Gold Price Forecast: XAU/USD holds around 2,330 aims for fresh record highs

XAU/USD Current price: $2,329.91

- The US Dollar trades with a weaker tone amid a better market mood.

- Central banks' decisions and US inflation take centre stage this week.

- XAU/USD corrected from a fresh record high, maintains the bullish tone.

Spot Gold keeps reaching record highs on a daily basis, hitting 2,353.64 a troy ounce on Monday. XAU/USD retreated from its Asian peak and currently trades below the $2,330 threshold as a better market mood undermines demand for the bright metal.

Meanwhile, the US Dollar trades with a weaker tone against most major rivals, although volatility is limited amid upcoming first-tier news. Next Wednesday, the United States (US) will release the March Consumer Price Index (CPI), while on Thursday, the European Central Bank (ECB) will announce its decision on monetary policy. In between, the Bank of Canada (BoC) and the Reserve Bank of New Zealand (RBNZ) will also announce their decisions on monetary policy.

Stock markets trade in positive territory, although gains remain modest amid caution ahead of critical events that may set the tone for the rest of the month. Finally, it is worth adding that the odds for a Federal Reserve (Fed) June rate cut keep decreasing, and major analysts now see July as the date for the first move. Upcoming inflation data will surely be a make-it-or-break for the USD.

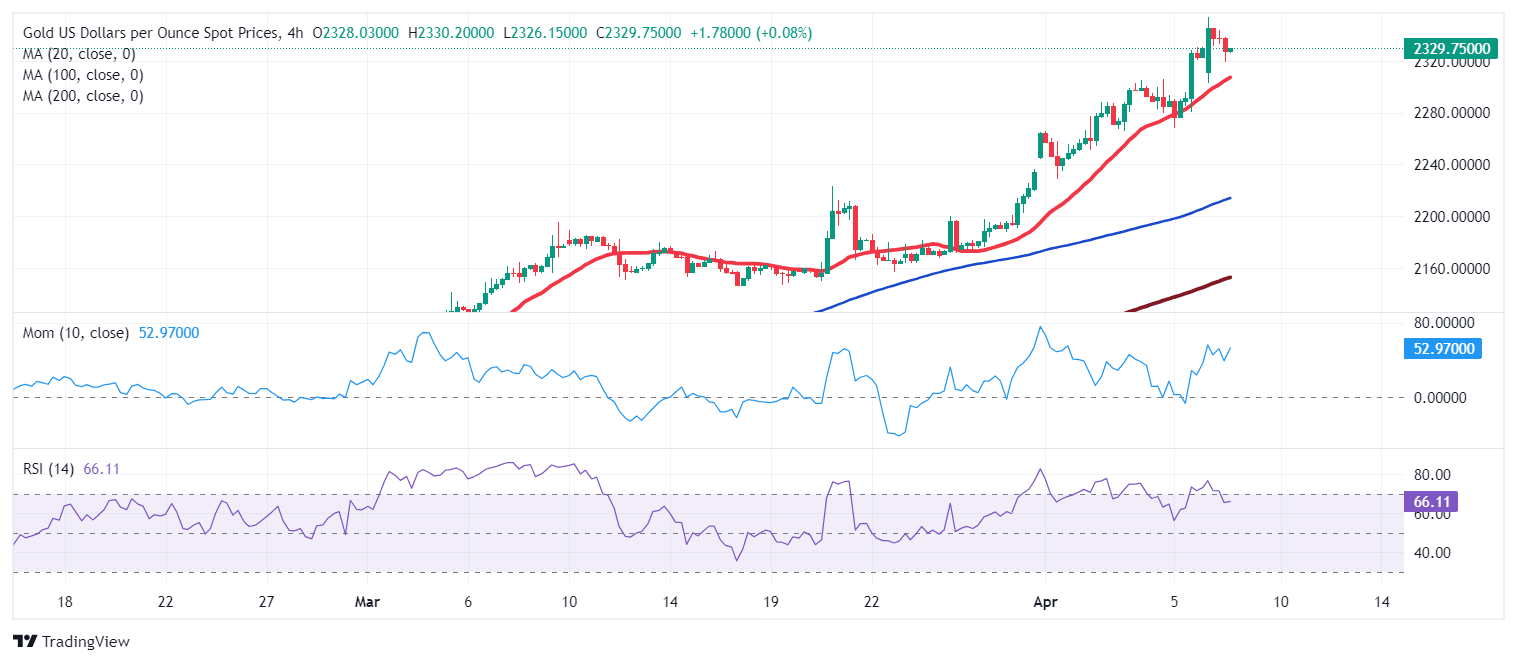

XAU/USD short-term technical outlook

XAU/USD's bullish trend is evident in the daily chart, which shows the pair consistently developing above all its moving averages. The 20 Simple Moving Average (SMA) has been steadily increasing but stands far below the current level and above the longer ones, showing a clear uptrend. Meanwhile, technical indicators are partially losing their bullish strength but still developing in extremely overbought territory. The Relative Strength Index (RSI) indicator has been doing so since March 27, anticipating a potential corrective slide or at least a consolidative stage.

The near-term picture is also bullish. The 4-hour chart shows all moving averages heading firmly north below the current level. Furthermore, the RSI indicator has corrected extreme overbought readings but turned flat at around 64, reflecting limited selling interest and far from signaling an upcoming reversal. Finally, the Momentum indicator has picked up within positive levels, in line with the dominant trend.

Support levels: 2,318.60 2,303.80 2,287.30

Resistance levels: 2,337.70 2,353.65 2,370.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.