Gold Price Forecast: XAU/USD looks to fresh record highs as trade war fears rekindle

- Gold price pauses its record rally early Tuesday but bullish potential remains intact.

- Renewed trade war fears help the US Dollar rebound while US Treasury bond yields keep losing.

- Gold price closed above the $2,950 barrier; more upside remains in the offing.

Gold price consolidates the previous rebound to fresh record highs of $2,956 in Tuesday’s Asian trading hours. Gold buyers take a breather before resuming the uptrend as trade war fears rekindle on fresh protectionism talks from US President Donald Trump and his team.

Gold price to rebound on trade war fears

Risk sentiment remains in a weak spot so far this Tuesday, with the re-emergence of Trump’s tariff talks sagging investors’ confidence amid the market’s nervousness heading into the American artificial intelligence (AI) leader Nvidia earnings report on Wednesday.

Broad risk aversion is helping the safe haven US Dollar (USD) sustain the previous rebound, capping the Gold price upside. However, the corrective decline appears restricted by the recent decline in the US Treasury bond yields and mounting trade war fears.

The US Treasury bond yields extended their bearish momentum across the curve on Monday, courtesy of a strong auction for two-year US government bonds. Additionally, the recent release of the US S&P Global business PMI data raised concerns over the economy's health, ramping up the odds for two interest rate cuts by the Federal Reserve (Fed) this year.

The dovish sentiment surrounding the Fed expectations remains a drag on the US Treasury bond yields. This has helped Gold price build on its ongoing upsurge.

Furthermore, lingering trade war risks continue to support the traditional store of value – Gold. US President Donald Trump said Monday that sweeping US tariffs on imports from Canada and Mexico “will go forward” when a month-long delay on their implementation expires next week.

Early Tuesday, Bloomberg reported that Trump’s administration is seeking to tighten chip controls on China. Bloomberg added that the 47th US President’s team is considering stricter controls on Nvidia chip exports to China, urging Japan and the Netherlands to harmonize on China limitations.

Meanwhile, a lack of progressive developments on the second round of US-Russia peace talks to end the Ukraine conflict also underpins the bright metal.

In the day ahead, Gold price will remain at the mercy of the Trump tariff talks as the mid-tier US Consumer Confidence data will likely play second fiddle. A generalized profit-taking across the markets cannot be ruled ahead of Nvidia earning results.

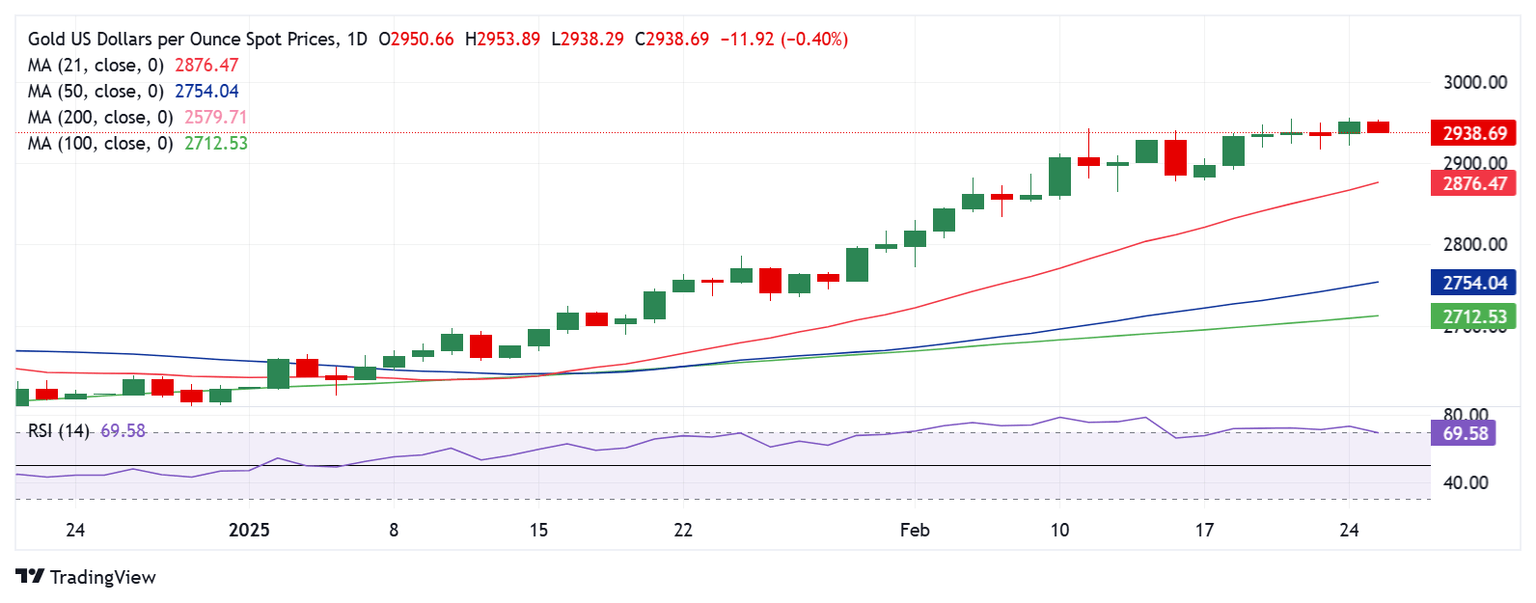

Gold price technical analysis: Daily chart

The daily chart shows that Gold price is retreating from record highs of $2,956, having found acceptance above the key $2,950 psychological barrier on a closing basis on Monday.

The 14-day Relative Strength Index (RSI) is easing off the overbought territory to enter within the bullish zone, currently near 70, suggesting that Gold price will likely catch a fresh bid on dips.

The immediate support is seen at the previous day’s low of $2,921, below which a test of the $2,900 round level will be inevitable. Further south, the February 14 low of $2,877 will be the line in the sand for Gold optimists.

However, Gold buyers could retest the all-time highs at $2,956 if the uptrend regains traction. The next topside barriers are seen at the $2,970 resistance and the $3,000 threshold.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.