Gold Price Forecast: XAU/USD on its way to $2,000 ahead of mid-tier US data

- Gold price is extending the rebound toward $2,000; fresh two-month highs.

- US Dollar loses recovery momentum amid increased Fed rate hike pause bets.

- The daily technical setup for Gold price favors the upside, with eyes on US data.

Gold price extends the previous rebound toward $2,000, flirting with fresh two-month highs early Thursday. The United States Dollar (USD) has returned to the red, failing to capitalize on a cautious market mood and an uptick in the US Treasury bond yields across the curve.

US Dollar returns to the red ahead of United States data

The US Dollar built on Tuesday’s turnaround and added recovery gains on Wednesday, triggering a pullback in Gold price from near eight-week highs. Currency markets saw a notable correction across the board, led by the Pound Sterling following soft United Kingdom Consumer Price Index (CPI) data. That helped the Greenback stage a decent comeback even though the US Treasury bond yields incurred losses and the US housing data disappointed.

The US Dollar Index briefly recaptured the 100.50 psychological barrier, dragging the Gold price lower to test the static support at $1,970. However, in American trading, the US Dollar sellers returned, as markets remained optimistic ahead of Tesla Inc’s and Netflix’s earnings reports, lifting Gold price back toward the $1,980 level.

So far this Thursday, investors have turned cautious following mixed US earnings results after market hours. Tesla Inc. reported a record for quarterly revenue but lower margins, courtesy of price cuts and incentives. Netflix beat Wall Street forecasts, adding 5.9 million subscribers in the quarter. Despite the tepid risk tone, the safe-haven US Dollar is losing ground, as dovish US Federal Reserve (Fed) expectations act as a major headwind for the Greenback.

Markets widely expect the Fed to pause its tightening cycle in September again after the likely 25 basis points (bps) rate increase in July. Investors also weigh an end to the Fed’s rate hike program beyond September, as inflation softened more than expected.

Gold price could extend the renewed upside further in the day if the US Dollar resumes its downtrend ahead of the mid-tier United States weekly Jobless Claims and Existing Home Sales data. The main drivers will likely remain the Fed expectations and the US earnings reports, which could significantly impact the broader market sentiment and the USD-denominated Gold price.

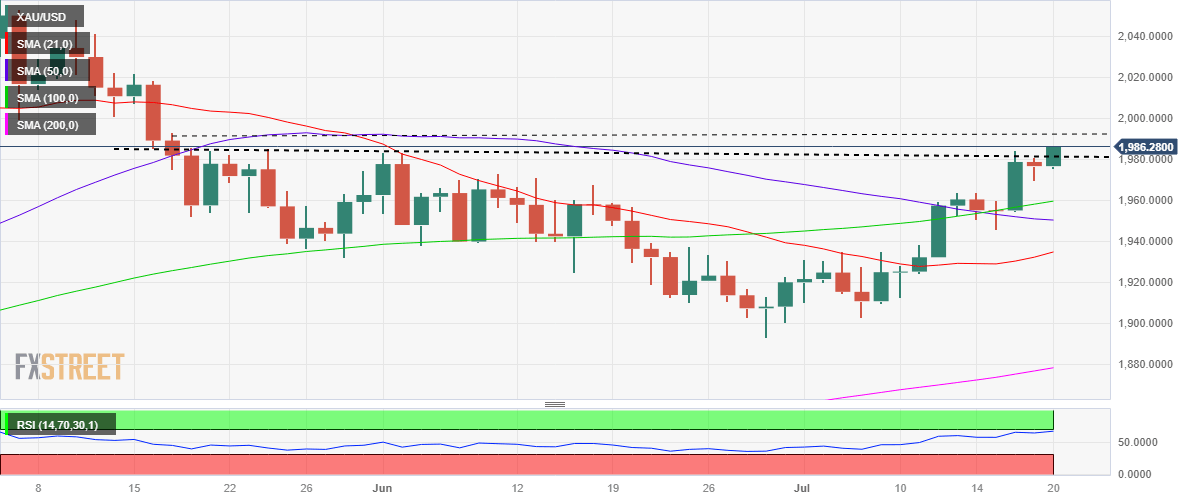

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price has swept through a couple of key upside barriers on its way to the $2,000 threshold.

The 14-day Relative Strength Index (RSI) is increasing to test the overbought territory, suggesting room for further upside.

Therefore, immediate resistance is seen at the May 17 high of $1,993, above which a test of the $2,000 mark will be inevitable.

Acceptance above the latter on a daily closing basis is needed to challenge bearish commitments near the $2,010 round level.

Conversely, any retracements will face an initial hurdle at the intraday low of $1,976. Gold sellers must then breach the previous day’s low and critical support at $1,970.

A fresh drop toward the bullish 100-Daily Moving Average (DMA) at $1,960 cannot be ruled out if the pullback gathers strength.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.