Gold Price Forecast: XAU/USD retreats as market mood improves, holds above $1,900

XAU/USD Current price: $1,915.25

- Financial markets are in a better mood amid signs institutions will contain the banking crisis.

- The European Central Bank delivered, as expected, a 50 bps rate hike.

- XAU/USD partially lost its positive momentum but remains well above $1,900.

Stop gold lost momentum and trades at around $1,918 a troy ounce after failing to overcome the monthly high posted this week at $1,930.32. Markets started the day in a better mood, as governments and central banks are taking steps to ensure banks’ credibility and prevent a steeper crisis.

Relief came after the Swiss National Bank (SNB) and the Swiss Financial Market Supervisory Authority (FINMA) announced late Wednesday that Credit Suisse met the capital requirements imposed on banks and that they would provide liquidity if necessary.

Mid-European session, the European Central Bank (ECB) announced its monetary policy decision, and as widely anticipated, the central bank pulled the trigger and hiked rates by 50 basis points (bps). The accompanying statement did not include a mention of the banking situation, but President Christine Lagarde started the press conference by stating that European banks are resilient and are much stronger than in 2008 after raising interest rates despite Credit Suisse's turmoil. Furthermore, she added that they are “monitoring current market tensions closely” and stand ready to respond as necessary.

Market players had a hard time digesting her optimistic words, but in the end, risk-on won. European indexes closed in the green, while Wall Street is also up. Government bond yields, in the meantime, were sharply down ahead of the American opening but turned positive after the dust settled. The 10-year Treasury note currently offers 3.55%, while the 2-year note is up to 4.14%.

XAU/USD price short-term technical outlook

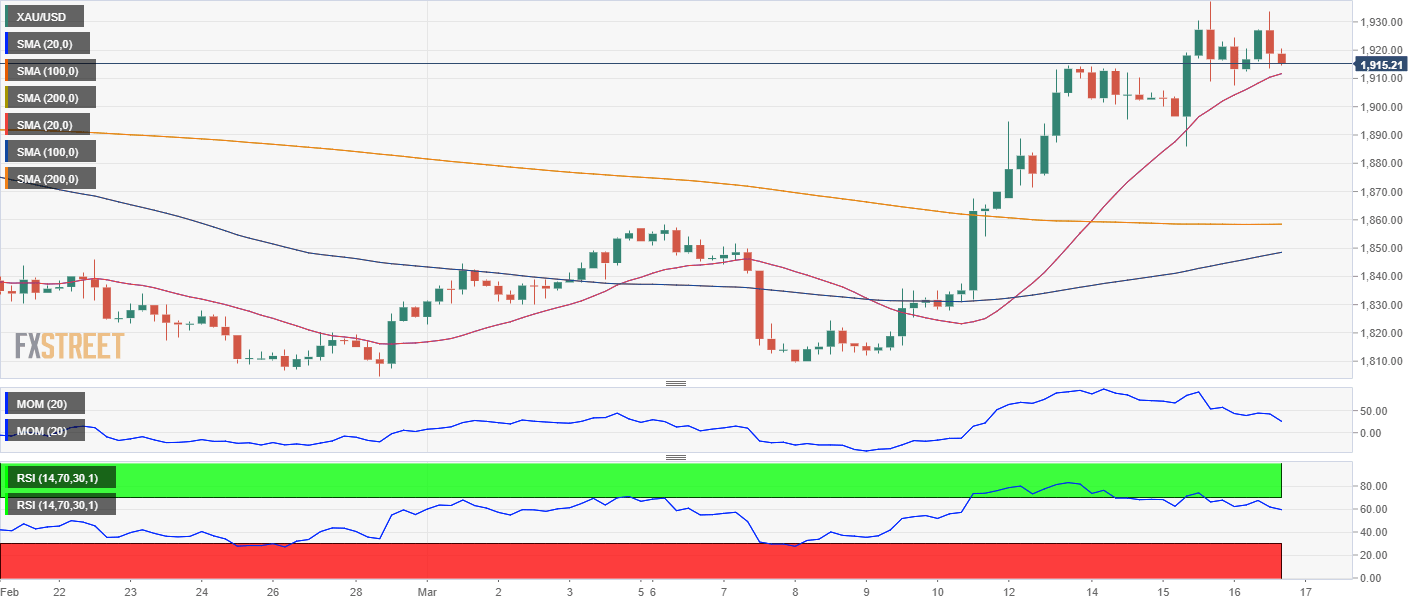

The XAU/USD pair daily chart shows that it trades in negative territory but retains its bullish stance. The bright metal keeps developing above bullish moving averages, with the 20 Simple Moving Average (SMA) gaining upward traction above the longer ones. At the same time, the Momentum indicator keeps advancing near overbought readings, while the Relative Strength Index (RSI) indicator consolidates at around 64. Finally, it is worth adding that XAU/USD holds above the $1,900 price zone.

In the near term, the pair partially lost its bullish strength, but there are no signs of an upcoming slide. In the 4-hour chart, a bullish 20 SMA provides dynamic support at around $1,910.25 while maintaining its upward slope well above the longer ones. The Momentum indicator rests above its 100 level, while the RSI retreats from overbought readings but remains well into positive territory.

Support levels: 1,910.25 1,900.00 1,889.20

Resistance levels: 1,938.50 1,947.90 1,960.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.