Gold Price Forecast: XAU/USD stabilizes above $2,500

XAU/USD Current price: $2,505.91

- The US Dollar eases further after a downward revision to job creation data.

- The Federal Open Market Committee will release the Minutes of the July meeting.

- XAU/USD corrective decline may continue, but a steeper decline is out of the picture.

XAU/USD trades with modest losses mid-Wednesday, confined to a tight intraday range. The pair briefly dipped below the $2,500 mark, but continued pressure on the US Dollar helped it trim intraday losses.

Investors await fresh clues from the Federal Open Market Committee (FOMC) Minutes. The Federal Reserve (Fed) met on July 31 and surprised market players with a more dovish tone, as officials showed fewer concerns about inflation and shifted the focus to the employment sector, acknowledging it has been loosening. Chairman Jerome Powell noted in the following press conference that a September rate cut was “on the table,” something the Minutes should somehow confirm.

In the meantime, a revision of Nonfarm Payrolls (NFP) showed the US economy created 818K fewer jobs than originally reported in the twelve months to March 2024, according to the Bureau of Labor Statistics. The actual job growth was then roughly 30% less than initially reported. The news further supported the case of an upcoming interest rate cut, maintaining the USD on the losing side.

XAU/USD short-term technical outlook

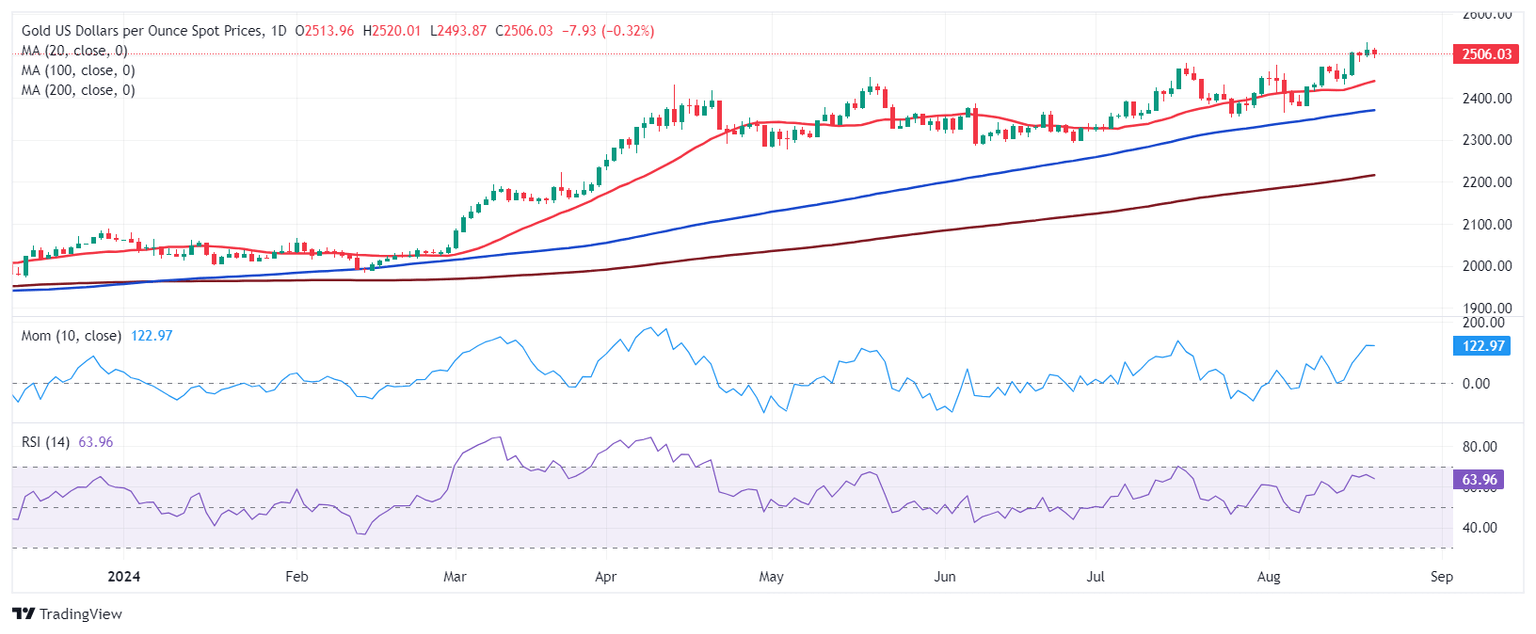

The daily chart for XAU/USD shows the pair holds above all its moving averages, with a bullish 20 Simple Moving Average (SMA) accelerating north at around $2,440, while above also bullish longer ones. Technical indicators, in the meantime, lack directional strength but remain well above their midlines, limiting the chances of a downward movement.

In the near term, and according to the 4-hour chart, the corrective slide continues. XAU/USD is currently battling a bullish 20 SMA, while the 100 and 200 SMA gained upward traction far below the current level. Finally, technical indicators edged marginally lower, with the Momentum indicator approaching its 100 line. The overall picture is not enough to suggest a steeper decline ahead, although a clear break below the $2,500 mark following FOMC Minutes could open the door for a corrective extension in the upcoming sessions.

Support levels: 2,496.40 2,485.10 2,427.20

Resistance levels: 2,510.00 2,523.50 2,535.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.