Gold Price Forecast: XAU/USD’s rebound appears limited, focus on ADP, yields

- Gold price rebounds amid yield curve inversion, ringing recession alarm.

- US dollar drops with Treasury yields, aiding the renewed upside in gold price.

- Gold’s recovery could gain traction above $1,931, focus shifts to US jobs, Ukraine updates.

Gold price witnessed good two-way businesses on Tuesday, although it booked the second straight daily loss, as bears refused to give up amid mixed market catalysts. In the early part of Tuesday’s trading, gold price attempted a tepid recovery, as the US dollar appeared broadly subdued amid an improved market sentiment, courtesy of the economic measures rolled out by Shanghai city to lessen the impact of the covid lockdowns. Meanwhile, the flattening of the yield curve also intrigued gold buyers.

The rebound in gold price, however, quickly faded and the bright metal tumbled nearly $40 after the risk-on mood flourished in full swing after Russian Deputy Defence Minister Alexander Fomin pledged to reduce its military activity in Ukraine, specifically around the capital Kyiv and Chernihiv. Gold price hit five-week lows at $1,890 before staging a decent comeback to $1,920 at the close. The turnaround in XAUUSD could be attributed to increasing risks of a US economic recession, as the 2-year and the 10-year Treasury yield curve inverted for the first time since September 2019. Although it was a momentary inversion, investors turned cautious and flocked to the ultimate safety net in gold price. Gold traders also digest upbeat comments from Philadelphia Fed President Patrick Harker.

Heading towards the US ADP Employment report showdown on Wednesday, gold price is replicating moves seen in Tuesday’s Asian trading. XAUUSD is looking to extend the rebound, as the US dollar loses ground alongside the Treasury yields. Gold price is reversing the previous decline, as optimism over a potential ceasefire between Russia and Ukraine fades while the US and its Western allies remain skeptical over the de-escalation of the conflict. The Pentagon said Ukraine’s capital Kyiv remains under threat while US President Joe Biden said he’ll wait and see whether Russia delivers on a pledge made after peace talks in Istanbul.

The focus will remain on a fresh batch of top-tier US economic releases, including the ADP employment and the final Q4 GDP revision. The developments surrounding the Ukraine-Russia war and the yields’ price action will continue to remain the main drivers, influencing gold price.

Read: US ADP Employment March Preview: Private job creation slows while yield curve flattens

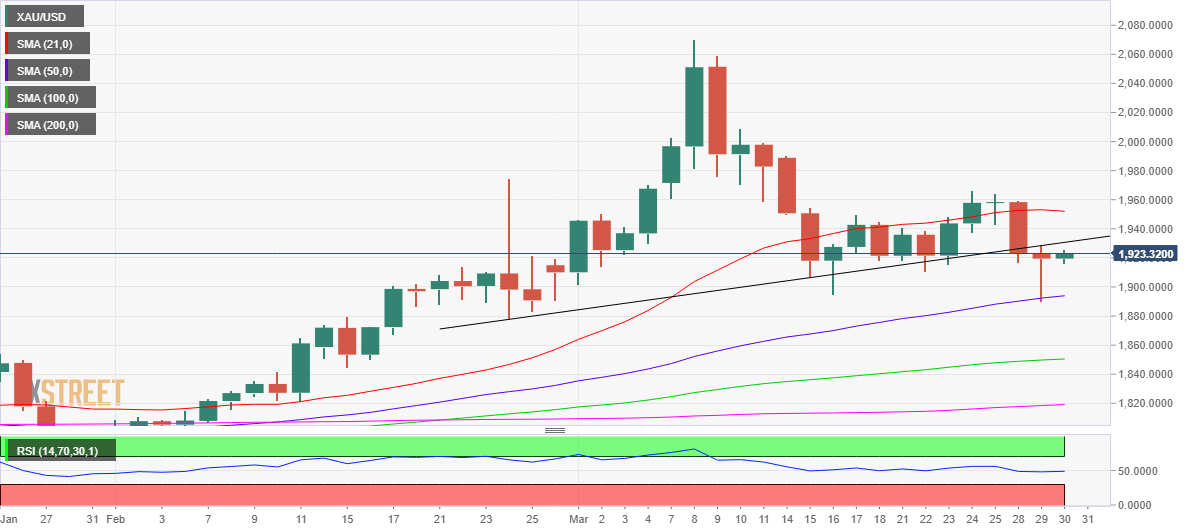

Gold: Daily chart

Having breached the rising trendline support, then at $1,928, on a daily closing basis on Monday, gold price extended the downside and tested the ascending 50-Daily Moving Average (DMA) at $1,892.

Gold bulls managed to defend the latter and rebounded sharply only to face rejection at the abovementioned trendline support now turned resistance. That hurdle is currently pegged at $1,931.

Acceptance above the latter will provide legs to the latest uptick in gold price, as bulls will then look to retest the 21-DMA barrier at $1,952.

The previous week’s high of $1,966 remains on the buyers’ radars.

On the downside, the immediate support is seen at the previous week’s low of $1,910, below which the $1,900 round level could get tested.

The bullish 50-DMA, now at $1,894 will make it an uphill battle for sellers while the last line of defense for buyers is seen at $1,890.

The 14-day Relative Strength Index (RSI) remains below the midline, keeping gold bears optimistic.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.