Gold Price Forecast: XAU/USD’s battle with key $2,410 level extends amid risk recovery

- Gold price consolidates the rebound after Monday’s risk aversion-led ‘sell-everything mode’.

- The US Dollar rebounds with Treasury bond yields and risk appetite, checking Gold price upside.

- Increased bets for aggressive Fed rate cuts remain supportive of Gold price.

- Gold price defended 21-day SMA at $2,410, acceptance above $2,425 is critical while the daily RSI stays bullish.

Gold price is consolidating the previous swift rebound to near the $2,410 region early Tuesday, as traders absorb Monday’s volatile trading. Gold price struggles to build on the recovery mode amid a solid comeback staged by the US Dollar, alongside the US Treasury bond yields.

Gold price looks to Middle East updates

Following the assurances by the US and Japanese authorities to calm nerves, markets are witnessing a massive positive shift in risk sentiment. The Asian stocks attempt a turnaround, with the Japanese benchmark index - the Nikkei 225, jumping nearly 10% so far, reversing the 12% historic sell-off seen Monday.

With the return of risk flows, the haven demand for the US government bonds fades, putting a fresh bid under the US Treasury bond yields and helping lift the US Dollar across the board at the expense of the non-interest-bearing Gold price.

San Francisco Fed President Mary Daly said early Tuesday, “none of the labor market indicators she looks at are flashing red at present, but she is monitoring carefully.” Daly, however, added that her mind was open to cutting interest rates as necessary and policy needed to be proactive.

Meanwhile, Japanese Finance Minister Shunichi Suzuki said that he is “seeing bright aspects in the economy on wages, investment front.”

Further, diplomats from the US and Arab nations attempt to de-escalate the tensions between Iran and Israel that flared up since Wednesday, when Hamas leader Ismail Haniyeh was killed in Tehran in an attack. Iran blamed Israel, vowing to retaliate, with US intelligence noting that the attack could be panned over multiple days.

The diplomatic efforts to diffuse the situation seem to provide some support to the recovery in risk sentiment. However, traders remain wary of Iran striking back against Israel, as the former said “it didn’t care if the response triggered a war.”

Iran's foreign ministry spokesperson, Nasser Kanaani, stated on Monday that while Iran does not intend to heighten regional tensions, it believes it must punish Israel to deter further instability.

As the Middle East geopolitical situation remains in a delicate spot, traders are glued to the upcoming developments, refraining from placing any fresh position in the Gold price. However, the downside in Gold price could remain limited, as markets continue pricing in a nearly 90% chance that the US Federal Reserve (Fed) will cut interest rates by 50 basis points (bps) in September, according to the CME Group’s FedWatch Tool.

Additionally, the market has around 115 basis points of easing priced in for this year, and a similar amount for 2025, per Reuters.

Monday’s sell-off in Gold price, despite broad risk-aversion, could be attributed to investors locking in gains in their Gold longs to cover losses elsewhere. Global stock markets were in turmoil amid escalating Middle East tensions and US economic slowdown fears, following the weak US jobs report on Friday.

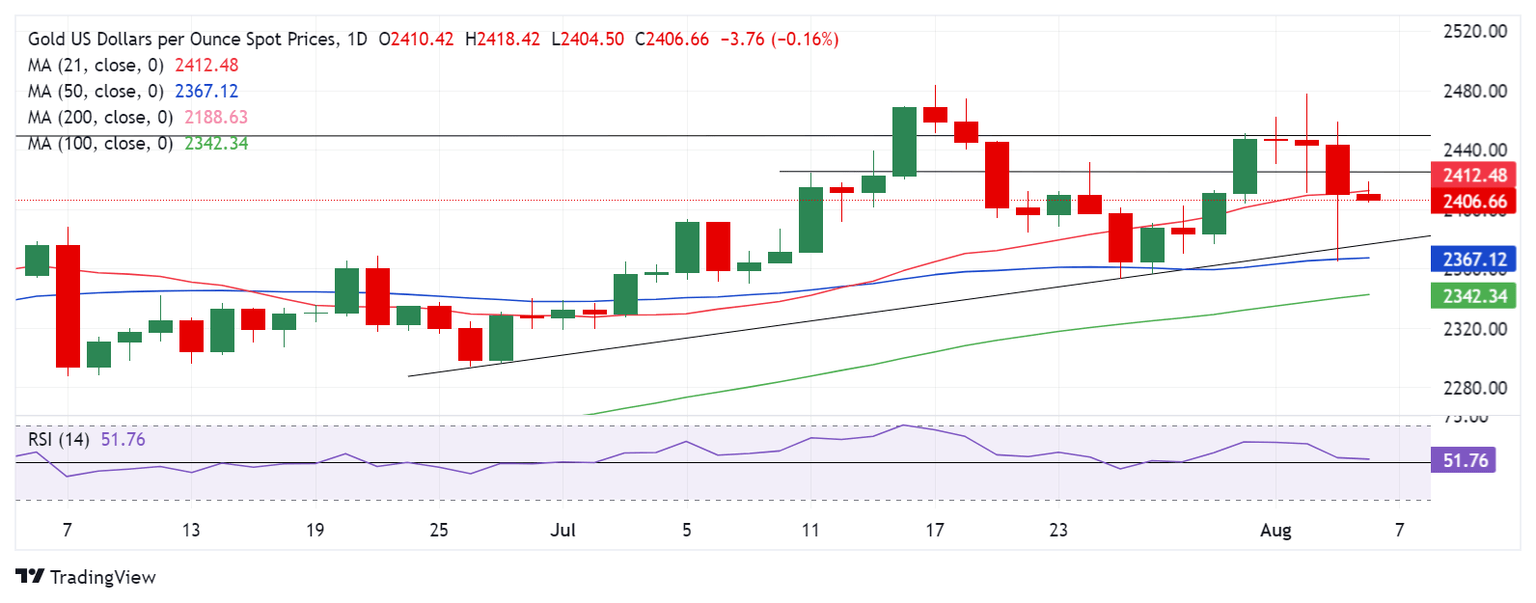

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price closed Monday above the key 21-day Simple Moving Average (SMA) support, then at $2,411.

Meanwhile, the 14-day Relative Strength Index (RSI) holds above the 50 level, currently near 52.50, suggesting that the bullish potential remains intact for Gold price.

Gold buyers, however, need acceptance above the static resistance at $2,425 to resume the recovery momentum toward the previous record highs of $2,450.

Further up, the lifetime high of $2,484, reached on July 17, will be on buyers’ radar.

On the flip side, if Gold sellers seek a strong foothold below the 21-day SMA, now at $2,412, the door will open up for a retest of the key confluence support near $2,370. The rising trendline support closes in on the 50-day SMA at that level.

The next relevant downside target is the 100-day SMA at $2,342.

(This story was corrected on August 6 at 6.46GMT to say that "if Gold sellers seek a strong foothold below the 21-day SMA, now at $2,412, not $2,417.)

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.