Gold Price Forecast: XAU/USD holds above $2,660 with a soft tone

XAU/USD Current price: $2,663.89

- In the absence of macroeconomic figures, sentiment leads the way across financial boards.

- Fresh UK and US inflation data and President-elect Donald Trump in the eye of the storm.

- XAU/USD trades with a soft tone and could reach lower lows in the near term.

Spot Gold is on the back foot on Monday amid persistent US Dollar’s (USD) demand. The XAU/USD hit a multi-week high of $2,697.88 on Friday, as a solid United States (US) monthly employment report spurred risk aversion. The Nonfarm Payrolls (NFP) report showed the country added 256,000 new jobs in December, while the Unemployment Rate edged lower to 4.1%. The figures were upbeat. Even further, Average Hourly Earnings rose by 3.9%, easing from the previous 4%. The combined headlines hint at an on-hold Federal Reserve (Fed) for longer.

Demand for safety equally benefited Gold and the Greenback at the end of the previous week, yet persistent USD demand finally took its toll on XAU/USD, now trading at around $2,665. In the absence of relevant macroeconomic data, the focus remained on sentiment, and stocks’ behaviour. Asian and European indexes closed in the red, while Wall Street trades mixed: only the Dow Jones Industrial Average trades in the green after collapsing on Friday, while the S&P500 and the Nasdaq Composite remain in the red.

Meanwhile, the focus this week will be on inflation. The United Kingdom (UK) and the US will release fresh Consumer Price Index (CPI) figures next Wednesday. Market participants will also be waiting for President-elect Donald Trump and tariffs updates.

XAU/USD short-term technical outlook

From a technical point of view, the daily chart for the XAU/USD pair shows sellers have gained courage, yet at stepper decline is far from evident. The pair remains above all its moving averages, although a mildly bearish 20 Simple Moving Average (SMA) converges with a bullish 100 SMA at around $2,635. Technical indicators, in the meantime, turned sharply lower, yet remain within positive levels.

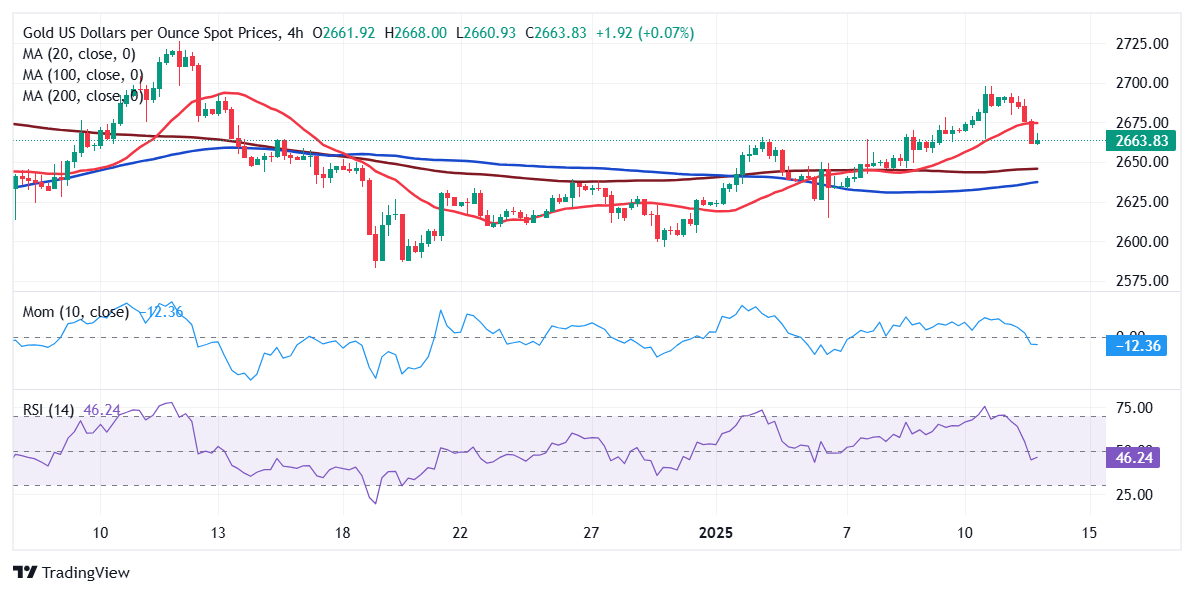

In the 4-hour chart, Gold is developing below its 20 SMA, which lost its bullish strength and provides resistance at around $2,672. The 100 and 200 SMAs, in the meantime, remain flat below the current level. Finally, technical indicators head firmly south, pressuring their midlines straight from overbought readings, suggesting the near-term slide could continue.

Support levels: 2,660.70 2,645.15 2,635.00

Resistance levels: 2,672.20 2,683.20 2,697.90

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.