Gold Price Forecast: XAU/USD turns bearish with technicals amid bond rout, 50-DMA back in sight

- Gold price kicks off a fresh week on a downbeat note, as bond rout extends.

- Hawkish Fedspeak, uptick in US wage inflation back aggressive tightening.

- Gold’s daily chart favors bears as Russia-Ukraine peace talks offer a ray of hope.

Despite the below-forecast US Nonfarm Payrolls, the upward revisions to the previous release and hotter than expected earnings growth bolstered the US dollar’s recovery rally alongside the Treasury yields. US payrolls arrived at 431K in March vs. 490K expected and the 750K previous upward revision. A relatively upbeat US labor market report boosted aggressive Fed’s tightening expectations, weighing down on the non-interest-bearing gold price. The bond rout resumed on hopes for a double-dose rate hike at the May Fed meeting, which propelled the Treasury yields higher across the curve. Meanwhile, the worsening Ukraine crisis added to the demand for the safe-haven US dollar, exacerbating the pain in gold price. XAUUSD closed the week in the red near the $1,925 area.

Gold price is extending the previous decline at the start of a fresh week this Monday, undermined by the extended bond rout, which has led to the inversion of the two-year and 10-year yield curve. Amidst holiday-thinned market conditions, with Chinese traders away, gold price is also feeling the pain from the dollar’s upside consolidative mode. Surging covid cases in China is sapping investors’ confidence, who are scurrying for safety in the buck, keeping any pullback in the US dollar index cushioned. Meanwhile, some optimism on the Russia-Ukraine front after last week’s peace talk also bodes ill for the yellow metal. A top Ukrainian negotiator said Saturday, “Ukrainian and Russian negotiators have reached an agreement on enough elements of a potential peace agreement that it is ready to be discussed between Russian President Vladimir Putin and Ukrainian President Volodymyr Zelensky.”

Later in the day, the sentiment around the bond market and the incoming headlines from the scheduled peace talks will likely be the main market drivers, in absence of the top-tier US economic data releases.

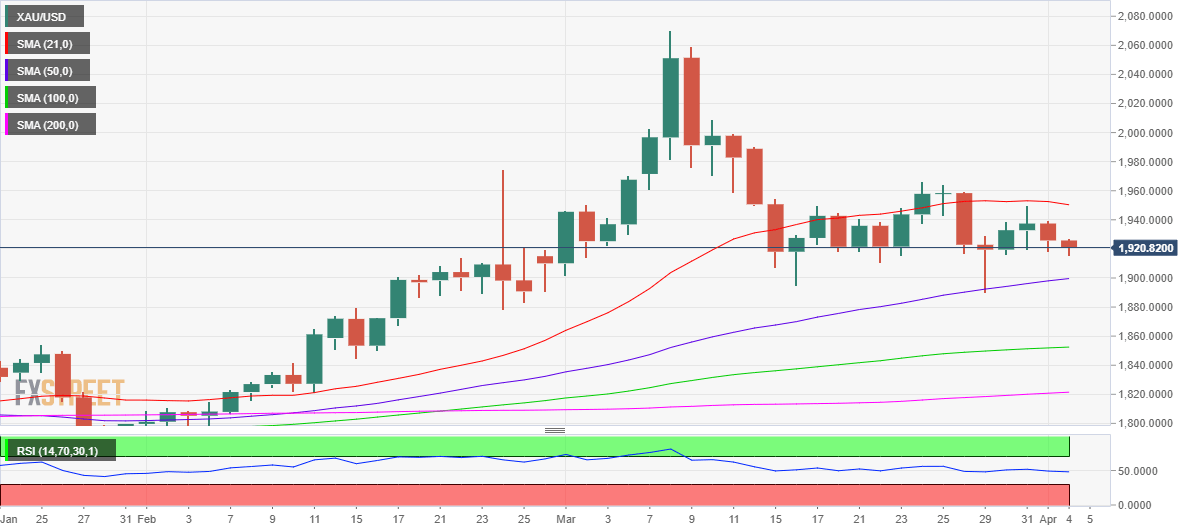

Gold: Daily chart

Gold’s daily technical setup suggests that the tide has turned in favor of bearish traders, as the 14-day Relative Strength Index (RSI) has slipped gradually below the midline to now trade in the negative territory.

On renewed selling wave, gold price could retest four-day lows near $1,915, below which a fresh downside will open up towards the ascending 50-Daily Moving Average (DMA) at $1,900.

Further down, sellers will aim for the previous week’s low of $1,890, which emerge as a tough nut to crack for them.

Alternatively, should the recovery pick up pace, Friday’s high of $1,940 will be put to test. The horizontal 21-DMA at $1,950 will be seen as the next relevant resistance level.

The previous year’s high at $1,960 will be the level to beat for bulls.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.