Gold Price Forecast: XAU/USD’s path of least resistance is down, focus on US jobs

- Gold price keeps the bearish streak intact amid the US dollar’s strength.

- DXY buoyed by Fed’s hawkish expectations, Delta strain ahead of US jobs.

- Bear pennant breakdown confirmed on the 1D chart, more losses in the offing.

Gold price tumbled on Monday, reaching the lowest in two months at $1751 after a negative start to a fresh week. Broad-based US dollar strength amid intensifying risk-off sentiment remained the key underlying theme, which weighed heavily on gold price. Investors fretted that the rapidly spreading Delta covid strain in Australia and Europe could derail the global economic recovery. Therefore, they scurried to the best safety net, the US dollar. Adding to the pain in gold price, ‘a very optimistic’ Fed Governor Christopher Waller said that the world’s most powerful central bank may need to start dialing back the QE program as soon as this year while increasing rates in late 2022. The Fed’s hawkish tilt combined with upbeat US Consumer Confidence data favored the greenback at gold’s expense. US consumer confidence jumped to its highest level in nearly one-and-a-half years in June.

Gold is back in the red zone, wallowing near $1760 after attempting a tepid bounce to the $1765 level. Despite a slight improvement in the market mood, investors still remain cautious, keeping the dollar’s demand underpinned. Meanwhile, stabilizing US Treasury yields also remain a weight on gold price. Heading into the US ADP payrolls data, the greenback is holding the higher ground near weekly highs, undermining gold prices. The ADP report is expected to show 600K jobs addition in June versus 978K recorded previously.

Gold Price Chart - Technical outlook

Gold: Daily chart

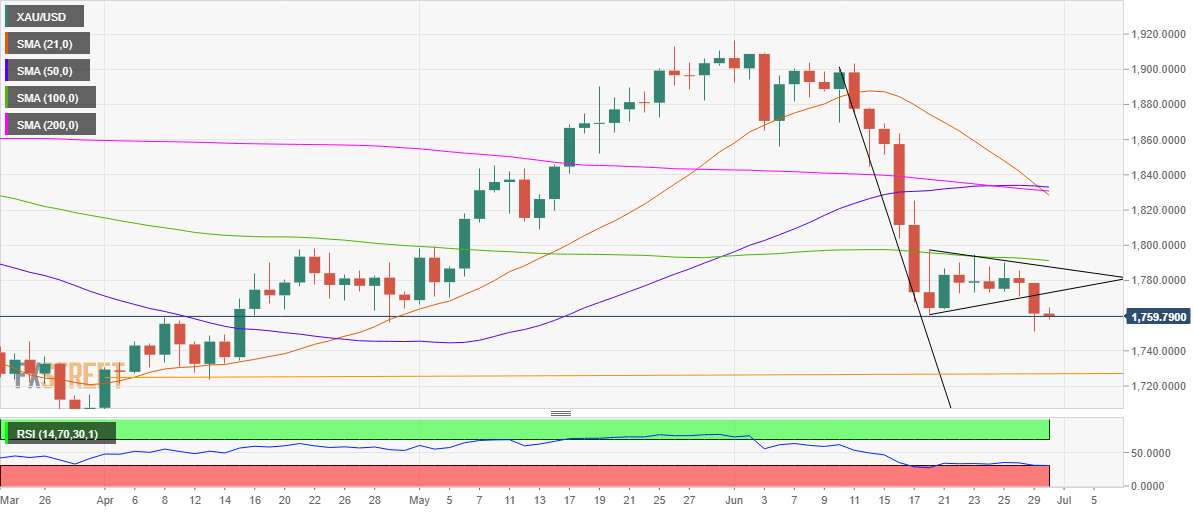

On the daily chart, gold price finally confirmed a bear pennant formation on Tuesday, after it closed the day below the rising trendline support at $1771.

The measured pattern target calls for a test of $1650 levels. However, the buyers could find some solid support near $1750 and $1725, which is the recent lows and horizontal (orange) trendline support respectively.

The 14-day Relative Strength Index (RSI) is probing the oversold territory, currently at 30.58, allowing room for more declines. The bearish crossover on the daily time frame also adds credence to the downside bias.

Any recovery attempts are likely to face stiff resistance at the bear pennant support, now at $1773.

Further up, the $1780 round number could limit the advances.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.