Gold Price Forecast: XAU/USD under mild selling pressure around $2,320

XAU/USD Current price: $2,323.79

- Comments from Federal Reserve Chair Jerome Powell helped the market’s mood improve.

- The focus shifts to United States employment-related data, ADP report scheduled for Wednesday.

- XAU/USD trades with a soft tone, limited chances of a bearish extension in the near term.

Spot Gold holds to familiar levels on Tuesday, with XAU/USD now retreating from an intraday high of $2,336.72 to trade just above the $2,320 mark. The bright metal turned south as the mood somehow improved in the American session following comments from Federal Reserve (Fed) Chairman Jerome Powell. Powell participated in a monetary policy panel at the 2024 ECB Forum on Central Banking in Sintra and noted the disinflation trend shows “signs of resuming.” However, he also said that the labor market is still strong, and that policymakers need to see more data like the one they have been seeing recently.

Meanwhile, Austan Goolsbee, President of the Federal Reserve (Fed) Bank of Chicago, also hit the wires in a different event and said he still thinks a soft landing is possible and that the ark of inflation is clearly down. As a result, stock markets trimmed most of their intraday losses, although Wall Street’s major indexes remain in the red. Nevertheless, decreased demand for safety weighed on Gold.

Speculative interest now focuses on United States (US) employment-related data. The country will release the Automatic Data Processing (ADP) Research Institute's monthly report on private sector job creation for June and Challenger Job Cuts for the same month on Wednesday. The ADP report is expected to show that the private sector added 160K new positions in June, slightly above the 152K added in May. The reports could confirm or deny the case presented by Chair Powell about the labor market still being tight.

XAU/USD short-term technical outlook shows

The daily chart for XAU/USD shows it hovers around a flat 20 Simple Moving Average (SMA) for a third consecutive day, while the longer moving averages keep heading north below the current level. A bullish 100 SMA provides dynamic support at around $2,261.50. Technical indicators, in the meantime, turned modestly lower at around their midlines, lacking clear directional strength.

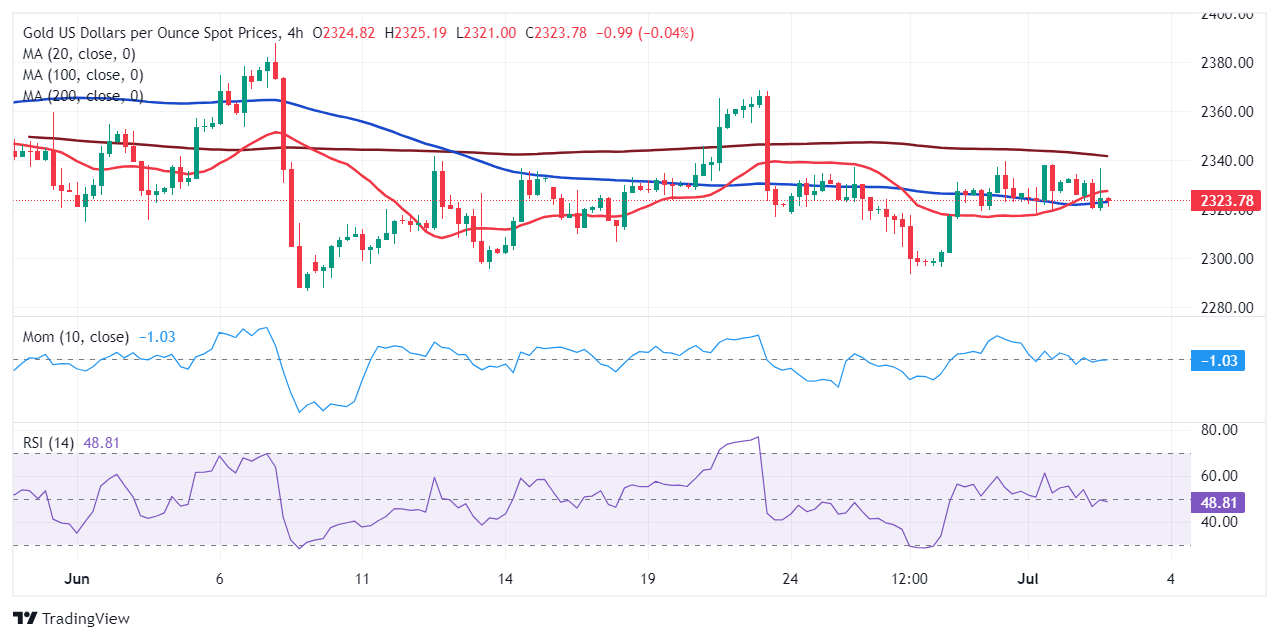

In the near term, and according to the 4-hour chart, XAU/USD is bearish-to-neutral, as it rests above a flat 100 SMA, while the 20 SMA turned directionless just above the current level. At the same time, the Momentum indicator heads south right below its midline, while the Relative Strength Index (RSI) indicator consolidates at around 48.

Support levels: 2,319.00 2,308.30 2,293.50

Resistance levels: 2,337.00 2,345.20 2,354.60

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.