Gold Price Forecast: XAU/USD hits fresh all-time-highs near $2,150, what’s next?

- Gold price is back under $2,100, consolidating the upsurge to fresh record highs of $2,144.

- Renewed geopolitical tensions, Fed rate cut bets and thin liquidity triggered a sharp Gold price rally.

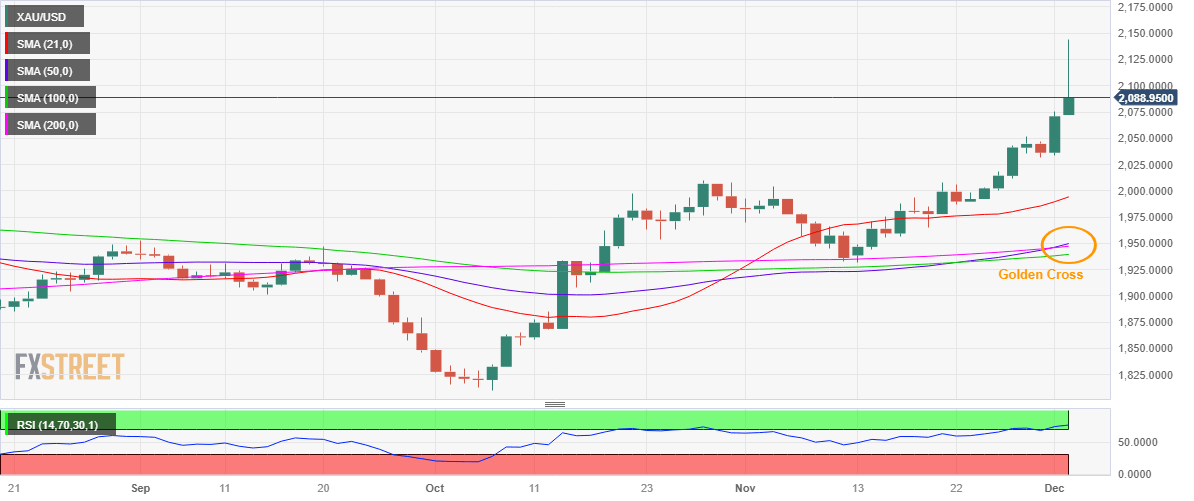

- Golden Cross remains in play amid overbought RSI on the daily chart. Where is Gold price headed next?

Gold price is consolidating the sharp pullback from fresh record highs of $2,144 reached in early Asia on Monday. Gold price is back under the $2,100 level, as the dust settles over the massive volatility seen in Gold price at the start of the United States (US) Nonfarm Payrolls week.

Gold price outshines amid supportive fundamental factors

Multiple factors can be attributed to the latest upsurge in Gold price, as buyers built on Friday’s rally at the start of the week on Monday. Gold price benefited from a fresh boost of safe-haven flows, in the wake of fresh geopolitical risks emanating between Yemen and the US over the weekend. The US military said on Sunday that Yemen’s Houthi rebels fired ballistics missiles and struck three commercial ships in the Red Sea. In retaliation, a US warship shot down three drones during the hours-long assault.

The US military’s Central Command said in a statement, "these attacks represent a direct threat to international commerce and maritime security. It added that “we also have every reason to believe that these attacks, while launched by the Houthis in Yemen, are fully enabled by Iran.”

These tensions add to the already persistent conflict between Israel and Hamas, as the truce failed on Friday after Israel accused Hamas of violating the ceasefire agreement. Israeli military resumed combat operations against Hamas, resuming hostilities in the Gaza Strip. Gold price is considered a traditional safe-haven asset and tends to benefit from escalating geopolitical tensions.

However, another safe-haven currency, the United States Dollar (USD) fails to find any inspiration from fresh geopolitical risks, as bets for a Fed interest rate cut in March ramp up, with markets pricing as much as a 60% probability of a March Fed rate cut. Fed Chair Jerome Powell’s efforts on Friday to push back against expectations of a policy pivot next year failed, as markets didn’t buy into his hawkish rhetoric amid cooling inflation in the US.

“It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease,” Powell said in his prepared remarks for an audience at Spelman College in Atlanta. “We are prepared to tighten policy further if it becomes appropriate to do so,” he added.

Further, thin liquidity conditions in early Asian dealing at the weekly open also contributed to the sharp uptick in Gold price, as markets also believe that such a move also came in after stops got triggered on a break of the previous all-time-high of $2,079 and the $2,100 psychological level.

Meanwhile, a recent survey by the World Gold Council (WGC) revealed that 24% of all central banks intend to increase their gold reserves in the next 12 months, as they increasingly grow pessimistic about the US Dollar as a reserve asset. This encouraging news also boded well for the Gold price.

Looking ahead, it remains to be seen if Gold price finds a fresh impetus to resume the upside, as the US Dollar could draw support from the Middle East geopolitical tensions. Although dovish Fed expectations are likely to dominate risk sentiment and the US Dollar valuations, as traders brace for the key US employment data due later this week.

Therefore, Gold price is expected to remain at the mercy of the US Dollar dynamics and Fed expectations, as the US Treasury bond yields take a breather from the recent sell-off. Geopolitical developments will also play part in driving the Gold price action.

Gold price technical analysis: Daily chart

The extent of the advance in Gold price early Monday, suggests that a sharp correction remains in the offing, especially as the 14-day Relative Strength Index (RSI) indicator remains well within the overbought territory.

The latest retracement could gather pace if the intraday low of $2,072 caves in. The next strong support is seen at the $2,050 psychological level, below which floors could reopen for a test of the $2,000 threshold.

However, any downside is likely to remain cushioned and could be seen as a good buying opportunity amid a Golden Cross in play.

The 50-day Simple Moving Average (SMA) yielded a weekly closing above the 200-day SMA, confirming a Golden Cross on Friday.

A daily closing above the $2,100 level is needed to initiate a sustained uptrend toward the $2,200 mark. Ahead of that, the record high of $2,144 will act as a stiff resistance.

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.