Gold Price Forecast: XAU/USD retreat from two-month highs could test key 100 DMA support

- Gold price is looking to extend its pullback from two-month highs of $1,984 on Wednesday.

- US Dollar is finding its feet after mixed US Retail Sales data, ahead of US tech earnings.

- Gold price could retreat toward the 100 DMA at $1,958 as the daily RSI turns south.

Gold price is reversing a part of the previous day’s solid recovery, retreating from two-month highs at $1,984. The United States Dollar (USD) is making a minor recovery attempt amid a dampening market sentiment, shrugging off the weakness in the US Treasury bond yields across the curve.

US tech earnings in focus, risk sentiment to hold the key

The US Dollar is attempting another bounce early Tuesday, having returned to the red on Monday following a brief reprieve on the mixed United States Retail Sales report. The US Commerce Department showed on Tuesday the country’s Retail Sales increased 0.2% last month. As previously reported, data for May was revised higher to show sales gaining 0.5% instead of 0.3%. The market forecast was for a growth of 0.5% in the reported period.

Despite the below-forecast reading, the underlying sales remained resilient, with online sales surging by 1.9%. Meanwhile, sales at food services and drinking places edged up 0.1%. US Dollar buyers, however, failed to retain control later in American trading, as the positive shift in risk sentiment on Wall Street curbed the Greenback recovery. Strong bank earnings boosted the US stocks, weighing negatively on the safe-haven US Dollar.

Further, the US Dollar rebound was also capped by a drop in the US Treasury bond yields across the curve, as the retail trade data from the world’s largest economy failed to douse expectations that the US Federal Reserve (Fed) is close to winding up its tightening program after the expected 25 basis points (bps) rate hike next week. Odds for a Fed rate hike pause in September increased to 86% following the mixed US Retail Sales and disappointing Industrial Production data, compared with about 81% seen before.

Attention now turns toward the mid-tier housing data due for release from the United States economic data and key tech earnings reports, including Tesla’s, for fresh cues on the broader market sentiment. Risk sentiment will likely influence the US Dollar valuations as investors adjust their USD positions, bracing for the Fed policy announcements next week. Gold price, therefore, could see a brief correction from higher levels should the US Dollar recovery gain traction on a cautious market mood.

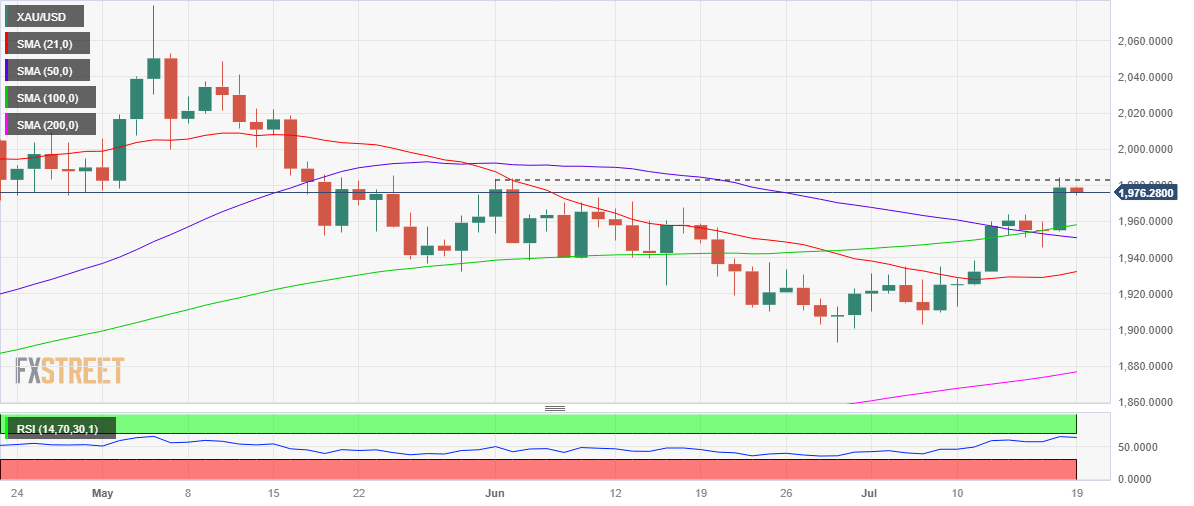

Gold price technical analysis: Daily chart

As expected, Gold price swung back higher and reached the highest level in two months, briefly surpassing the June 2 high at $1,984.

At the time of writing, the 14-day Relative Strength Index (RSI) has stalled its ascent and turned lower, suggesting that the pullback is likely to have legs.

Recall that a Bear Cross remains in play, adding credence to a potential pullback in Gold price.

Therefore, the Gold price correction could gather steam if the crucial resistance-turned-support at the June 16 high of $1,968 is taken out.

The next downside target for Gold sellers is envisioned at the mildly bullish 100-Day Moving Average (DMA) at $1,958. The additional declines could challenge the downward-pointing 50 DMA at $1,951.

On the upside, Gold price finds initial resistance at the $1,980 round number, above which the previous day’s high of $1,984 will be tested. Acceptance above the latter will trigger a fresh advance toward the $2,000 key barrier.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.