Gold Price Forecast: XAU/USD wavers between two key averages after the CPI blow, awaits US data

- Gold attempts a bounce as US Treasury yields retreat.

- US dollar’s haven demand remains intact as inflation concerns lurk

- Gold remains at the mercy of USD dynamics, awaits fresh US data.

After witnessing a choppy trend, in the first half of Wednesday’s trading, Gold (XAU/USD) tumbled to fresh three-day lows of $1813 after a big beat on the US inflation data jolted the dollar higher towards 91.00 against its main competitors. A bigger-than-expected jump in the US CPI data intensified concerns over mounting inflationary pressures, which spooked the investors and bolstered the dollar’s safe-haven appeal. The rally in the US Treasury yields also collaborated with the downside in gold, as speculative interest re-ignited the Fed tightening expectations. However, the sell-off in the US stocks helped limit gold’s downside.

Gold is struggling to extend its bounce so far this Thursday, with the risk-off mood capping the gains, as the US dollar continues to remain the most preferred safe-haven asset. The price of gold, although draws support from a retreat in the US yields, in the wake of reduced demand for riskier assets. The US dollar dynamics will continue to influence the gold price action, as markets look forward to the US Producers Price Index (PPI) and weekly Jobless Claims.

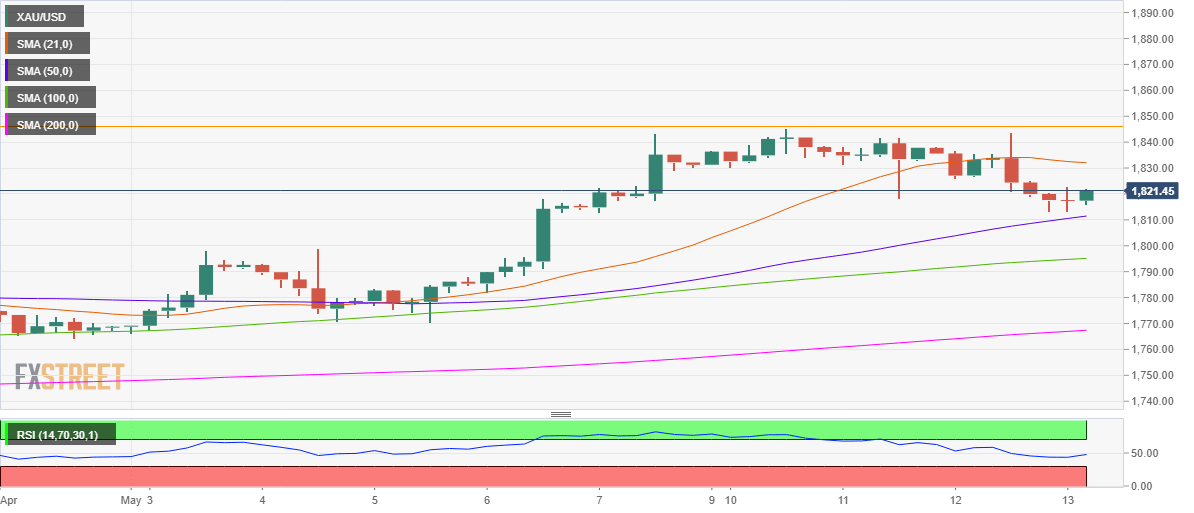

Gold Price Chart - Technical outlook

Gold: Four-hour chart

Despite Wednesday’s pullback from near $1850 levels, the gold price has managed to defend the upward-sloping 50-simple moving average (SMA) support at $1811.

Gold prices need to recapture the 21-SMA at $1832, in order to extend the recovery momentum towards the static resistance around $1845-$1850.

The Relative Strength Index (RSI) has edged higher but remains below the midline, suggesting that the buyers are likely to face a hard time.

A sustained break below the 50-SMA support could expose the $1800 threshold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.