Gold Price Forecast: XAU/USD under pressure, sellers defend $2,000

XAU/USD Current price: 1,980.81

- The US Core Consumer Price Index held steady at 4% YoY in November.

- The Federal Reserve will announce its decision on monetary policy on Wednesday.

- XAU/USD is poised to extend its decline in the near term, caution prevails ahead of Fed.

Gold prices changed little on Tuesday, with XAU/USD hovering around $1,980.00. The US Dollar started the day with a soft tone, as the better performance of Asian equities pushed investors away from the safe-haven currency. Still, investors were cautious about placing bets ahead of the release of the United States (US) Consumer Price Index (CPI). The report came as expected, with the monthly CPI up 0.1% and the annual one at 3.1%, slightly lower than the previous 3.2%. Finally, the core annual gauge was 4%, matching expectations and the October reading.

XAU/USD posted an intraday high of $1,996.68 as an immediate reaction to the news, but the Greenback quickly changed course and trimmed inflation-inspired losses. Investors are trying to anticipate the Federal Reserve (Fed) monetary policy move. The central bank will make an announcement on Wednesday, and investors expect it to keep rates on hold for a third consecutive meeting. What investors are looking for is a clue on when policymakers will reverse massive hikes and start cutting rates and by how much throughout 2024. Steady inflation partially weighed on rate-cut odds, spurring some near-term concerns and benefiting the USD.

XAU/USD short-term technical outlook

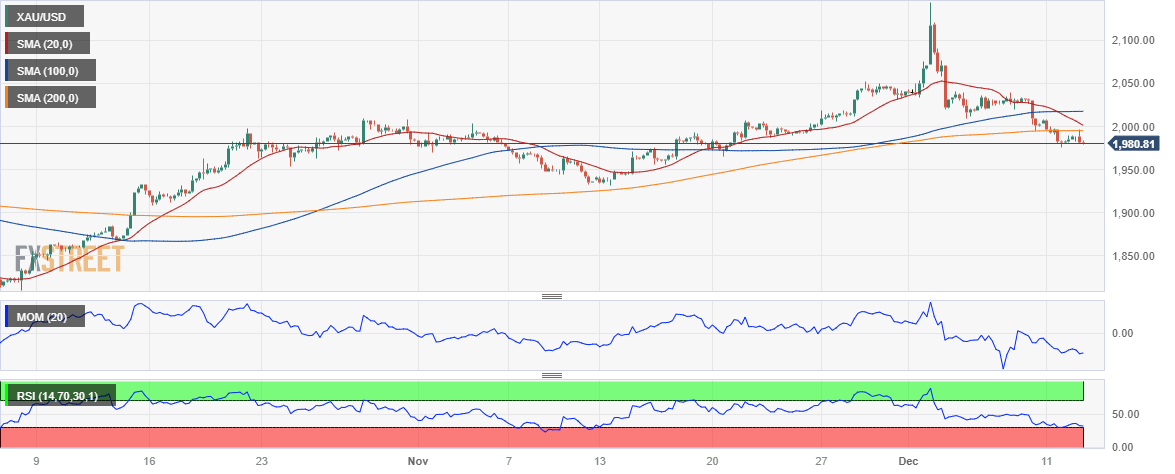

XAU/USD daily chart shows the pair trades within Monday’s range, unchanged from the Asian opening. Technical readings maintain the risk skewed to the downside, as selling interest was strong on an approach to the $2,000 threshold. Meanwhile, a mildly bullish 20 Simple Moving Average (SMA) stands well above the current level, while the 100 and 200 SMAs remain directionless, some $50 below the current level. Finally, technical indicators stand directionless right below their midlines.

The risk remains skewed to the downside in the near term, and according to the 4-hour chart. XAU/USD retreated from around a flat 200 SMA while the 20 SMA heads firmly south above it. Technical indicators, in the meantime, turned south within negative levels after correcting oversold conditions. The bright metal has room to extend its slump in the near term, although price action will likely remain limited ahead of the Fed’s announcement.

Support levels: 1,976.26 1,959.40 1,946.00

Resistance levels: 1,994.40 2,001.70 2,014.20

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.