Gold Price Forecast: XAU/USD poised for a big break above $1800 as yields keep falling

- Gold awaits a strong catalyst to break through the key $1800 barrier.

- Falling Treasury yields and DXY remain a key driver for gold’s upside.

- A test of rising wedge hurdle at $1802 on the 4H chart likely amid bullish RSI.

Gold (XAU/USD) rallied to hit fresh two-month highs at $1798 on Wednesday, helped by the renewed weakness in the US Treasury yields, which eventually dragged the dollar. The returns on the market tumbled once again amid resurfacing concerns over the economic recovery, as the covid surge globally continues to overwhelm. However, the solid rally lost strength once again just shy of the $1800 barrier, as the latter continues to act as a critical technical level. Meanwhile, the rebound in Wall Street indices also helped limit gold’s advance.

In Thursday’s Asian trading, gold bulls took a breather above $1790, as they await a strong catalyst to resume the uptrend. The sell-off in the Treasury yields could deepen if the market mood worsens on a likely cautious outlook on the economy from the European Central Bank (ECB). The ECB is widely expected to maintain its current monetary policy settings when they meet later in the European session today. Meanwhile, the dovish Fed expectations could continue to offer support to the non-interest-bearing gold, as the focus also remains on the US weekly Jobless Claims for fresh incentives.

Gold Price Chart - Technical outlook

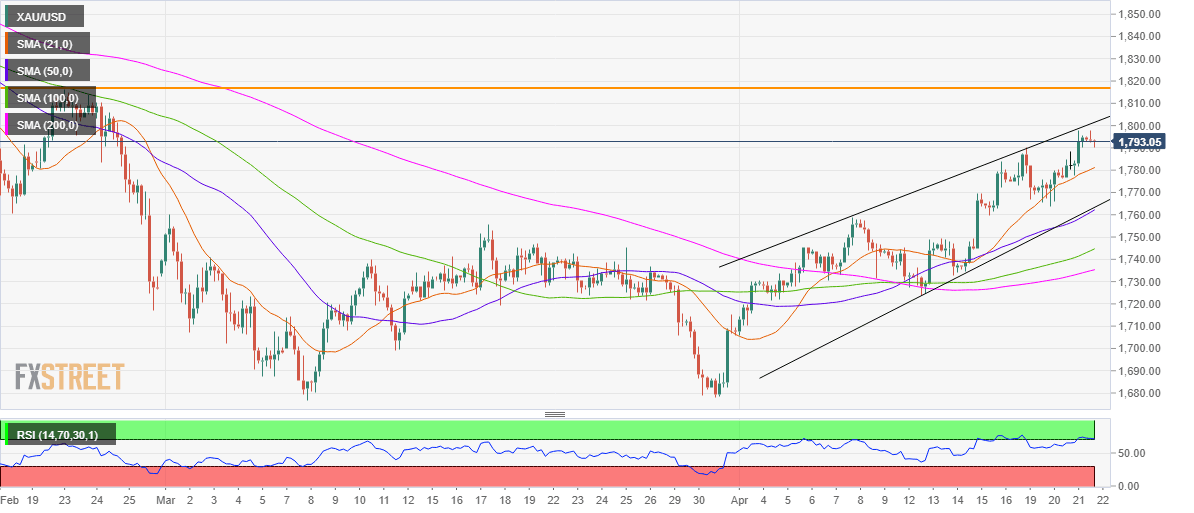

Gold: Four-hour chart

As observed on the four-hourly chart, gold faced rejection once again at the rising wedge hurdle, then at $1797/98.

Despite the pullback, it remains on the track to test that key barrier, now seen at $1802.

Supporting the bullish case, the Relative Strength Index (RSI) has reversed slightly from the overbought territory while trading well above the midline.

Gold buyers remain hopeful so long as the price holds above the 21-simple moving average (SMA) support at $1781.

A sustained move below the latter could expose the confluence zone of the wedge support and ascending 50-SMA at $1763.

Alternatively, a four-hourly candlestick close above $1802 could open the gates towards the horizontal (orange) trendline resistance at $1816.

Ahead of that target, the 100-day SMA at $1804 could test the bullish commitments.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.