Gold Price Forecast: XAU/USD holds record-setting rally ahead of US PCE inflation test

- Gold price refreshes record highs above $3,070 early Friday, awaiting US PCE inflation data.

- Trump’s tariffs reignite trade war and stagflation fears, driving safe-haven flows into Gold price.

- Gold buyers almost tested the triangle target at $3,080, where is price headed next?

Gold price extends its record-setting rally toward $3,100 after settling above $3,050 on Thursday. Sitting at record highs, Gold price keenly awaits the US Personal Consumption Expenditures (PCE) Price Index data and US President Donald Trump’s tariff updates for additional trading impetus.

Gold price reaches lifetime highs and counting

The safe-haven demand for the traditional store of value, Gold price, remains unabated amid a typical market unrest and panic situation, courtesy of Trump’s tariff plans. Investors scurry for safety in the bright metal, bracing for a raft of tariffs likely to be implemented as early as next week.

On Wednesday, Trump announced his plan to implement a 25% tariff on imported cars and light trucks, effective April 3, while the duty on auto parts is scheduled to begin on May 3. Markets also gear up for a wave of reciprocal tariffs on April 2.

Trump’s tariff wave has revived concerns over a potential trade war, which could lead to stagflation or recession in major economies. The revival of global economic slowdown fears and increased demand for Gold from Asian central banks have contributed to the latest record run in the bright metal.

Even though the recent economic data continue to indicate a healthy state of the American economy, tariff jitters overshadow and keep the US Dollar (USD) and the US Treasury bond yields on the losing end while propelling Gold price higher.

On Thursday, data showed that the fourth-quarter headline annualized Gross Domestic Product (GDP) growth was revised to 2.4%, higher than the previous and the consensus estimate of 2.3%. Meanwhile, the US Initial Jobless Claims came in at 224K, beating the expected 225K figure.

Looking ahead, the further upside in Gold price hinges on the US core PCE Price Index data release. Economists expect the Fed’s preferred inflation gauge to increase by 2.7% year-over-year (YoY) in February, following a 2.6% growth rate in January. A hotter-than-expected data release could prompt the US inflation print to justify the central bank’s prudent approach to interest rate cuts, weighing negatively on the non-interest-beating Gold price.

Conversely, a downside surprise in the data will likely bolster the ongoing rally in Gold price, alleviating pressure on the Fed over Trump’s tariffs-driven inflationary pressures. In such a scenario, markets will continue to bet on two rate cuts this year.

However, any reaction to the US data could be temporary as any developments on tariff plans by Trump could play a pivotal role in driving the market sentiment and the Gold price action. Additionally, a profit-taking slide in Gold price cannot be ruled out as traders reposition ahead of next week’s tariffs roll out and US Nonfarm Payrolls (NFP) data release.

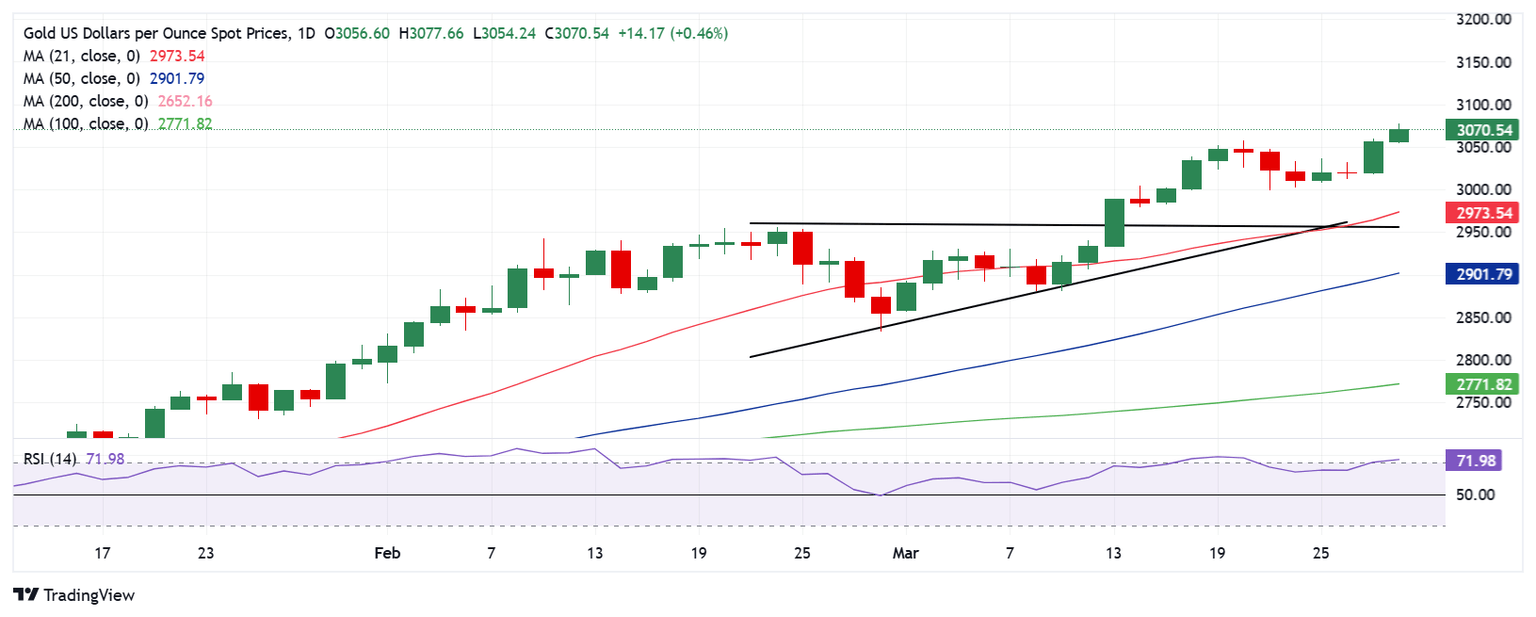

Gold price technical analysis: Daily chart

The daily chart shows that Gold price has almost tested the ascending triangle target, measured at $3,080.

Therefore, a minor pullback cannot be ruled out in the near term. Additionally, the 14-day Relative Strength Index (RSI) has entered the overbought region, currently at 72.50, lending credence to the retracement outlook.

If a correction unfolds, the immediate support for Gold buyers is at the $3,050 psychological barrier, below which the March 26 low of $3,012 could be tested.

Further down, the $3,000 round level will emerge as a significant support level.

On the other hand, if buyers manage to hold ground, the next topside target is seen at the $3,100 threshold.

Fresh buying opportunities would emerge above that level, opening doors for an advance toward the $3,150 level.

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Mar 28, 2025 12:30

Frequency: Monthly

Consensus: 2.7%

Previous: 2.6%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.