Gold Price Forecast: XAU/USD set to range between two key barriers amid light trading

- Gold price holds recovery from seven-month troughs amid a US holiday-thinned trading.

- Federal Reserve Minutes eyed this week after hawkish bets and strong United States data.

- Gold price could stay in a range below $1,853 after closing the week above the key $1,825 support.

Gold price is trading around a flatline at the start of the week on Monday, consolidating Friday’s sharp rebound from seven-week lows of $1,819. Markets remain cautious amid the renewed geopolitical risks while awaiting the Minutes of the US Federal Reserve (Fed) February meeting due later this week.

Federal Reserve sentiment to lead United States Dollar, Gold price

During the most part of the last week, expectations of more Federal Reserve rate hikes dominated the market, courtesy of the hawkish commentary from the Fed officials Loretta Mester, John Williams and James Bullard. As a result, the US Dollar recovery gathered steam alongside the US Treasury bond yields, smashing the Gold price to its lowest levels in seven weeks toward the $1,800 threshold. The hawkish remarks came on the back of the hot United States Consumer Price Index (CPI) and strong Retail Sales data, which ignited speculation of a potential 50 basis points (bps) rate increase going forward.

However, the tide suddenly turned against the US Dollar bulls late Friday after Fed Governor Michelle Bowman and Richmond Fed President Thomas Barkin squashed expectations of a 50 bps hike, citing that they are seeing a lot of inconsistent data in economic conditions. Following their comments, the US Dollar corrected sharply from multi-week highs against its major peers, tracking the sharp pullback in the US Treasury bond yields, reviving the Gold bulls from their graves.

In the week ahead, the sentiment surrounding the Federal Reserve rate hike expectations will continue to influence the US Dollar valuations, and, in turn, the Gold price action. All eyes will remain on the Minutes of the February Federal Reserve meeting will be scrutinized for discussion on when the central bank might pause its policy tightening. Of other interest will be the debate over whether to hike by 25 bps or 50bps.

Meanwhile, the Fed’s preferred inflation measure, the PCE Price Index, will be also awaited. The data is set to show an acceleration in pricing pressures, driven by solid growth in personal incomes and spending.

Risks from US-China and North Korea in focus

The US Dollar is back into positive territory so far this Monday, somewhat limiting the further recovery in the Gold price. Investors have rushed to the safety net in the US Dollar amid looming geopolitical risks surrounding the United States and China, as well as, the North Korean missile launches.

On Sunday, North Korea fired two ballistic missiles off its east coast, as the powerful sister of the North’s leader, Kim Jong-un, warned the isolated and nuclear-armed state could turn the Pacific into a “firing range”. In response, the US geared up for their annual military exercises as part of efforts to ward off the growing nuclear and missile threat that the North poses. The Japanese media outlet, Jiji Press reported early Monday, the United States (UN) Security Council is scheduled to hold a meeting on North Korean missile launches at 20:00 GMT this Monday.

Meanwhile, tensions continue to mount between the United States and China after US Secretary of State Antony Blinken said that the US has information that China is considering sending weapons to Russia for the war in Ukraine. Further, there were reports that the weekend meeting between China’s Director of the Office of the Central Foreign Affairs Commission Wang Yi and US’ Blinken in Germany was not very encouraging. Some other media reported that the US and Taiwan may sign a bilateral trade agreement earlier than expected this year.

Gold price technical analysis: Daily chart

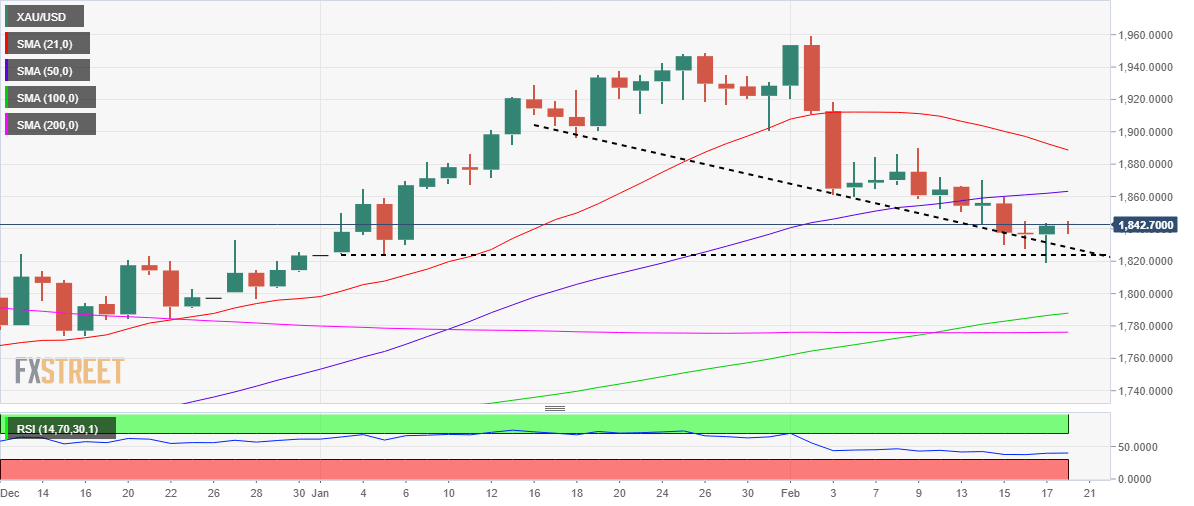

Gold price managed to settle the previous week above the critical horizontal trendline support from the January 5 low at $1,825.

Therefore, Gold bulls could gather some courage to retest the previous support now turned resistance at the flattish 50-Daily Moving Average (DMA), currently pegged at $1,853.

Ahead of that, Thursday’s high of $1,845 could challenge the bearish commitments.

With the 14-day Relative Strength Index (RSI), however, still, below the midline, Gold price remains a ‘sell the bounce’ trade in the near term. Volatility could be high, thanks to a US holiday on Monday.

On the downside, daily closing below the abovementioned key support at $1,825 is needed to retest the previous day’s low at $1,819. Additional selling will call for a fresh downswing toward the $1,800 barrier.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.