Gold Price Forecast: XAUUSD close to confirming a long-term double top

XAUUSD Current price: $1,717.15

- Tepid US employment-related data and month-end flows weighed on the greenback.

- US Treasury yields eased from their recent highs but remain at the upper end of their monthly range.

- XAUUSD is technically bearish, although losing downward momentum in the near term.

Spot gold fell to a fresh monthly low of $1,709.61 a troy ounce, maintaining the red but off the mentioned low at the time being. The dollar surged throughout the first half of the day but lost steam following the release of tepid US employment-related data. The ADP report showed that the private sector added 132K new job positions in August, much worse than the 288K expected and below the previous 270K.

The greenback is also suffering from month-end flows, but the pullback has been quite limited, somehow suggesting that dollar buyers are far from done. US Treasury yields are retreating from their early highs but holding at the upper end of their latest range, with the 10-year note currently yielding 3.11%. Wall Street, in the meantime, struggles to turn green, with the major indexes seesawing around their opening levels.

Gold price short-term technical outlook

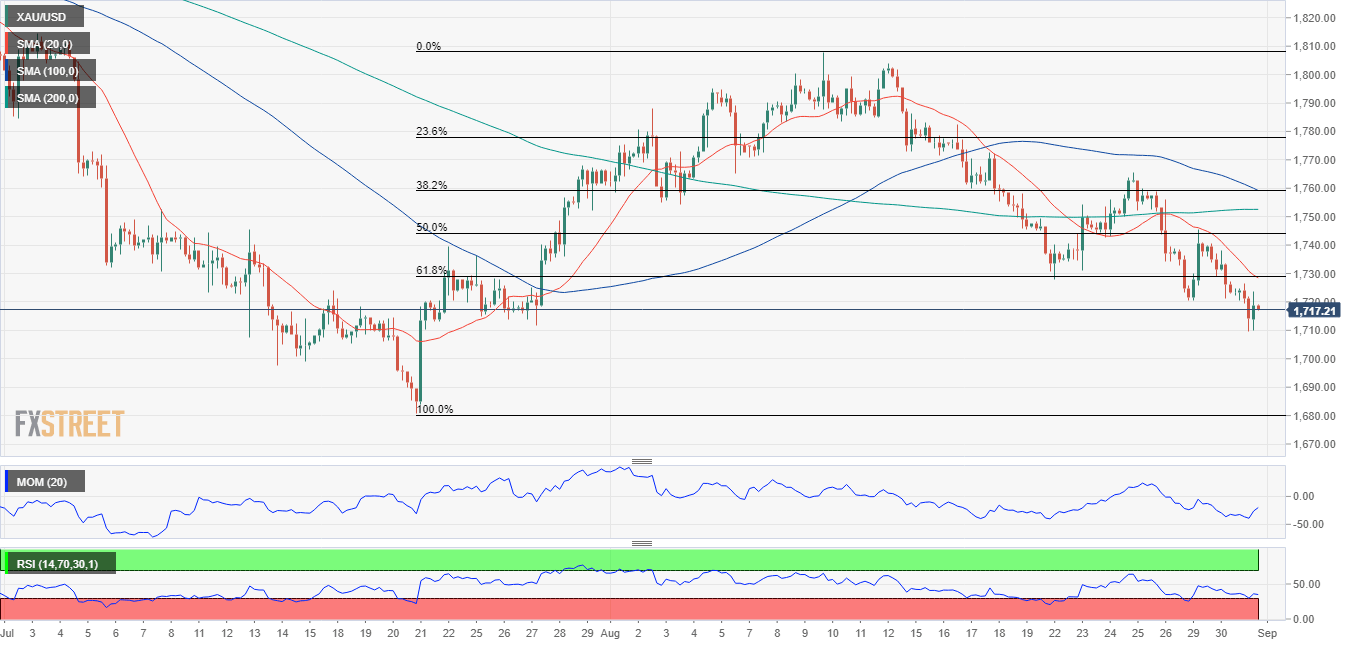

XAUUSD is closing a fifth consecutive month with sharp losses and is about to confirm a long-term double-top pattern. The pair reached record highs in the $2,070 price zone in August 2020 and March 2022, while in between, it posted relevant lows in the $1,670 area, which is now the neckline of the figure. A clear break below it should imply a $400 slump.

Technical readings in the daily chart favor the downside, although indicators are losing their bearish strength near oversold readings, suggesting the bright metal may soon correct some of its recent losses. Nevertheless, it remains well below bearish moving averages, also below the 61.8% retracement of its latest daily rally at $1,729.25, the immediate resistance level.

In the 4-hour chart, technical indicators aim higher within negative levels, reflecting the ongoing near-term recovery, but falling short of suggesting further gains. The 20 SMA has extended its decline and now converges with the aforementioned Fibonacci resistance, reinforcing it.

Support levels: 1,703.90 1,692.35 1,684.00

Resistance levels: 1,729.25 1,744.20 1,759.20

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.