Gold Price Forecast: XAU/USD stays hopeful heading into the Fed event risk

- Gold price holds the previous rebound below $2,770 on Fed day.

- The US Dollar trades subdued amid risk recovery, boosting Gold price.

- The daily technical setup for gold prices remains bullish, but the Fed could spoil its party.

Gold price clings to recovery gains near $2,770 in Wednesday’s Asian trading. Gold buyers trade cautiously, heading into the critical Federal Reserve (Fed) policy announcement that is due later this Wednesday.

Gold price looks to Fed verdict for the next trading impetus

Markets are in a wait-and-see mode, anticipating the Fed will pause the interest rate cut and provide hints on the following policy move. Markets are pricing in almost 50 basis points (bps) of cuts this year, or two 25 bp reductions starting in June, according to LSEG data.

However, Fed Chairman Jerome Powell’s press conference will be closely scrutinized for the timing and the scope of further rate reductions under US President Donald Trump’s second term. Trump's immigration and trade policies are perceived as inflationary, as they could prompt the Fed to keep higher rates for longer, boding ill for the non-interest-bearing Gold price.

In case, Powell and his colleagues express their confidence in the path of disinflation and acknowledge weakening labor market conditions, markets could read that as a dovish hold, ramping up bets for future rate cuts, lifting Gold price to new record highs.

In the meantime, Gold price will continue to draw support from stabilizing risk sentiment, broadly subdued US Dollar and holiday-thinned conditions. China, Singapore, and Hong Kong markets also closed due to the Lunar New Year holiday break.

Markets recover from China’s low-cost artificial intelligence (AI) model - DeepSeek-led global AI sell-off as the focus now also remains on the earnings results from the US tech titans – Microsoft, Meta and Tesla due in the late American session on Wednesday.

If earnings disappoint and budget forecasts leave investors unconvinced, a renewed global tech sell-off could be in the offing, with markets resorting to ‘sell-everything’ mode. In such a case, Gold price could reverse any reaction to the Fed policy announcements or extend the downside on a potential hawkish hold.

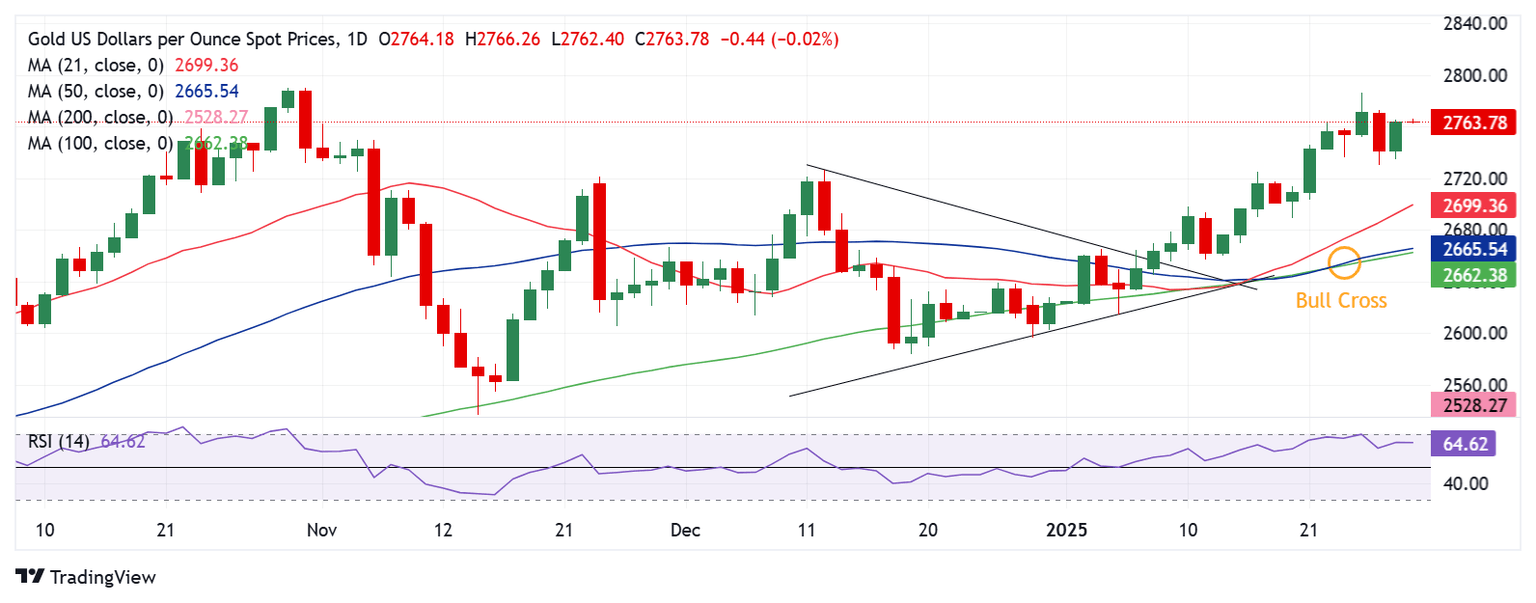

Gold price technical analysis: Daily chart

The technical setup on the daily time frame remains in favor of Gold price. Therefore, the bright metal will likely be a ‘buy-the-dips’ trade.

The 14-day Relative Strength Index (RSI) holds comfortably above the midline, currently near 65, keeping Gold buyers hopeful.

Adding credence to the bullish potential, the 50-day SMA closed above the 100-day SMA last Thursday, confirming a Bull Cross.

Gold price needs a daily candlestick closing above the symmetrical triangle target of $2,785 or record high of $2,790 to initiate a fresh uptrend.

The next relevant upside targets are $2,800 and the $2,850 psychological barrier.

On the downside, the immediate support will be seen at the previous day’s low of $2,735.

Sellers will then aim for the $2,700 round level, where the 21-day SMA coincides. The last line of defense for buyers is the $2,680 static support.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.