Gold Price Forecast: XAU/USD risks a corrective pullback before the uptrend resumes

- Gold price is sitting at the highest level in six months near $2,050 early Wednesday.

- The US Dollar and US Treasury bond yields lick their wounds after Fed Governor Waller’s dovish shift.

- Overbought RSI on the 1D chart cautions Gold buyers but an impending Golden Cross keeps the uprend intact.

Gold price is flirting with a fresh six-month high of $2,052 reached earlier in the Asian session on Wednesday, extending its winning streak into the fifth straight day.

In the absence of top-tier US economic data so far this week, Gold price remained at the mercy of the Fedspeak and risk sentiment, which intensified the bearish momentum in the United States Dollar (USD) and US Treasury bond yields across the curve.

Gold price keeps rallying on 2024 Fed rate cut bets

The US Dollar is languishing in three-month troughs against its major counterparts early Wednesday, keeping Gold price elevated at a half-year peak near mid-$2,050. The US Dollar Index refreshed a three-month low at 102.47 after the benchmark 10-year US Treasury bond yield extended its sell-off to reach 4.27%, the level last unseen since September 15.

The fresh leg down in the US Dollar alongside the US Treasury bond yields could be attributed to the increased expectations of a US Federal Reserve (Fed) interest rate cut in 2024. However, recent dovish comments from Fed Governor Christopher Waller, a known hawk, flagged a policy pivot and spelled disaster for the US Dollar and the bond yields.

"I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%," Waller said in his speech on Tuesday. If the decline in inflation continues "for several more months ... three months, four months, five months ... we could start lowering the policy rate just because inflation is lower," he added.

Adding to the dovish Fed bets, Chicago Fed President on Tuesday, expressed concerns about keeping rates too high for too long. Meanwhile, Fed Governor Michelle Bowman noted that she was willing to another increase rate increase should the incoming data support such a case.

According to CME Group’s FedWatch Tool, market pricing now shows a roughly 40% chance that the Fed could begin slashing rates as early as March, compared with a 21.5% chance a day ago. Roughly 100 bps worth of cuts are also priced in for next year.

Expectations surrounding the Fed’s dovish pivot will continue supporting the non-interest-bearing Gold price. However, an upward revision to the advance third-quarter US Gross Domestic Product (GDP) data and the broader market sentiment could trigger a corrective pullback in Gold price, allowing the US Dollar buyers some temporary reprieve.

All eyes will turn toward Thursday’s Personal Consumption Expenditures - Price Index data and the Eurozone inflation data for a fresh take on the major central banks’ interest rate expectations. On Friday, Fed Chair Jerome Powell’s speech will hog the limelight, as it will be his last appearance before the Fed’s ‘blackout period’ begins on Saturday, ahead of the December 12-13 policy meeting.

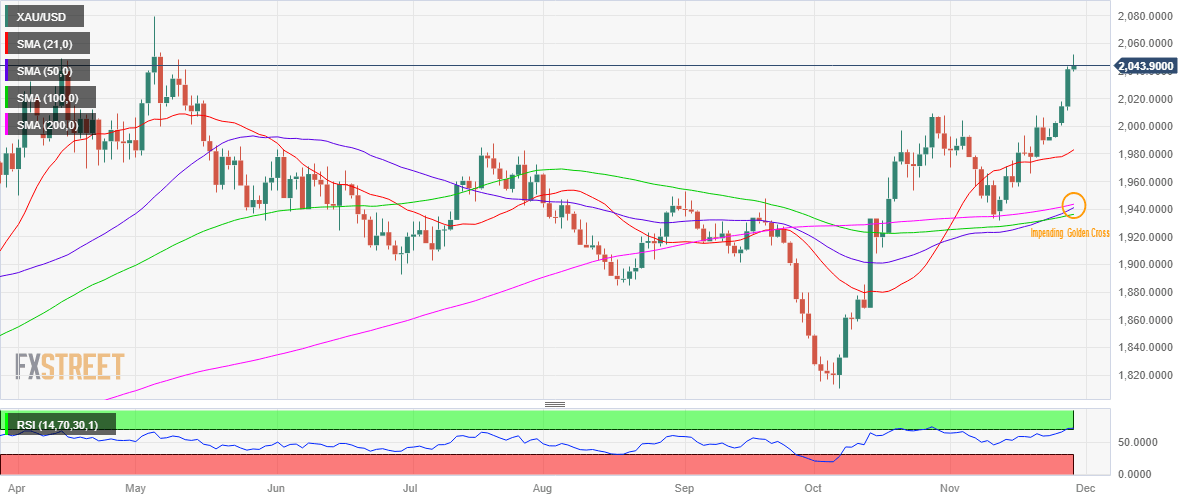

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price remains poised for further upside. However, a correction cannot be ruled out before a fresh advance kicks in.

The 14-day Relative Strength Index (RSI) indicator has entered into the overbought territory, justifying chances of a potential pullback in Gold price.

In such a case, immediate support is seen at the mid-September highs of 2,022, which was earlier an important resistance.

The next critical downside cap is expected to be the previous day’s low of $2,012, below which the corrective momentum could regain traction for a test of the $2,000 threshold.

The last line of defense for Gold buyers would be the upward-pointing 21-day Simple Moving Average (SMA) at $1,983.

However, the daily chart portrays an impending Golden Cross, as the 50-day SMA is on track to cross the 200-day SMA from below.

The potential Golden Cross formation should keep the downside cushioned for Gold price.

On the upside, acceptance above the multi-month high of $2,052 will fuel a fresh uptrend toward the $2,070 static resistance.

The all-time-highs of $2,079 will be next on Gold buyers’ radars.

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.