Gold Price Forecast: XAU/USD needs acceptance above 200-DMA on Biden’s inauguration day

- Gold edges higher as Yellen backs Biden’s stimulus plan.

- Dollar’s weakness and covid concerns also boost gold.

- Acceptance above 200-DMA is critical for XAU/USD.

Gold (XAU/USD) settled higher around $1840 on Tuesday, as the US dollar remained on the back foot amid prospects of additional stimulus. US Treasury Secretary nominee Janet Yellen argued in favor of a large stimulus in her testimony before the Senate, boosting stocks alongside the market mood. The risk-on environment dented the US dollar’s safe-haven appeal. The weakness in the US Treasury yields also benefited the non-yielding gold.

On Wednesday, Joe Biden will take the Presidential office and his inaugural speech will be closely eyed for fresh hints on the fiscal stimulus and the next direction in gold. In the meantime, the yellow metal will continue to cheer the calls for more fiscal spending under the Biden administration and growing covid cases in the US. However, the risk-on rally in global stocks could likely cap the upside in the metal.

Gold Price Chart - Technical outlook

Gold: Daily chart

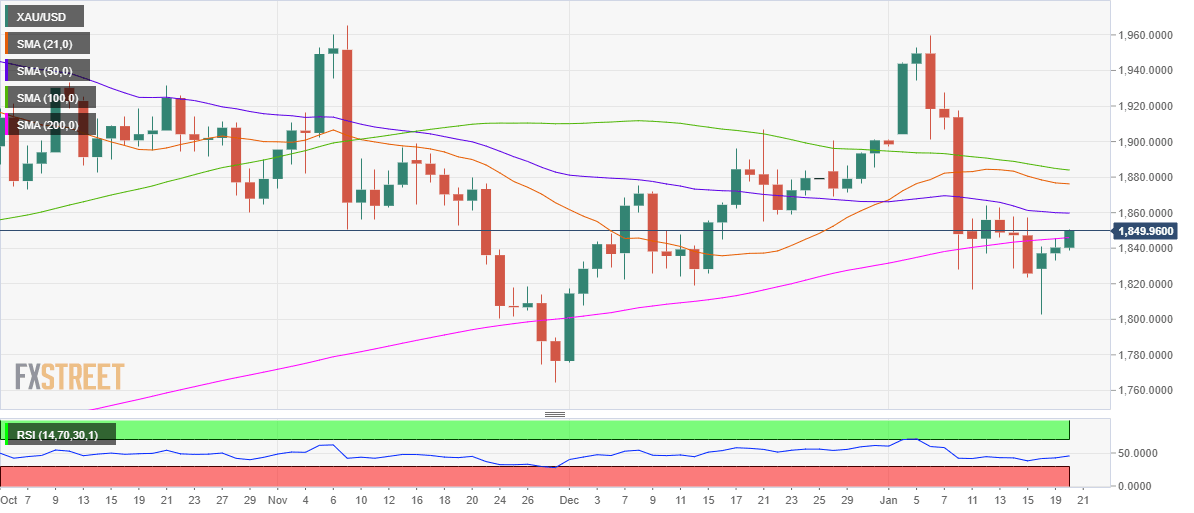

The daily chart shows that gold has recaptured the 200-daily moving average (DMA) at $1846, extending the recovery from seven-week lows into the third straight session.

However, daily closing above that critical hurdle is needed to negate the near-term downside bias. Acceptance above the 200-DMA barrier could expose a powerful 50-DMA hurdle at $1860. Further up, the 21-DMA at $1876 will be on the bulls’ radar.

Alternatively, a failure to resist above the 200-DMA could revoke the recovery momentum, calling for a retest of the multi-week lows of $1803. A break below which the December low at $1775 could be put to test.

The 14-day Relative Strength Index (RSI) points north but remains below the midline, suggesting that the downside still remains favored.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.