- Stimulus hopes and pre-Fed caution keep gold underpinned.

- XAU bears to cheer encouraging vaccine new and IMF forecasts.

- All eyes on US data, stimulus updates and the Fed verdict.

Gold (XAU/USD) wavered in a $10 range around $1855 on Tuesday, settling in the red amid a broadly firmer US dollar. Uncertainty over the US $1.9 trillion stimulus plan, covid growth concerns and US-Sino tussle weighed on the market mood and boosted the US dollar’s appeal as a safe-haven. Meanwhile, upbeat US CB Consumer Confidence data also added to the upbeat momentum in the greenback. The International Monetary Fund's (IMF) upward revision of the 2021 global growth forecasts further exerted bearish pressures on gold.

On the Fed, gold remains depressed amid encouraging vaccine news from the US. President Joe Biden announced Tuesday that his administration will ramp up weekly vaccine supplies. However, expectations of the stimulus approval keep the buyers hopeful. Senate Majority Leader Chuck Schumer said Democrats will move forward on Biden’s covid relief package without Republican support if necessary.

However, markets remain nervous and refrain from placing any directional bets on the metal ahead of the Fed decision due later on Wednesday. The Fed is likely to strike a dovish tone at its first policy meeting of 2021, in the wake of new virus cases and the need to do more to stimulate the economic recovery. Ahead of the Fed outcome, the US durable goods orders data will be closely eyed for any impact on the greenback.

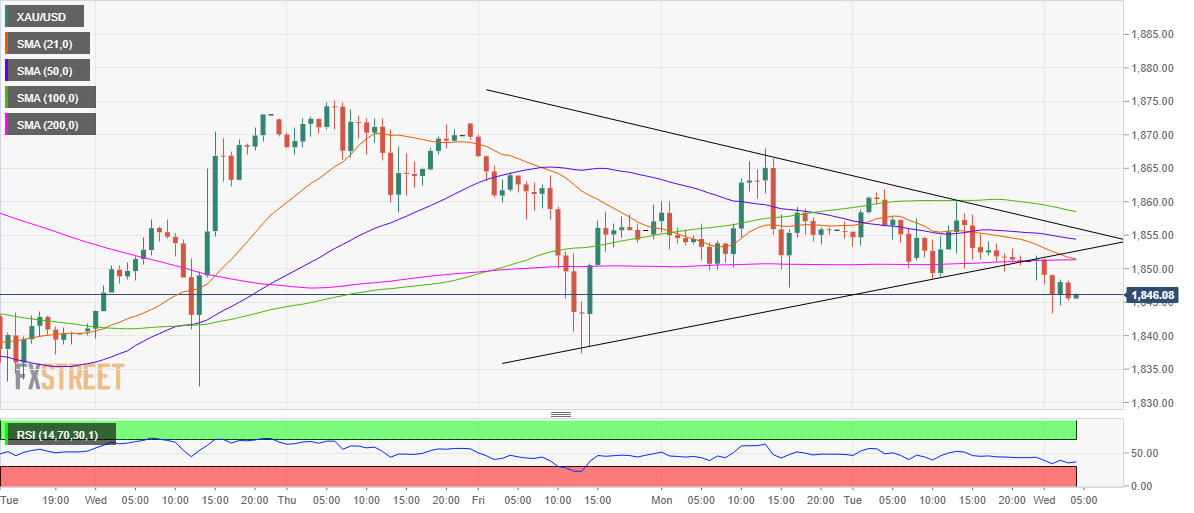

Gold Price Chart - Technical outlook

Gold: Hourly chart

Having confirmed a symmetrical triangle breakdown on the hourly chart, gold is consolidating the downside around $1845, as of writing.

An impending bear cross on the given timeframe backs the case for additional weakness. Also, the Relative Strength Index (RSI) trends in the bearish zone, allowing for more declines.

Therefore, the price could drop further to test the January 22 low of $1837, below which $1832 (Jan 20 low) could be put at risk.

Meanwhile, any pullbacks could meet strong supply at $1851, which is the confluence of the horizontal 200-hourly moving average (HMA) and 21-HMA.

Further up, the pattern support now resistance at $1853 could be probed. The XAU bulls need to recapture 100-HMA at $1858 to negate the near-term downside bias.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds steady near 0.6250 ahead of RBA Minutes

The AUD/USD pair trades on a flat note around 0.6250 during the early Asian session on Monday. Traders brace for the Reserve Bank of Australia Minutes released on Monday for some insight into the interest rate outlook.

USD/JPY: Traders set for rocky 2025 on rediverging interest rates, Trump and North Korea

The Federal Reserve remains the primary driver of USD/JPY and may halt its rate-cut cycle in 2025. Bank of Japan officials will probably refrain from bigger rate hikes. Wild-card politics are set to stir this currency pair, reflecting a duel of safe-haven currencies.

Gold: Is another record-setting year in the books in 2025?

Gold benefited from escalating geopolitical tensions and the global shift toward a looser monetary policy environment throughout 2024, setting a new all-time high at $2,790 and rising around 25% for the year.

Week ahead: No festive cheer for the markets after hawkish Fed

US and Japanese data in focus as markets wind down for Christmas. Gold and stocks bruised by Fed, but can the US dollar extend its gains? Risk of volatility amid thin trading and Treasury auctions.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.