Gold Price Forecast: XAU/USD in a consolidative phase ahead of PCE inflation

XAU/USD Current price: $2,347.35

- A bunch of dismal United States macroeconomic data hit the Greenback.

- The focus shifts to the US Personal Consumption Expenditures Price Index.

- XAU/USD under modest selling pressure but not far from its weekly high.

Spot Gold is little changed on Thursday, trading around its daily opening in the $2,340 price zone. XAU/USD extended its weekly slide to $2,322.50 during Asian trading hours, grinding higher afterwards amid a slight improvement in the market’s sentiment. The advance extended up to $2,351.72 with the release of dismal United States (US) data.

The US Bureau of Economic Analysis (BEA) reported that the country’s Gross Domestic Product (GDP) expanded at an annual rate of 1.3% in the first quarter, downwardly revising the previous estimate of 1.6%. Furthermore, Initial Jobless Claims in the week ended May 24 increased to 219K, worse than the 218K expected, while the preliminary estimate of April Wholesale Inventories increased by 0.2%, worse than the 0.1% decline anticipated.

Wall Street came under selling pressure, with the three major indexes trading in the red. At the same time, Treasury yields retreated, limiting USD strength against the bright metal. The 10-year note currently offers 4.54%, down 7 basis points (bps), while the 2-year note yields 4.92%, shedding 5 bps.

Market participants are now waiting for fresh US inflation data, which will be released on Friday. The country will publish the April Personal Consumption Expenditures (PCE) Price Index, which is foreseen at 2.7% YoY, matching March figures. The core annual reading is also expected to remain unchanged at 2.8%.

XAU/USD short-term technical outlook

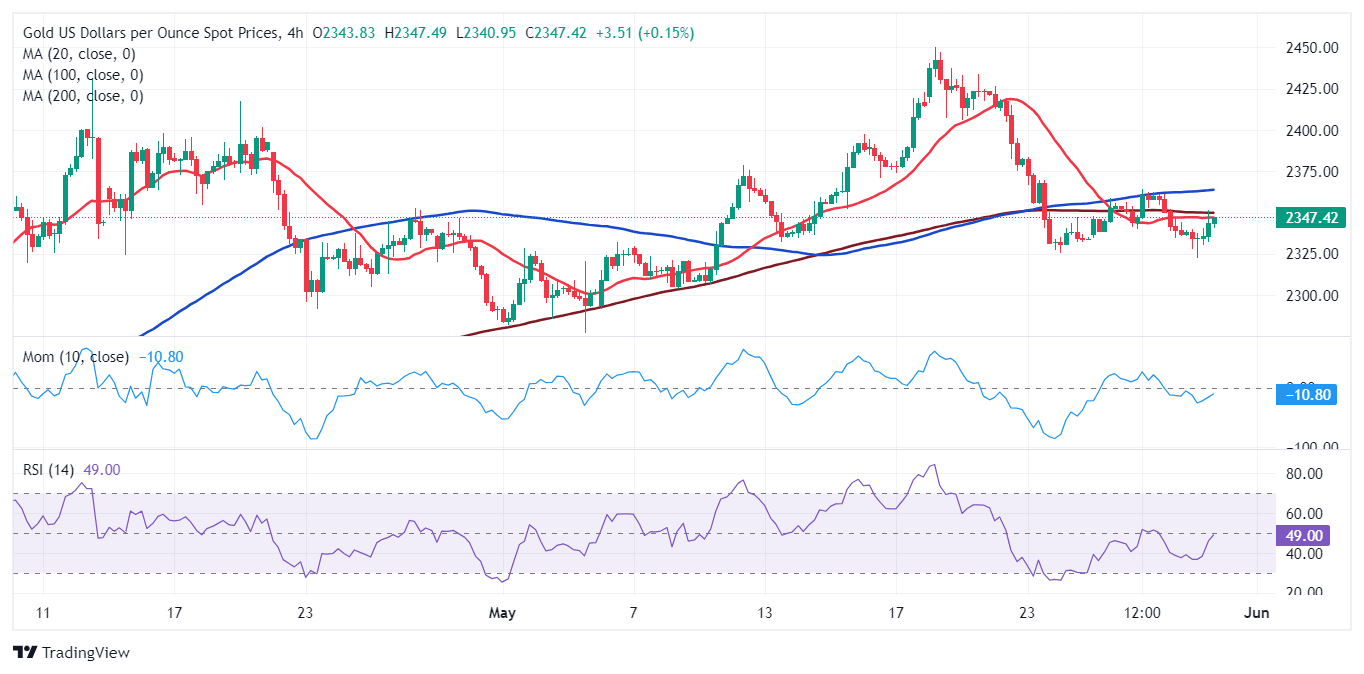

XAU/USD is weak, according to technical readings in the daily chart. Technical indicators stand within neutral levels with modest downward slopes, not enough to suggest an upcoming directional movement. At the same time, a flat 20 Simple Moving Average (SMA) caps the upside at around $2,355.50, while the 100 and 200 SMAs maintain their upward slopes well below the current level.

In the near term, and according to the 4-hour chart, XAU/USD is neutral. Technical indicators stalled their advances around their midlines while the pair remains below directionless moving averages. The weekly high at around 2,364.00 is the level to surpass for bulls to retake control of the pair.

Support levels: 2,334.35 2,325.30 2,307.10

Resistance levels: 2,355.50 2,364.00 2,372.90

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.