Gold Price Forecast: XAU/USD stands tall as tariff jitters outweigh overbought conditions

- Gold price sits at fresh record highs above $3,130 early Tuesday, awaits Wednesday’s US tariffs announcement.

- US President Trump’s pushback on narrower tariffs weighs again on the US Dollar, Treasury yields.

- The daily RSI remains heavily overbought, suggesting a likely correction in the Gold price?

Gold price closes in on the $3,150 psychological mark in Asian trading on Tuesday, extending its record rally. Gold buyers eagerly await the US announcement of “reciprocal tariffs” on Wednesday for a fresh directional impetus. In the meantime, tariff updates and top-tier US data will likely keep them entertained.

Gold price remains unstoppable on tariff woes

The traditional safe-haven Gold price sees a fresh leg higher early Tuesday after pulling back slightly from record highs in the late American session on Monday. Tensions over Wednesday’s US tariff announcement and its economic fallout reignited after President Donald Trump rejected plans for narrower tariffs late Monday, noting that his reciprocal tariffs plan will target all other countries.

US Treasury Secretary Scott Bessent singled out what he called the “Dirty 15” — the 15% of countries that trade heavily with the US and have high tariffs. Bessent added that Trump will announce these tariffs on April 2 at 19:00 GMT.

Renewed tensions surrounding the scope of the ‘reciprocal tariffs’ fuelled a fresh bout of US Dollar (USD) selling as the trade barriers are expected to dent the US economic prospects.

A potential US stagflation could prompt the Federal Reserve (Fed) to deliver aggressive interest rate cuts. This narrative weighs heavily on the USD and the US Treasury bond yields, while the Gold price challenges record highs.

The bright metal also capitalises on increased buying from central banks and rising exchange-traded funds (ETF) inflows amid the market unrest and panic. Gold price remains on course for its strongest quarter since 1986.

However, the Gold price could witness another pullback in the sessions ahead if traders adjust their long positions in anticipation of Trump’s ‘Liberation Day’ on April 2. Markets could also use the US economic data releases as an excuse to take profits off the table, bracing for Trump’s ‘reciprocal tariffs,’ which are expected to induce intense volatility.

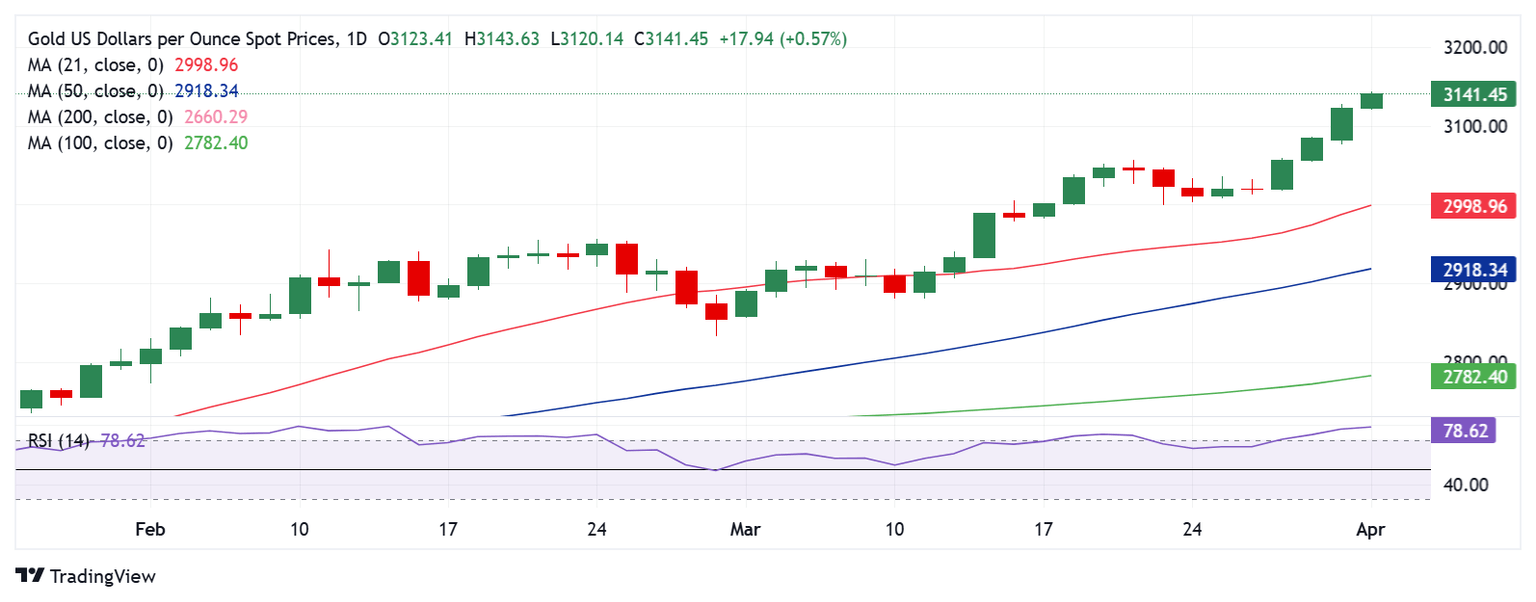

Gold price technical analysis: Daily chart

The daily chart indicates that the 14-day Relative Strength Index (RSI) remains in the highly overbought region, currently at 78.50, suggesting that buyers may be exhausted.

Therefore, a brief pullback could ensue, dragging Gold price back toward the $3,100 round level.

The next relevant support is seen at the previous day’s low of $3,077, below which the $3,050 psychological barrier will be tested.

On the flip side, Gold buyers need to find acceptance above the $3,150 threshold to initiate a fresh advance toward the $3,200 level.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.