Gold Price Forecast: XAU/USD off record highs but bulls stay hopeful amid trade war fears

- Gold price corrects from record highs to return below $2,800 early Monday.

- US Presi. Trump started the trade war on Saturday, bolstering the US Dollar demand.

- Markets resort to ‘sell everything’ mode as risk aversion intensifies.

- The daily technical setup favors Gold buyers despite the ongoing retracement.

Gold price is falling back below $2,800 early Monday, extending its correction from record highs of $2,817 set on Friday. Despite, the latest leg down in Gold price, buyers remain hopeful as global trade war fears intensify.

Gold price down but not out

US President Donald Trump on Saturday imposed 25% tariffs on Canada and Mexico while slapping China with 10% levy, effective 05:01 GMT on Tuesday, citing that the measures were necessary to combat illegal immigration and the drug trade.

In response, Canadian Prime Minister Justin Trudeau and Mexican President Claudia Sheinbaum, in a tit-for-tat, announced retaliatory tariffs on US goods. Meanwhile, China’s Foreign Ministry said it would challenge Trump's levies at the World Trade Organization (WTO).

Trump’s tariffs initiated the inevitable trade war, with Asian traders hitting their desks and reacting negatively to the weekend announcement. Risk sentiment is heavily hit, reflective of the 1.40% decline in US S&P 500 futures.

Markets have resorted to ‘sell everything’ mode in times of panic and uncertainty, flocking to the go-to haven – the US Dollar (USD) at the expense of the traditional store of value, Gold. Traders are taking profits off the table in Gold price after it set record highs last week to cover for their losses in other financial assets.

However, if China retaliates with tariffs and risk-off flows intensify, Gold price could also find some support amid mounting concerns over a global trade war and its impact on global growth and inflation. Trump’s trade policies are perceived as inflationary, eventually boding well for the renowned inflation-hedge – Gold price.

Besides, traders might also take some cues from the top-tier US ISM Manufacturing PMI due later in the American session on Monday. Amid trade worries, discouraging China’s Caixin Manufacturing PMI data, which arrived at 50.1 in January, adds to the gloom. Meanwhile, speeches from US Federal Reserve (Fed) policymakers will also provide some trading incentives in Gold price.

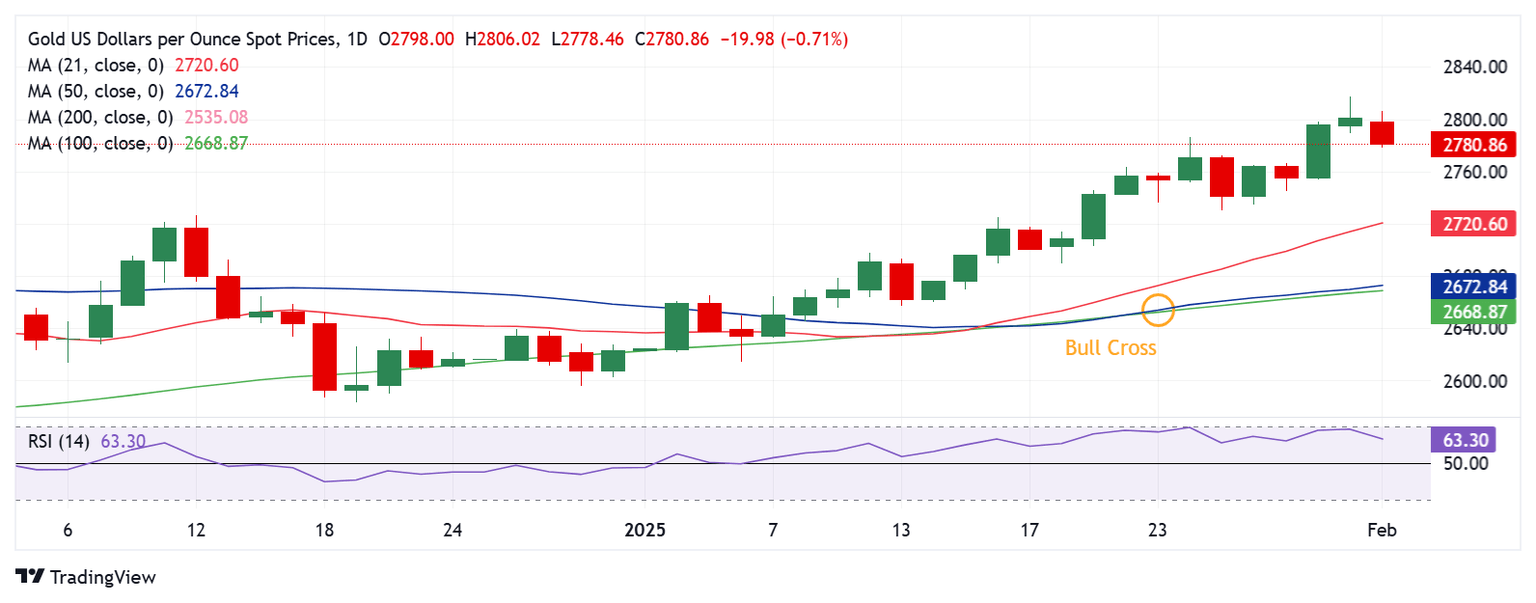

Gold price technical analysis: Daily chart

The short-term technical outlook for Gold price remains constructive as long as the 14-day Relative Strength Index (RSI), currently near 63.50, holds above the 50 level.

Adding credence to the bullish potential, the 50-day Simple Moving Average (SMA) and 100-day SMA Bull Cross remains in play.

Gold price needs a sustained move above the $2,800 level to retest the all-time highs of $2,817. The next topside barrier is at the $2,850 psychological level.

Conversely, the extended correction could challenge the January 30 low of $2,754, below which the previous week’s low of of $2,731 will come to buyers’ rescue.

The last line of defense for them is seen at the 21-day SMA at $2,721.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.