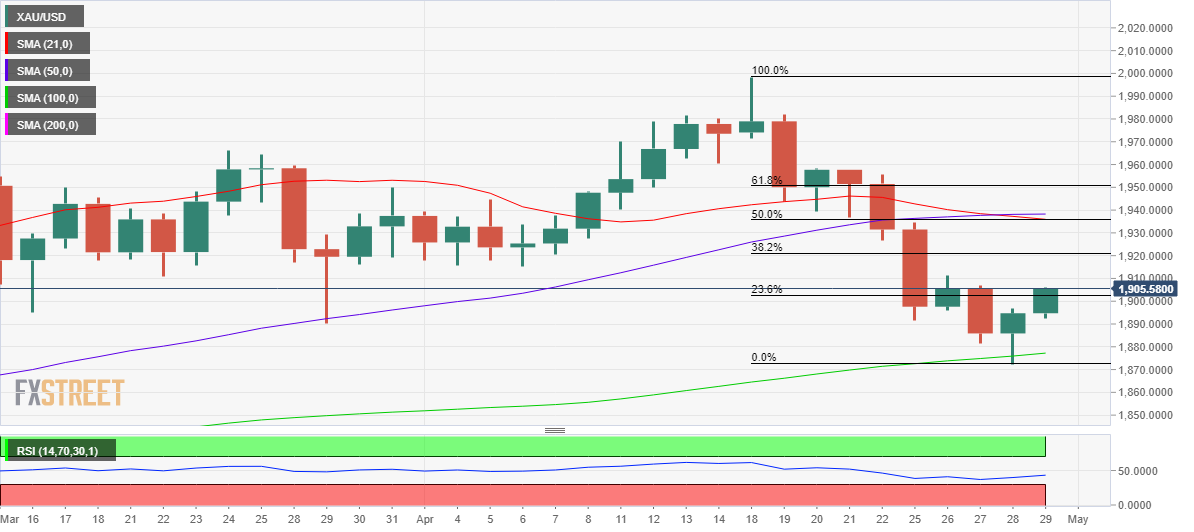

Gold Price Chart: Daily chart

The daily chart shows that Gold Price has recaptured $1,902 hurdle, which is the Fibonacci Retracement (Fibo) level of the correction from April 18 highs of $1,998 to the two-month troughs of $1,872.

If bulls manage to find a strong foothold above the latter on a daily closing basis, then the recovery could extend towards the April 26 highs of $1,911.

Further up, the Fibo 38.2% of the same decline at $1,921 will challenge the bearish commitments.

The 14-day Relative Strength Index (RSI) is edging higher but remains well below the midline, suggesting that the bearish bias remains intact in the near term.

Also, a bear cross confirmed Wednesday is in play, adding credence to the resumption of the downtrend.

Selling resurgence could see a retest of the daily lows at $1,892, below which the April 27 low of $1,881 will be targeted.

Thursday’s low of $1,872 will be the level to beat for XAUUSD bulls should bears keep their sights on the $1,850 psychological barrier.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD falls as Wall Street turns red

EUR/USD turned bearish as Wall Street gives up and major indexes turn red. The pair trades near a fresh weekly low in the 1.0460 price zone. Earlier in the day, the European Central Bank trimmed interest rates as expected, and the United States published discouraging employment and inflation-related data.

GBP/USD dips below 1.2700 as US Dollar surges on risk aversion

GBP/USD finally broke below the 1.2700 mark in the American session, as sentiment shifted to the worse, following dismal US employment and inflation-related data. The poor performance of stocks and an uptick in Treasury yields boost demand for the US Dollar.

Gold could extend its corrective slide

XAU/USD fell towards $2,680 and remains under pressure as investors diggest US figures and the European Central Bank monetary policy announcement. Inflation in the US at wholesale levels rose by more than anticipated in November, according to the latest Producer Price Index release.

-637336005550289133_Medium.jpg)

Chainlink surges amid World Liberty purchase, Emirates NBD partnership and CCIP launch on Ronin network

Chainlink price surges around 15% on Thursday, reaching levels not seen since mid-November 2021. The rally was fueled by the Donald Trump-backed World Liberty Financial purchase of 41,335 LINK tokens worth $1 million on Thursday.

Can markets keep conquering record highs?

Equity markets are charging to new record highs, with the S&P 500 up 28% year-to-date and the NASDAQ Composite crossing the key 20,000 mark, up 34% this year. The rally is underpinned by a potent mix of drivers.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.