Gold Price Forecast: XAU/USD under pressure around $2,640

XAU/USD Current price: $2,640.51

- Canada's inflation and the United Kingdom's inflation hint at more central banks’ action.

- The Federal Reserve will announce its decision on monetary policy on Wednesday.

- XAU/USD posted a fresh weekly low, could soon revisit the $2,600 mark.

Spot Gold settled a fresh weekly low of $2,633.00 a troy ounce early in the American session, bouncing just modestly from the level in a risk-averse environment. Following a mixed performance of its overseas counterparts, Wall Street is firmly down, with the three major indexes trading in the red.

Investors got mixed macroeconomic headlines, as United States (US) Retail Sales were up a modest 0.7%, better than the 0.5% expected, yet not enough to boost the mood. The country also reported that November Capacity Utilization rose 76.8%, worse than the 77.3% expected, while Industrial Production in the same period fell 0.1%, missing the 0.3% advance anticipated by market analysts.

Meanwhile, the United Kingdom (UK) published its monthly employment figures, which showed that the ILO Unemployment Rate stayed unchanged at 4.3% in the three months to October, while the number of people claiming jobless benefits climbed by only 0.3K in November. Finally, the report showed an unexpected advance in wage pressures as Average Earnings excluding Bonus grew by 5.2% 3M YoY in October, while including bonuses were also up by 5.2%, both surpassing the market’s expectations.

Additionally, Canada reported that the Consumer Price Index (CPI) declined to 1.9% on a yearly basis in November, below the market expectation of 2%. On a monthly basis, the CPI matched the 0.4% increase recorded in October.

The US Dollar trades mixed across the FX board, firmer against commodity-linked currencies and barely down against European rivals, as the Federal Reserve (Fed) monetary policy announcement looms. The Fed will unveil its decision on monetary policy on Wednesday, and is widely anticipated to cut the benchmark interest rate by 25 basis points (bps). The focus will then be on the Summary of Economic Projections (SEP) and Chairman Jerome Powell’s words on what 2025 may bring.

XAU/USD short-term technical outlook

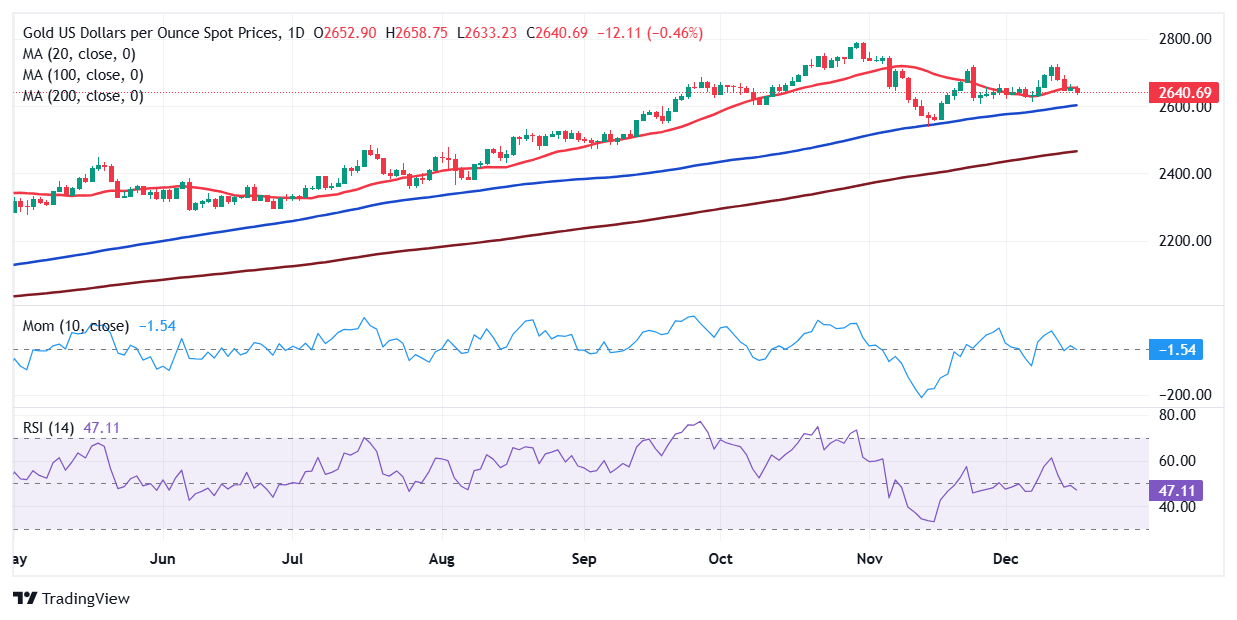

From a technical point of view, the daily chart for the XAU/USD pair suggests the pair may extend its slide. It met buyers around a now flat 20 Simple Moving Average (SMA), providing dynamic resistance at around $2,655. The 100 and 200 SMAs keep heading higher well below the current level, with the 100 SMA developing in the $2,602 region. Finally, technical indicators turned lower. The Momentum indicator remains within neutral levels, but the Relative Strength Index (RSI) indicator aims lower at 46, reflecting mounting selling pressure.

The near-term picture is bearish. The XAU/USD trades below all its moving averages in the 4-hour chart, with the 20 SMA accelerating south right above converging 100 and 200 SMAs. Technical indicators, in the meantime, turned marginally higher but remain within negative levels, falling short of supporting a recovery in the upcoming Asian session.

Support levels: 2,633.00 2,617.90 2,603.15

Resistance levels: 2,643.40 2,657.30, 2,672.70

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.