Gold Price Forecast: XAUUSD hangs by a thread above $1,700.00

XAUUSD Current price: $1,729.91

- A White House memo dismissing recession chances underpinned the market’s mood.

- The greenback remains strong amid recession fears and ahead of US inflation data.

- XAUUSD has room to test $1,676.73, the 2021 yearly low.

Gold Price remains under pressure on Tuesday, falling to $1,723.15 a troy ounce at the beginning of the day, a fresh 2022 low. Financial markets remain in a risk-off mood amid fears of a global recession in the middle of soaring inflationary pressures.

The dollar kept rallying as investors seek safety, although the greenback pared gains during the American session. A slightly better market mood came from a White House memo, which noted that US macroeconomic data, including the June jobs report, are not consistent with a recession. The document added that “labor market strength puts the US in a better position than many other countries to transition to lower inflation and steady growth.”

XAUUSD managed to bounce back and currently hovers around $1,730 as equities shrug off the early dismal sentiment. European indexes managed to post modest gains, while Wall Street trades in the green at the time being. At the same time, US Treasury yields eased from their weekly peaks as investors await US inflation figures.

The country will release the Consumer Price Index on Wednesday, which is expected to show inflation reached a new multi-decade high of 8.8% YoY in June. The core inflation reading, however, is expected to have eased from 6% to 5.8% in the same period.

Gold Price short-term technical outlook

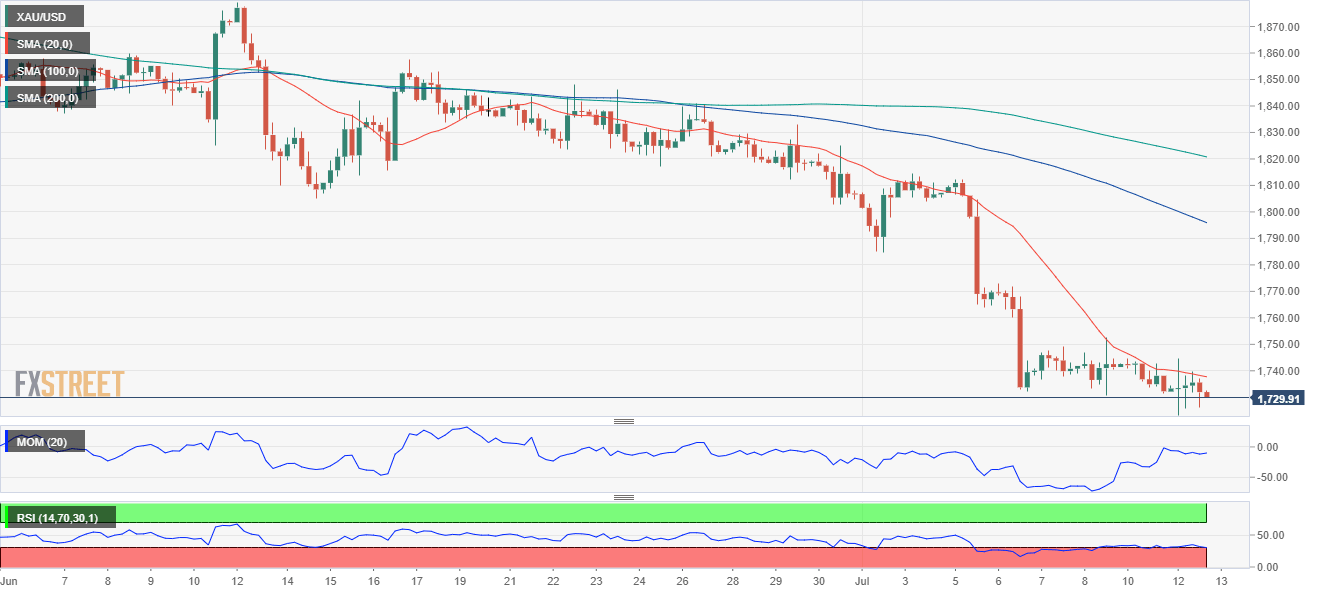

The daily chart for XAUUSD hints at persistent selling interest. The bright metal reached a lower low, far below bearish moving averages. Additionally, technical indicators have extended their declines within oversold territory without signs of bearish exhaustion.

Gold is neutral-to-bearish in the near term. The 4-hour chart shows that a bearish 20 SMA continues to cap advances, but losing its bearish strength. The longer moving averages, however, remain firmly bearish far above the shorter one. Technical indicators, on the other hand, remain flat within negative levels, lacking directional strength.

Support levels: 1,720.30 1,708.50 1,695.90

Resistance levels: 1,741.60, 1,752.50 1,765.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.