Gold Price Forecast: XAU/USD reclaims 100 DMA, further upside hinges on Fed Chair Powell

- Gold price is defending $1,960, with the upside capped by renewed US Dollar demand.

- US Treasury bond yields hold gains, awaiting Federal Reserve policy announcements.

- Gold price closed Tuesday above 100 DMA at $1,964, Fed Chair Powell holds the key.

Gold price is clinging to critical 100-Daily Moving Average (DMA) at $1,964, consolidating the previous rebound from six-day lows, as investors gear up for the all-important US Federal Reserve (Fed) interest rate decision, followed by Chair Jerome Powell’s press conference.

All eyes on Federal Reserve Chair Jerome Powell’s presser

The United States Dollar (USD) is finding fresh demand in Asia this Wednesday, capping the recovery in the Gold price while the US Treasury bond yields enter a phase of upside consolidation ahead of the key Fed event. Markets stay cautious and refrain from placing any fresh bets on the Greenback as well as Gold price, as Fed Chair Jerome Powell’s words and the probable language in the policy statement could ramp up volatility across the financial markets.

The Fed is widely expected to raise rates by 25 basis points (bps) at its July meeting and, therefore, the Bank’s view on the interest rates path and the economy is likely to be closely scrutinized, shaping up Gold price direction in the coming weeks.

Recent signs of resilience in the United States economy keep hopes alive for another rate hike by the Fed beyond July, especially after the US Conference Board Consumer Confidence increased to a two-year high of 117.0 in July, in the wake of a persistently tight labor market and receding inflation. The probability of a Fed rate hike pause in September has dropped to 79% from about 85% seen last week.

If Fed Chair Jerome Powell signals a pause at the September meeting but leaves doors open for a rate hike later this year, his words will renew hawkish expectations and send the US Dollar higher at the expense of Gold price. However, the US Dollar could drop alongside the US Treasury bond yields should Powell hints at the end of the Fed’s tightening cycle, expressing economic growth worries.

Citing a third scenario, FXStreet’s Senior Analyst, Yohay Elam, notes: “If Powell says the Fed is open to raising rates as soon as September, it would serve as a bigger scare for investors, sinking stocks, melting Gold, and supercharging the US Dollar.“

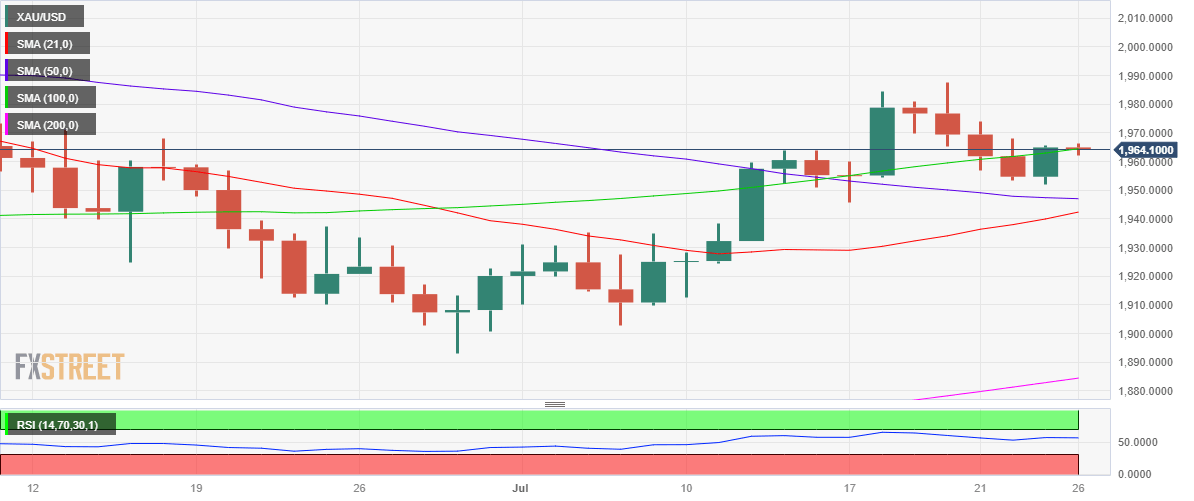

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price turnaround found acceptance above the 100-Daily Moving Average (DMA) support-turned-resistance at $1,964 after settling Tuesday above the latter.

However, Gold buyers have turned cautious in the lead-up to the Fed policy announcements. Dovish Fed outlook could see Gold price catching a fresh bid wave toward the two-month highs of $1,988 above which the $2,000 threshold will be challenged again.

The 14-day Relative Strength Index (RSI) stays firmer above the midline, suggesting that the upside appears more compelling for Gold price.

In case Powell sticks with his hawkish rhetoric, signaling another rate hike this year, Gold price is set to test the flattish 50 DMA of $1,947. Selling pressure is likely to intensify below the latter, opening flloors for a test of the upward-sloping 21 DMA of $1,942.

Further south, the $1,930 round figure will be the line in the sand for Gold buyers.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.