Gold Price Forecast: XAU/USD on its way to challenge record highs

XAU/USD Current price: $2,687.35

- Upcoming central banks’ monetary policy decisions keep investors on their toes.

- The United States will publish the November Consumer Price Index on Wednesday.

- XAU/USD recovered its bullish poise and aims towards $2,700 in the near term.

Spot Gold maintains its bullish route on Tuesday, extending gains beyond the $2,680 threshold on the back of a dismal market mood. The US Dollar (USD) suffered some modest losses throughout the first half of the day, but demand for safety accelerated in the American session, benefiting the Greenback against high-yielding assets yet not against Gold.

The poor performance of European stocks and upcoming first-tier events further pushed speculative interest into adopting a cautious approach. On Wednesday, the United States (US) will release the November Consumer Price Index (CPI), and investors hope they can collect hints on what the Federal Reserve (Fed) may do when it meets next week. The Fed is widely anticipated to trim the benchmark interest rate by 25 basis points (bps) and inflation needs to be out of the rook to actually force them to proceed with a more aggressive cut, an unlikely scenario.

But it is not just about the Fed. Almost all major central banks will announce their decisions on monetary policy in the upcoming days. The Reserve Bank of Australia (RBA) was the first one early Tuesday, delivering no big surprises as the Board left the Official Cash Rate (OCR) unchanged at 4.35% as expected. The Bank of Canada (BoC) will come next, followed by the European Central Bank (ECB) on Thursday.

Central banks are struggling to return to normal interest rate levels while keeping inflation tamed and protecting economic growth. Indeed, the latter is out of their mandate, yet policymakers can’t play blind and deaf on soft economic progress and the risks of upcoming recessions. Their decisions will shed some light on what 2025 may bring regarding monetary policy.

XAU/USD short-term technical outlook

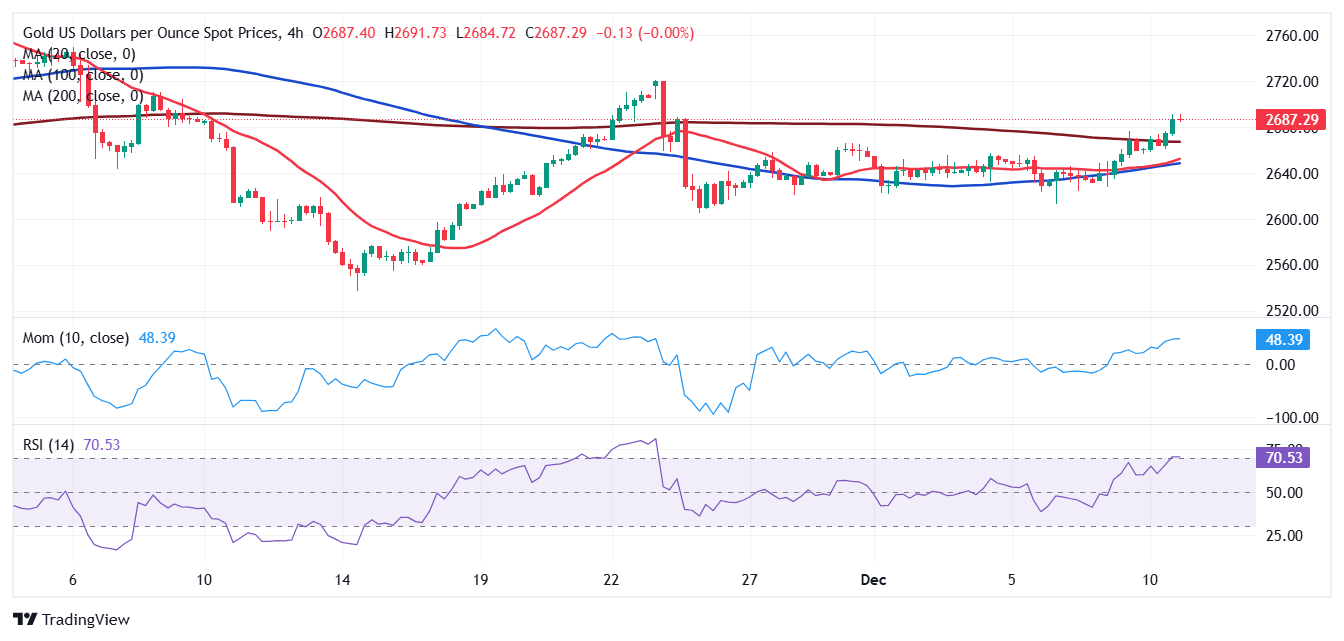

Meanwhile, the XAU/USD pair holds on to early gains and trades near the $2,690 mark. In the daily chart, technical readings favor an upward extension, given that the pair keeps recovering above a now mildly bullish 20 Simple Moving Average (SMA), while the 100 and 200 SMAs recovered their bullish poise below the shorter one. At the same time, technical indicators gain upward traction within positive levels, reflecting increased buying interest.

In the near term, and according to the 4-hour chart, the risk also skews to the upside. XAU/USD is above a flat 200 SMA for the first time in the month, while the 20 and 100 SMA advance below it, converging around $2,650. Finally, technical indicators develop near overbought reading with modest upward strength, but still heading north. Overall, XAU/USD seems poised to extend gains towards its record high in the $2,790 region.

Support levels: 2,676.30 2,662.50 2,650.40 2

Resistance levels: 2,693.70 2,704.35 2,722.60

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.