Gold Price Forecast: XAU/USD stands tall on concerns over trade war, Fed’s independence

- Gold price closes on $3,400 as the record rally regains strength on Easter Monday.

- Concerns over US-China trade war escalation and the Fed’s independence smash the US Dollar to three-year troughs.

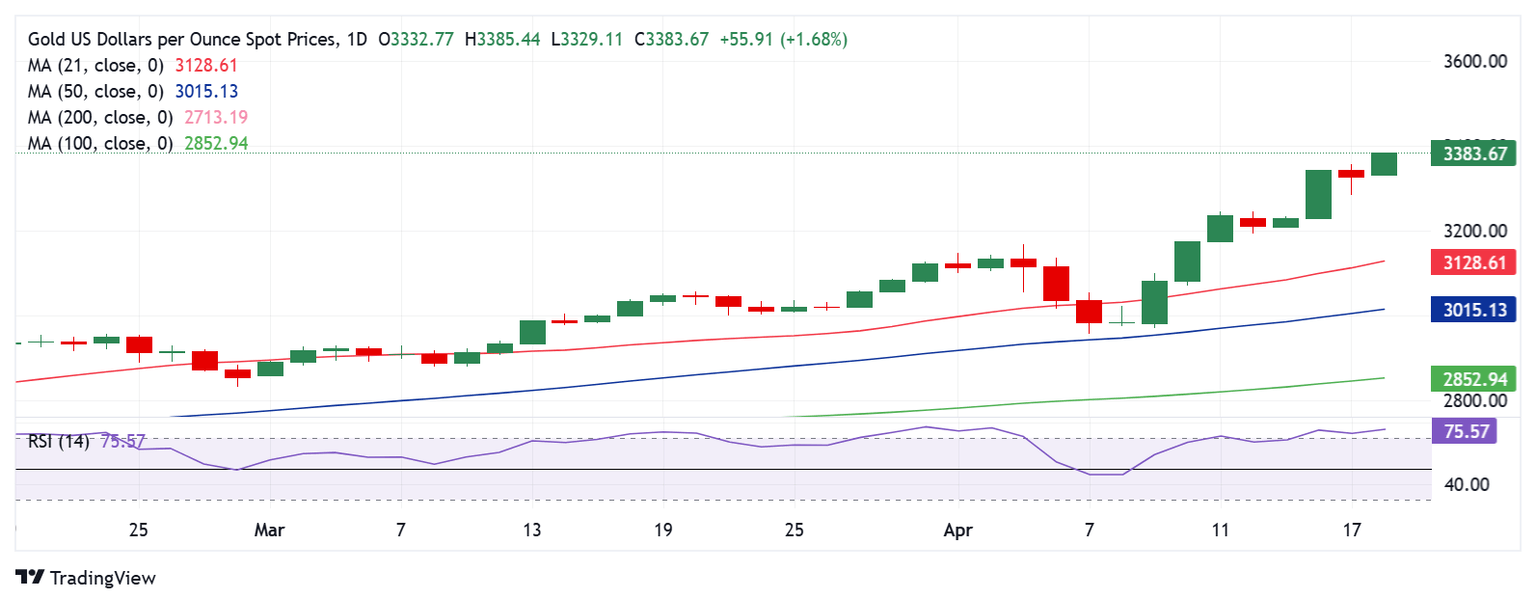

- RSI stays overbought on the daily chart, with thin volumes likely to exaggerate moves in Gold price.

Gold price remains within a striking distance of fresh record highs above $3,380 at the start of a new week, with thin liquidity conditions on Easter Monday likely to exaggerate the price movement.

Gold price stands tall at the start of a new week

Following a brief corrective pullback on Friday due to profit-taking ahead of the Easter weekend, Gold buyers are back with a bang early Monday. The bright metal resumes its record run, targeting the $3,400 threshold as the US Dollar (USD) is smashed to a three-year low against its major currency rivals on heightened risk of a US recession, induced by the US-China trade war.

The US-China trade war witnessed a significant escalation over the weekend after a Boeing jet intended for use by a Chinese airline landed back at the plane maker's US production hub due to China’s retaliatory move.

This came after US President Donald Trump ordered a probe into the potential new tariffs on all critical minerals imports from the industry leader China. US dependency on minerals imports "raises the potential for risks to national security, defense readiness, price stability, and economic prosperity and resilience," Trump said in an order directing Commerce Secretary Howard Lutnick to begin a national security review under Section 232 of the Trade Expansion Act of 1962.

Further, the Greenback remains vulnerable also as the US Federal Reserve’s (Fed) independence is threatened. “White House Economic Adviser Kevin Hassett said Friday that Trump and his team were studying if they could fire Federal Reserve Chair Jerome Powell, a sign that such a move, a matter of great consequence for the central bank's independence and global markets, is still an option,” per Reuters.

A broadly softer US Dollar and increased haven demand continue to bode well for the traditional safe-haven Gold price. In the day ahead, Gold price could be subject to intense volatility as trading conditions remain thin on account of Easter Monday.

However, all ears will likely be on any tariff headlines from the Trump administration and speeches from Fed policymakers for fresh trading impetus in Gold price.

It’s a relatively light week, in terms of US economic data, and hence, Gold price will remain at the mercy of Trump’s trade talks, risk sentiment and Fedspeak until the release of the S&P Global US flash PMI readings.

Gold price technical analysis: Daily chart

Despite the 14-day Relative Strength Index (RSI) remaining heavily overbought, currently near 75.50, Gold buyers stay defiant.

Gold buyers need to find acceptance above the $3,400 level on a daily closing basis to aim for the $3,450 psychological threshold next.

On the flip side, any retracement could challenge the intraday low of $3,329, below which the $3,300 round figure could come into play.

If the corrective declines intensify, a test of Friday’s low of $3,284 will be inevitable.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.