Gold Price Forecast: XAU/USD resumes record rally on trade-war woes

XAU/USD Current price: $3,156.40

- Headlines indicating US tariffs on China are actually 145% triggered a USD sell-off.

- Inflation in the US eased by more than anticipated in March, according to CPI data.

- XAU/USD retreated from fresh record highs, holding on to solid intraday gains.

Spot Gold maintains its positive momentum on Thursday, surging to a fresh record high of $3,175.07. Markets are all about tariffs, regaining their optimism after United States (US) President Donald Trump announced a 90-day pause on reciprocal tariffs, announced last week.

Nevertheless, the US Dollar (USD) traded on the back foot throughout the day, as investors still believe the escalating trade war between the United States (US) and China will take its toll on the American economy. Trump backed off on reciprocal tariffs and left the 10% baseline, although levies on China were increased to 145%, and not to 125% as previously believed. Canada and Mexico will face levies of 35%, the former 25% announced, plus the 10% reciprocal tariffs baseline previously announced.

Meanwhile, US data released earlier in the day further hit the Greenback, as inflationary pressures receded by more than anticipated in March, according to Consumer Price Index (CPI) figures.

The annual CPI declined to 2.4% in March from 2.8% in February, also below the expected 2.6%. The core annual figure printed at 2.8%, down from the previous 3.1%. On a monthly basis, inflation was down by 0.1% vs an anticipated 0.1% increase. Additionally, weekly unemployment claims rose by 223K last week, meeting the market’s expectations. The figures confirmed the Federal Reserve’s (Fed) decision to maintain a wait-and-see stance.

Asian and European indexes closed with gains, but Wall Street resumed its massive slide, with the three major indexes down over 3% each.

XAU/USD short-term technical outlook

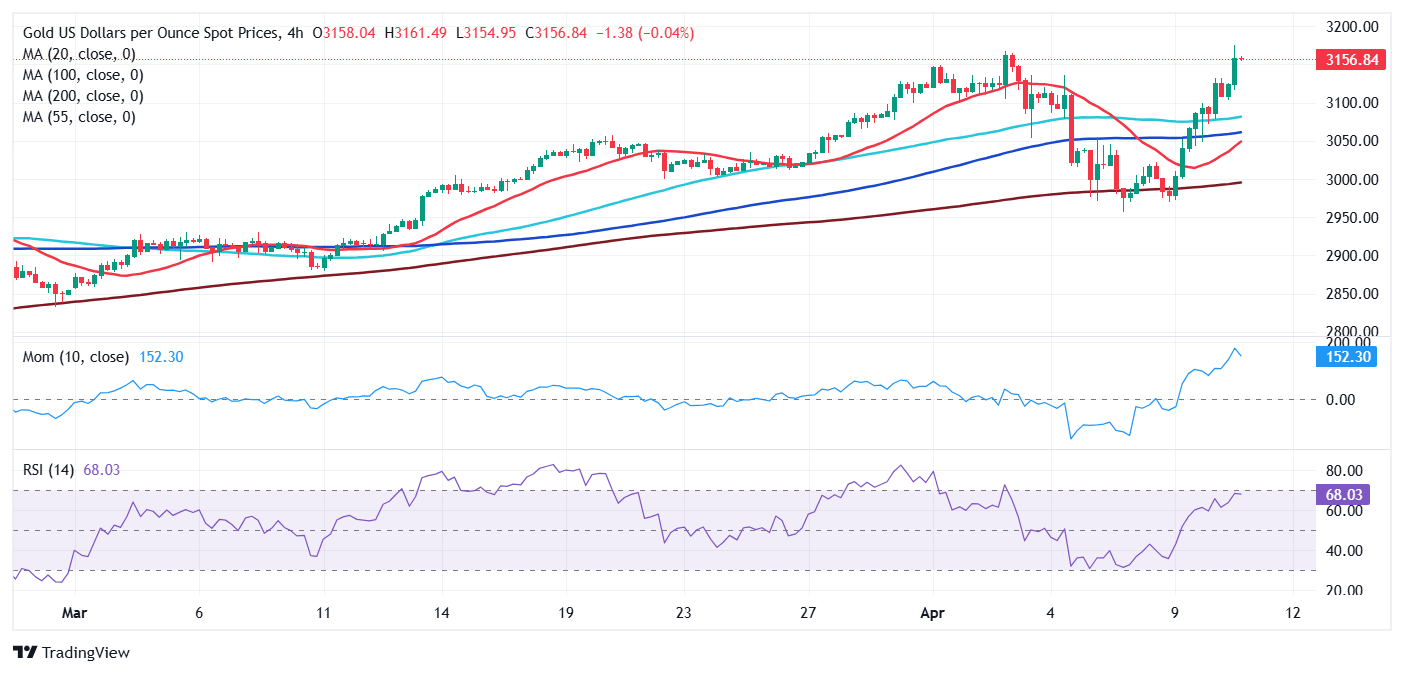

Technically, the XAU/USD pair's daily chart shows that additional gains are likely, given the strong upward momentum. Technical indicators head north almost vertically, while still far from overbought levels. At the same time, the bright metal extended its advance beyond a now bullish 20 Simple Moving Average (SMA), currently at $3,052. Finally, the 100 and 200 SMAs also aim north, but far below the shorter one.

In the near term, and according to the 4-hour chart, XAU/USD is bullish. Technical indicators reached fresh highs, maintaining their upward slopes yet indicating overbought conditions. At the same time, the 20 SMA turned firmly higher between the 100 and 200 SMAs, all of them far below the current level.

Support levels: 3,148.90 3,132.45 3,119.20

Resistance levels: 3,175.00 3,190.00 3,205.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.