Gold Price Forecast: XAU/USD hovers around $2.670, aims higher

XAU/USD Current price: $2,670.71

- Financial markets remained cautious, with safe-haven assets leading the way.

- Market players shift the focus to the US Nonfarm Payrolls report.

- XAU/USD keeps posting higher highs on a daily basis, aims to retest records.

Spot Gold is up for a third consecutive day, hitting $2,678.16 a troy ounce during European trading hours, holding nearby in a thinned American session amid a United States (US) holiday. Speculative interest maintained the cautious stance despite a lighter macroeconomic calendar, resulting in generally stronger safe-haven assets. XAU/USD trades comfortable above $2,670, moving one step closer to record highs in the $2,726 price zone.

Data-wise, US-based employers announced 38,792 cuts in December, a 33% decrease from the 57,727 cuts announced one month prior. According to the Challenger Job Cuts report, it is up 11% from the 34,817 cuts announced in the last month of 2023. The report adds to encouraging employment-related figures ahead of the Nonfarm Payrolls (NFP) report.

The December NFP report is expected to show that the US economy created 160,000 new positions, another solid figure. At the same time, the Unemployment Rate is foreseen to remain steady at 4.2%. If that’s the case, financial markets will likely welcome the headlines that would allow the Federal Reserve’s (Fed) recently adopted tighter path when they meet on January 28-29.

XAU/USD short-term technical outlook

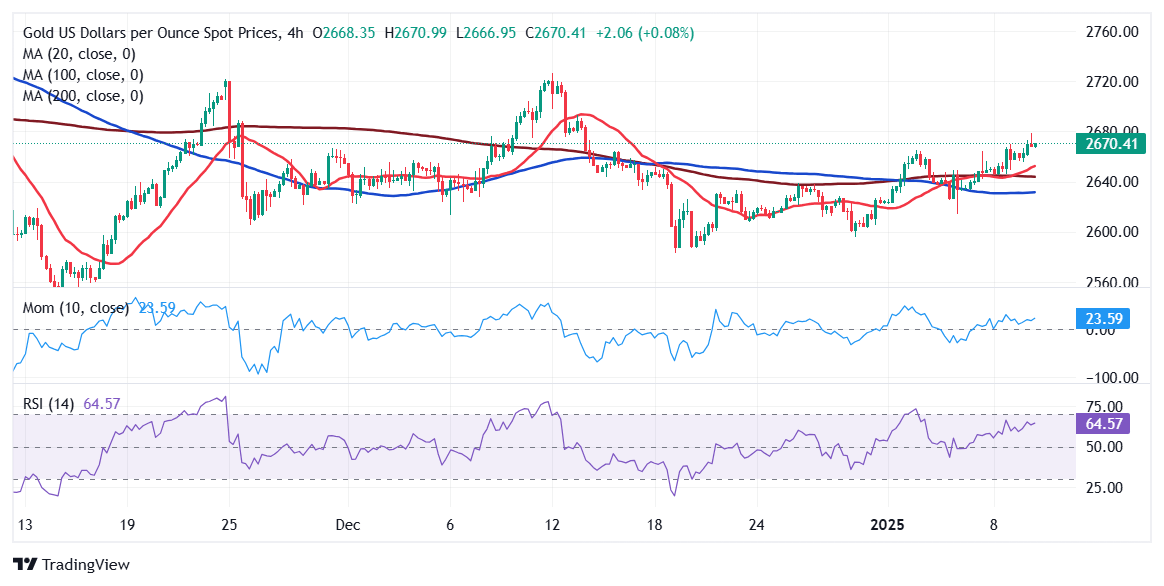

From a technical point of view, XAU/USD's bullish potential has increased. The pair posted a higher high and a higher low for a third consecutive day while extending gains beyond all its moving averages. The 20 Simple Moving Average (SMA) lacks directional strength at around $2,638, while the 100 SMA nears the shorter one with a bullish slope from below. At the same time technical indicators head firmly north within positive levels, favoring a continued advance.

In the near term, and according to the 4-hour chart, XAU/USD is also poised to extend its advance. The pair currently develops above all its moving averages, with a bullish 20 SMA advancing beyond the longer ones. The 200 SMA stands directionless at $2,645.98, providing support. As per technical indicators, the Momentum indicator grind higher within positive levels, while the Relative Strength Index (RSI) indicator retreats modestly from near overbought readings, not enough to support a bearish movement.

Support levels: 2,664.10 2,645.90 2,632.70

Resistance levels: 2,678.20 2,692.15 2,726

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.