Gold Price Forecast: XAU/USD struggles to retain the $2,500 mark

XAU/USD Current price: $2,502.60

- Wall Street turned red as investors await NVIDIA´s earnings report.

- Market participants keep waiting for a United States inflation update.

- XAU/USD battles to retain the $2,500 level ahead of critical market announcements.

Spot Gold fell to $2,493.46 on Wednesday, retaining the negative tone in the American session but still trading in the red on a daily basis. The US Dollar gained some footing after reaching oversold conditions against most major rivals. The US Dollar Index (DXY) fell to a fresh YTD low of 100.52, meeting buyers near the critical threshold.

XAU/USD is purely moving on sentiment, as the macroeconomic calendar remained scarce. The focus remains on upcoming inflation figures, as the United States (US) will release the July Personal Consumption Expenditures (PCE) Price Index next Friday, the Federal Reserve's (Fed) favourite inflation gauge. Market participants have also turned cautious ahead of NVIDIA earning reports, scheduled for after the market’s close. The AI giant is expected to report revenue growth of over 70% in the current quarter, and any divergence will likely spur some wild action early in Asia, exacerbated by the limited volumes at that time of the day.

Other than that, Wall Street trades in the red, unable to follow the lead of its overseas counterparts, while government bond yields remain stable near their August lows. At the time being, the 10-year Treasury note offers 3.83%.

XAU/USD short-term technical outlook

From a technical point of view, the XAU/USD pair seems poised to extend its slide. The bright metal ended a three-day winning streak, retaining modest weekly gains. Technical indicators in the daily chart, however, gain downward traction within positive levels, supporting a steeper corrective decline. At the same time, the 20 Simple Moving Average (SMA) is losing its bullish strength at around $2,467.00, a potential bearish target. Finally, the longer moving averages maintain their upward slopes far below the shorter one, suggesting the long-term bullish trend remains intact.

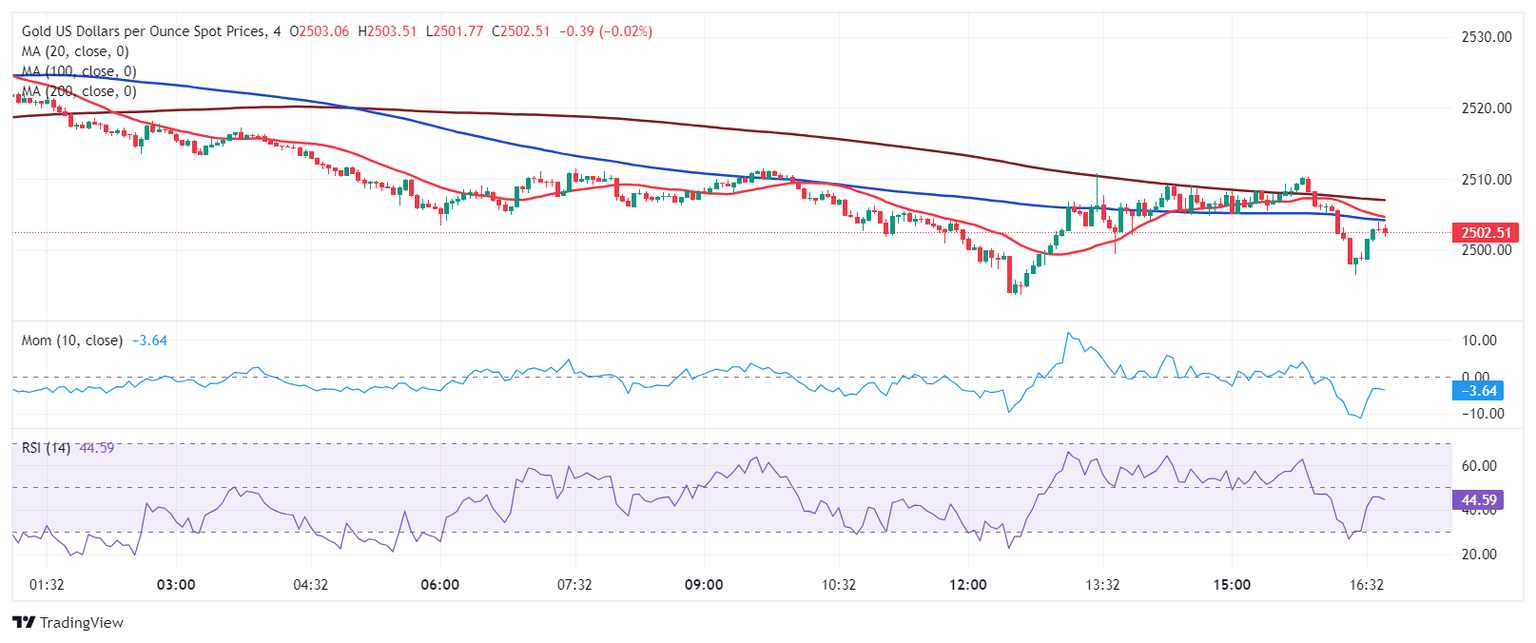

XAU/USD briefly recovered the $2,500 level early in the American session but resumed its decline afterwards, in line with another leg lower. Technical readings in the 4-hour chart suggest the pair can fall further, as it keeps posting red candles below a now flat 20 SMA. Even further, the Momentum indicator heads south almost vertically within negative levels, while the Relative Strength Index (RSI) indicator heads firmly south at around 43.

Support levels: 2,508.80 2,496.40 2,485.10

Resistance levels: 2,523.50 2,531.60 2,542.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.