Gold Price Forecast: XAU/USD retains its bullish bias around $2,740

XAU/USD Current price: $2,740.65

- Market players are cautiously optimistic ahead of multiple first-tier data.

- Turmoil in Japan and the Middle East backed the US Dollar during Asian trading hours.

- XAU/USD consolidates near record highs, bulls paused but did not give up.

Spot Gold is comfortable trading in the $2,740 price zone, marginally higher for the day. The bright metal gapped lower at the weekly opening amid renewed US Dollar demand, although the latter changed course amid an improved market mood. Such a better sentiment limits the upside for XAU/USD in the American session.

The focus during Asian trading hours was on Japan after a snap election that resulted in the worst result in fifteen years for the Liberal Democratic Party (LDP). Prime Minister Shigeru Ishiba pledged to stay in office despite losing support amid a political scandal, including undocumented political funds and kickbacks. The Japanese Yen (JPY) edged sharply lower, supporting the USD.

Falling oil prices also helped the Greenback. Crude Oil Prices fell after Iran reported that the latest Israel attacks did not affect the country’s oil industry. As a result, stock markets trade in positive territory. Gains are modest ahead of multiple first-tier figures scheduled throughout the week. The United States (US) will publish the flash estimate of the Q3 Gross Domestic Product (GDP) and several employment-related figures ahead of the Nonfarm Payrolls (NFP) report scheduled for Friday. Additionally, the US, Australia, Germany and the Eurozone will publish fresh inflation-related figures, while the Bank of Japan (BoJ) will announce its decision on monetary policy.

XAU/USD short-term technical outlook

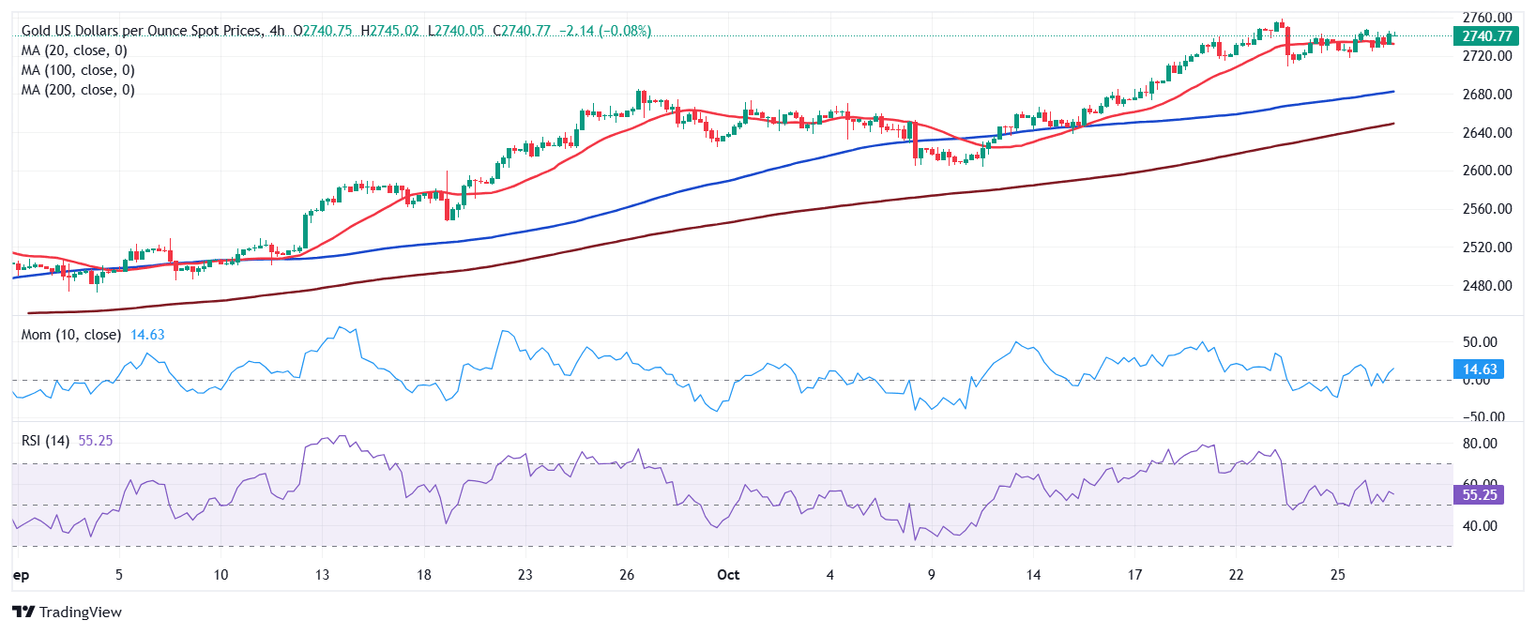

Gold holds on to modest intraday gains but trades below Friday’s close and within familiar levels. XAU/USD daily chart shows moving averages keep heading north far below the current level, with the 20 Simple Moving Average (SMA) accelerating higher, in line with buyers’ dominance. Technical indicators, on the contrary, offer neutral-to-bearish slopes holding within positive levels.

Even further, XAU/USD met intraday buyers just ahead of $2,721.20, the 23.6% Fibonacci retracement of the $2,601.87/$2,756.36 rally. More relevant support comes at $2,698.66, which is the 38.2% retracement of the same rally.

The near-term technical picture is neutral. The XAU/USD 4-hour chart shows the pair barely holding above a mildly bearish 20 SMA. The 100 and 200 SMAs keep heading north far below the current level, yet technical indicators have turned marginally lower, just above their midlines. A break through the intraday high at around $2,745.90 should favor a retest of the record high en route to the $2,800 mark.

Support levels: 2,721.20 2,708.50, 2,698.60

Resistance levels: 2,745.90 2,758.40 2,775.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.