Gold Price Forecast: XAU/USD on its way to retest record highs

XAU/USD Current price: $2,653.70

- Market players started the new year, dropping high-yielding assets amid persistent uncertainty.

- Central banks’ hawkishness and political uncertainty undermine the market’s mood.

- XAU/USD is reaching overbought conditions in the near term, but buyers are unlikely to give up.

Spot Gold trades around $2,650 a troy ounce as market players slowly return to their desks in the New Year holiday aftermath. Investors started the year dropping high-yielding assets, expressing their concerns about what the new year may bring.

Speculation that central banks may keep slowing the pace of interest rate cuts amid stubborn inflation are among the main themes. Geopolitical tensions are also at the top of the list after Ukraine interrupted the flow of Russian gas to several European countries after a former agreement ended on New Year’s Day, with Ukraine refusing to renew it.

Meanwhile, a risk-averse environment dominates the scenes. United States (US) indexes started the day with a positive tone but quickly dipped in the red, sending investors into safe-haven Gold.

XAU/USD short-term technical outlook

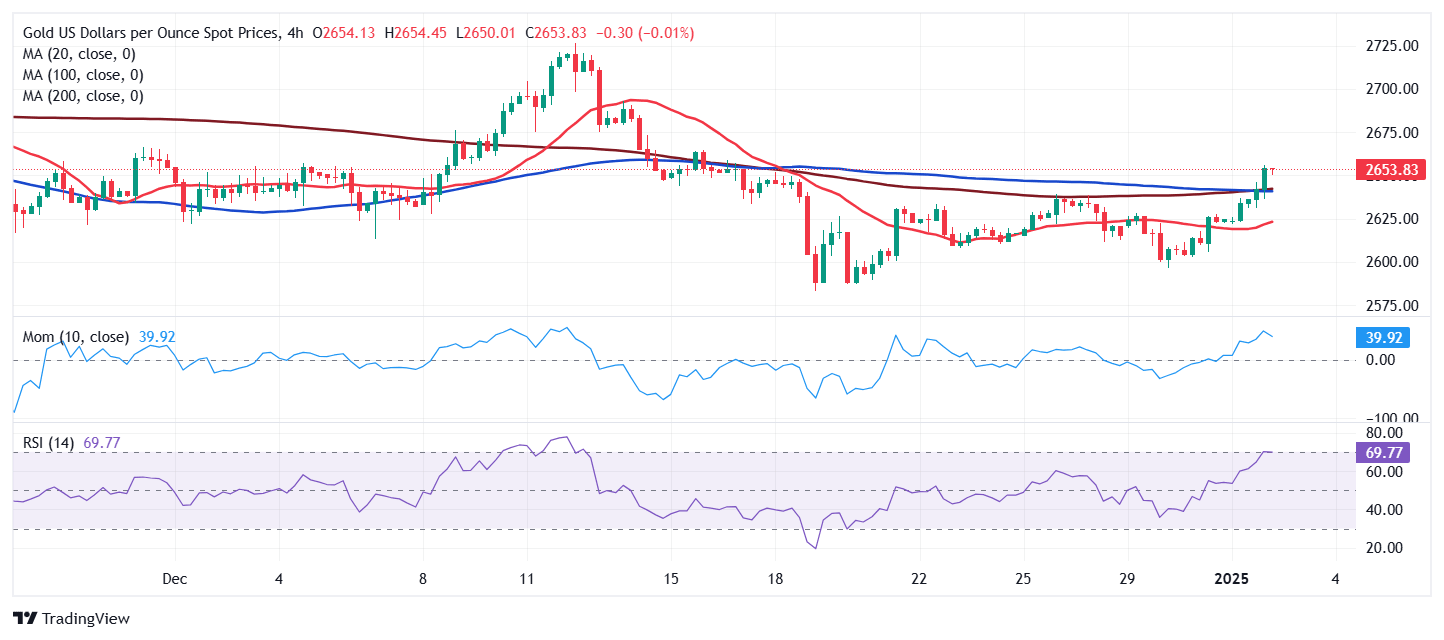

XAU/USD peaked at $2,655.68 and holds nearby in the mid-American session. From a technical point of view, the daily chart shows that the positive momentum is not enough to confirm additional gains, yet also that bulls dominate the bright metal. XAU/USD currently trades above all its moving averages, recovering above a flat 20 Simple Moving Average (SMA) after finding buyers around a bullish 100 SMA. Technical indicators, in the meantime, have pared their slides and turned marginally higher, albeit with uneven strength and still far from reflecting strong buying interest.

In the near term, and according to the 4-hour chart, however, XAU/USD is firmly bullish. The Momentum indicator heads north almost vertically well above its 100 line, while the Relative Strength Index (RSI) indicator advances around 70. Finally, the pair has moved above all its moving averages, although they lack directional strength. Gold needs to settle above $2,664.27, December 16 high, to convince speculative interest it could re-test record highs.

Support levels: 2,639.15 2,621.60 2,607.30

Resistance levels: 2,664.30 2,678.85 2,691.60

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.