- Gold pressured by the DXY rebound, higher Treasury yields.

- Rally in platinum group metals dulls gold’s attractiveness.

- Daily chart suggests that the bears are likely to retain control.

Gold (XAU/USD) extends its downward spiral into the second straight day on Friday, although remains on track to book a weekly gain. The broad-based US dollar rebound amid a pullback in the US Treasury yields and risk-aversion continues to exert bearish pressure on gold. The market mood remains tepid after US President Joe Biden warned a group of senators that China will “eat our lunch” if America doesn’t “step up” its infrastructure spending. He warned a day after his first phone call with Chinese President Xi Jinping.

Also, negatively affecting the risk tone is the lack of fresh developments on the massive US stimulus front, which adds to the downside in the inflation-hedge gold. Markets are resorting to taking profits off the table on their US dollar short positions after the recent slide while gold’s rejection above the $1850 level also warrant caution for the bullish buyers. Meanwhile, the surge in the platinum group metals (PGM), in the wake of the expectations of swifter economic recovery from the coronavirus pandemic-led downturn, diminishes gold’s attractiveness as an alternative store of value. The PGM has wider applications as industrial metals, which could benefit from the economic turnaround.

Gold Price Chart - Technical outlook

Gold: Daily chart

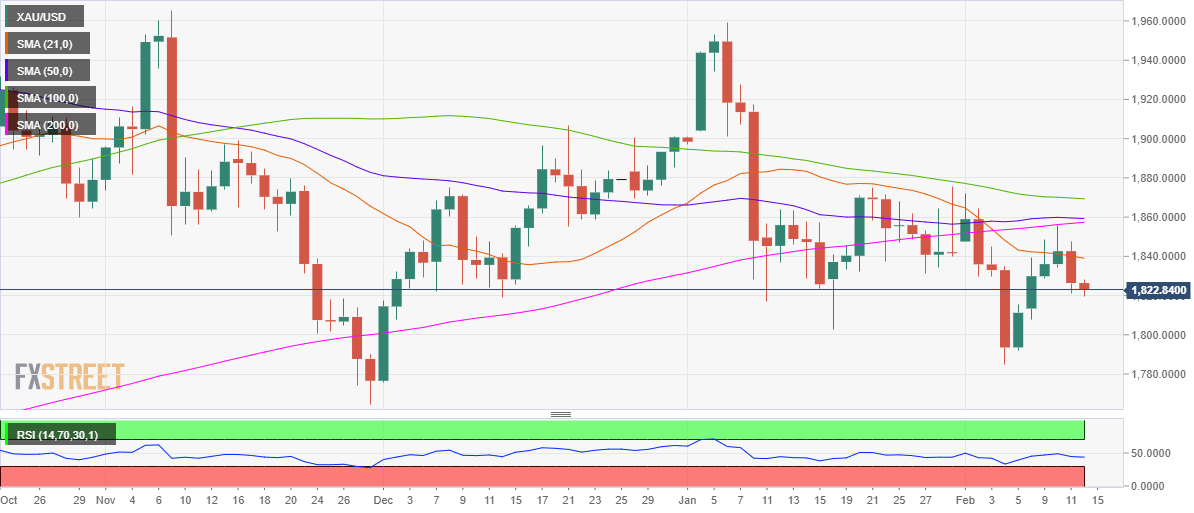

Gold’s daily chart shows that the price has failed to find acceptance above the 21-simple moving average (SMA), now at $1839.

Meanwhile, an impending death cross could add credence to further downside in the XAU/USD pair. A death cross is confirmed when the 50-simple moving average (SMA) cuts the 200-SMA from above.

Backing the downside bias, gold trades below all the major averages on the given timeframe while the 14-day relative strength index (RSI) points south below the midline. Therefore, a test of the Feb 8 low of $1808 remains inevitable, below which the January 18 low of $1803.

To the upside, recapturing the 21-DMA is critical for the XAU bulls to take on the fierce resistance around $1858, the confluence of the 50 and 200-DMAs. The next stop for the buyers awaits at $1869, the horizontal 100-DMA.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD recovers above 1.0300, markets await comments from Fed officials

EUR/USD gains traction and trades above 1.0300 on Thursday despite mixed German Industrial Production and Eurozone Retail Sales data. Retreating US bond yields limits the USD's gains and allows the pair to hold its ground as market focus shifts to Fedspeak.

GBP/USD rebounds from multi-month lows, trades above 1.2300

GBP/USD erases a portion of its daily gains and trades above 1.2300 after setting a 14-month-low below 1.2250. The pair recovers as the UK gilt yields correct lower after surging to multi-year highs on a two-day gilt selloff. Markets keep a close eye on comments from central bank officials.

Gold climbs to new multi-week high above $2,670

Gold extends its weekly recovery and trades at its highest level since mid-December above $2,670. The benchmark 10-year US Treasury bond yield corrects lower from the multi-month high it touched above 4.7% on Wednesday, helping XAU/USD stretch higher.

Bitcoin falls below $94,000 as over $568 million outflows from ETFs

Bitcoin continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week. Bitcoin US spot Exchange Traded Funds recorded an outflow of over $568 million on Wednesday, showing signs of decreasing demand.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.