Gold Price Forecast: XAU/USD’s path of least resistance is down as dollar stays bid

- Gold remains pressured, as the dollar remains favored.

- US-China escalation could save the day for XAU bulls.

- Technical set up remains in favor of the bears.

Gold (XAU/USD) remained under pressure amid US holiday-led light trading and settled Monday around $1929, having formed lower highs for the fourth straight session. Gold held onto its recent trading range, with the downside bias intact amid a broadly firmer US dollar. The uptick in the European stocks added to the weight on the safe-haven gold. Investors shrugged-off last week’s correction in the US stocks and ongoing US-China tensions. The Sino-American tech war escalated on Monday following a report that the US is considering imposing export controls on China’s state-owned Semiconductor Manufacturing International Corporation (SMIC).

On early Tuesday, the greenback trades on the front foot amid a bearish view on the euro, in light of dovish ECB expectations. Meanwhile, the sell-off in the pound due to growing no-deal Brexit fears also helps keep the buoyant tone intact around the dollar. Therefore, gold is likely to remain less preferred, as the US traders return after a long weekend. However, any escalation on the US-China front could offer temporary respite to the XAU bulls. According to the latest NY Times report, the US is considering a ban on cotton from China’s Xinjiang province.

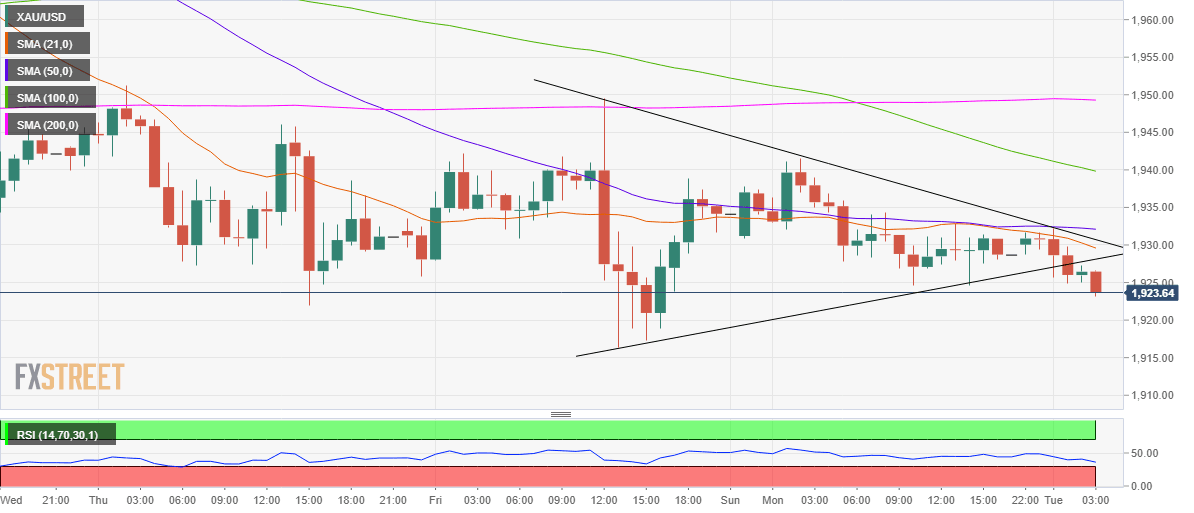

Gold: Hourly chart

Following the downside consolidation overnight, gold broke the range to the downside, confirming a symmetrical triangle breakdown on the hourly sticks. The price closed below the rising trendline (pattern) support at $1927.42.

The move lower exposes the pattern target at $1895. Ahead of that level, the bulls could defend last Friday’s low of $1916.42. A break below which will put a $1900 mark to test. The 14-day Relative Strength Index (RSI) points south in the bearish territory, backing the case for additional declines.

Alternatively, the recovery attempts could meet the robust upside barrier around $1930, the confluence of the bearish 21-hourly Simple Moving Average (HMA), pattern resistance and horizontal 50-HMA.

A sustained break above the latter could fuel a rally towards the next hurdle of the downward-sloping 100-HMA at $1940. Acceptance above the horizontal 200-HMA at $1949.29 is critical to recall the buyers.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.