Gold Price Forecast: XAU/USD’s path of least resistance appears down, focus on US NFP

- Gold price licks its wounds but remains vulnerable amid USD rebound.

- Treasury yields keep rallying amid Fed’s tapering bets, ahead of NFP.

- Gold price could see a range breakout, with a test of $1720 levels likely.

Gold price fell on Thursday after failing to find acceptance above the recent range highs near $1770. The relentless rise in the US Treasury yields on the hawkish Fed expectations and risk-on market mood reduced gold’s appeal. Although the downside in gold price remained cushioned just above the $1750 level, helped by a minor pullback in the US dollar across the board. Markets resorted to repositioning ahead of this week’s key event risk, the US Nonfarm Payrolls (NFP), especially in light of the dollar’s recent advance to ten-month tops.

In the lead-up to the much-awaited US Nonfarm Payrolls (NFP) showdown, gold is licking its wound after the previous decline, although remains in a familiar range above $1750. Gold price witnessed good two-way businesses so far this Friday, as it initially fell to test the $1750 barrier before rebounding to briefly recapture $1760. Gold price extended previous losses, earlier on, after the risk sentiment got an additional boost from the US Senate’s approval of the debt ceiling extension bill while worries over the global energy crisis ease. However, with the Chinese back after a week-long holiday, the concerns over the country’s indebted property market also returned, denting the risk appetite while lifting the dollar’s safe-haven appeal.

Looking ahead, gold’s upside potential appears limited as the US Treasury yields continue to climb on the Fed’s tapering, which is almost seen as a done deal ahead of the all-important NFP release due later in the NA session on Friday. The benchmark 10-year yields sit at the highest levels since June, weighing on the non-interest-bearing gold price.

The US economy is seen adding 488K jobs in September vs. 235K jobs created in August. Any number below 300K is likely to fade the Fed’s tapering expectations, which could fuel a fresh uptrend in gold price. However, the risks appear to the downside for gold price after the upbeat US ADP jobs data while Fed remains on track to dial back the monetary policy stimulus

Gold Price Chart - Technical outlook

Gold: Daily chart

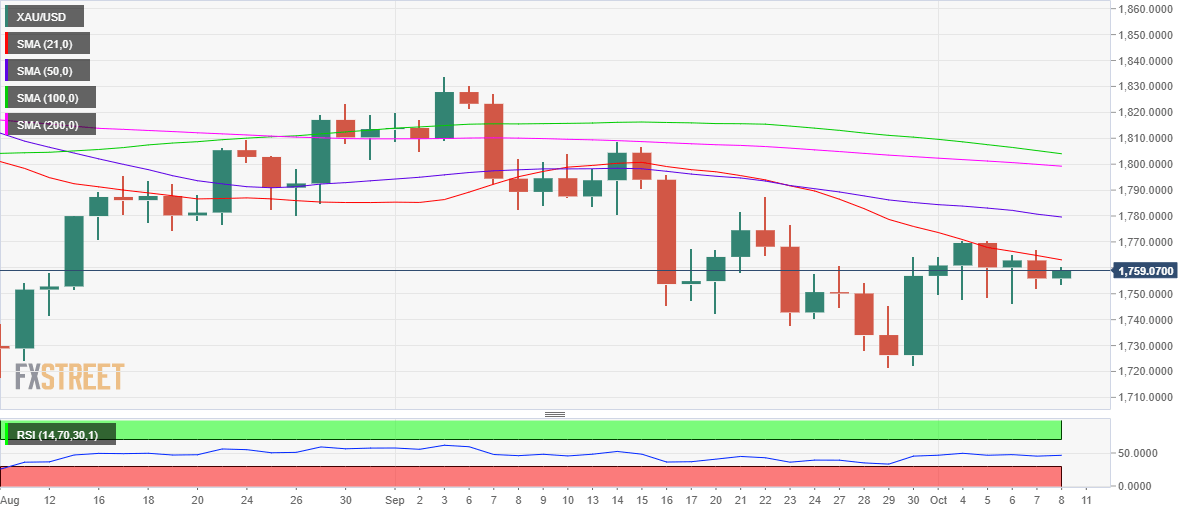

Gold’s daily chart shows that the price continues to form lower highs over the past week while keeping its range below the short-term critical resistance of the 21-Daily Moving Average (DMA) at $1763.

Meanwhile, gold buyers are finding fresh bids near $1750 every time the price has failed to sustain at higher levels.

The NFP release could yield a range breakout for gold price, with increasing odds of a downside break, given that the 14-day Relative Strength Index (RSI) continues to trade below the midline.

On a sustained break below the $1750-$1745 demand area, gold bears could tighten their grip, exposing the multi-week troughs near $1720.

On the flip side, daily closing above the 21-DMA barrier is critical to reverse the near-term bearish momentum in gold price.

Further up, gold buyers will target the downward-sloping 50-DMA at $1780, above which a test of the $1800 round number will be inevitable. At that level, the crucial 200-DMA aligns.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.