Gold Price Forecast: XAU/USD giving first signs of upward exhaustion

XAU/USD Current price: $2,156.71

- Policymakers from around the world put more weight on the battered US Dollar.

- US Treasury yields reached fresh multi-week lows, trimmed losses after Wall Street’s opening.

- XAU/USD reached fresh record highs, pulled back modestly despite extremely overbought conditions.

Spot Gold reached a fresh all-time high of $2,164.76 a troy ounce on Thursday, as speculative interest kept selling the US Dollar. The bright metal lost momentum early in the American session, and XAU/USD currently trades at around $2,155, holding on to modest intraday gains. Across the board, however, the US Dollar extended its slump to reach fresh multi-week lows against most major rivals.

Several factors affected the USD. On the one hand, Bank of Japan (BoJ) policymakers offered some relatively hawkish comments on monetary policy that boosted the Japanese Yen (JPY) against the Greenback. Governor Kazuo Ueda said it is “fully possible to seek an exit from stimulus while striving to achieve the 2% inflation target.” Additionally, BoJ’s Board member Junko Nakagawa said the local economy is making steady progress toward achieving its price goal, backed by solid wage growth.

On the other hand, the European Central Bank (ECB) announced its decision on monetary policy, and as widely anticipated, rates were left on hold. Policymakers made downward revisions to inflation and growth forecasts, falling short of surprising markets with fresh clues on monetary policy. In fact, President Christine Lagarde was modestly hawkish, confident about reaching the central bank’s inflation goal and noting demand for labour is slowing and growth in wages in starting to moderate.

Finally, Federal Reserve’s (Fed) Chair Jerome Powell testified before Congress for a second consecutive day. Powell added some interesting comments to those delivered on Wednesday, noting some small banks may fail, but no big one is expected to fall. Regarding monetary policy, Powell added he wants to be more confident (before cutting rates), saying policymakers are not far from it.

It is worth adding that Treasury yields remained under modest pressure, falling to fresh multi-week lows ahead of Wall Street’s opening. The 10-year Treasury note currently yields 4.11%, pretty much flat for the day after trimming early losses, while the 2-year note offers 4.52%, down 3 basis points (bps).

XAU/USD short-term technical outlook

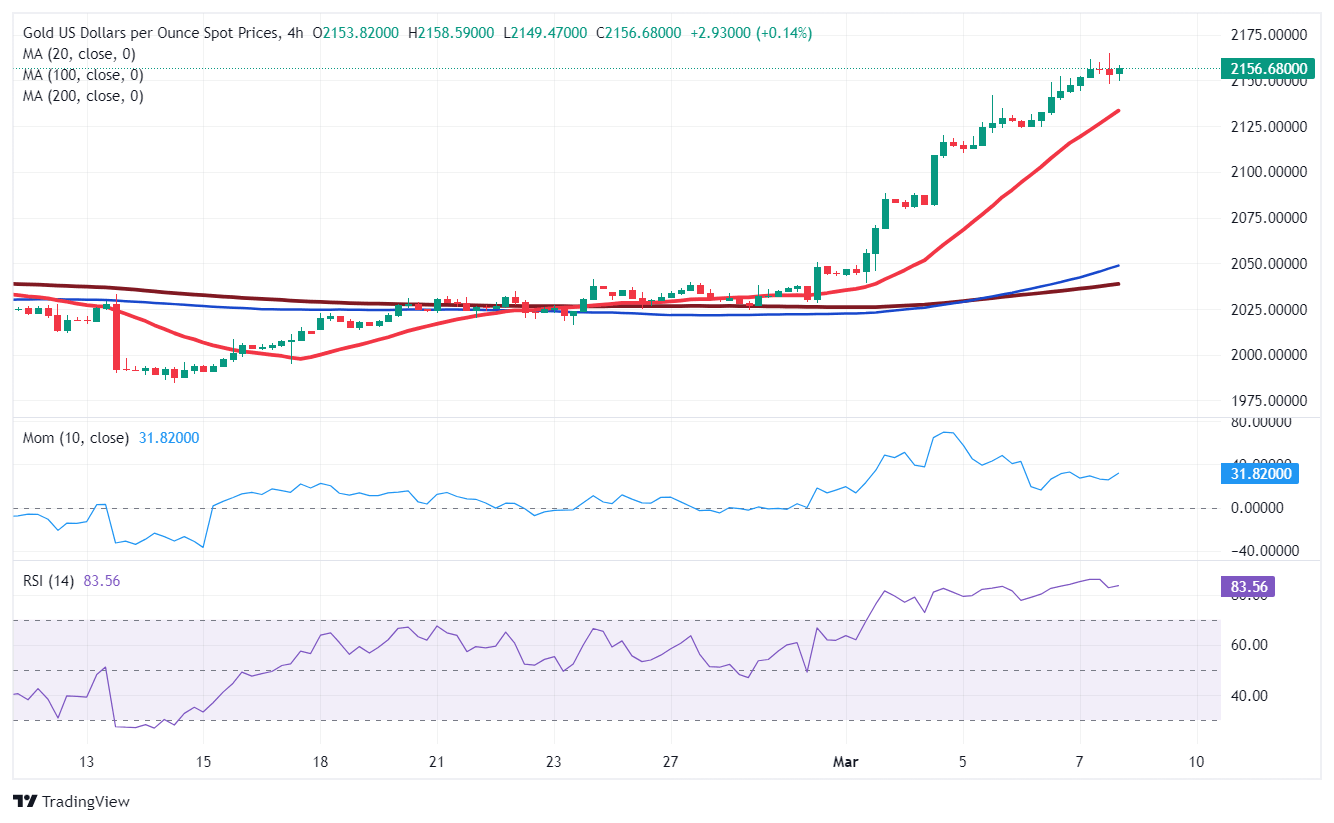

XAU/USD is up for the seventh consecutive day, partially losing its upward momentum. Extreme overbought conditions make it difficult for the pair to extend gains, and a bearish correction or a consolidative phase is on the cards. Technically, the daily chart shows that indicators turned flat at extreme readings, suggesting some upward exhaustion. Still, the pair keeps developing well above bullish moving averages, with the 20 Simple Moving Average (SMA) accelerating north above the longer ones.

In the near term, and according to the 4-hour chart, technical divergences are more evident. The Momentum indicator is posting lower lows within positive levels despite higher highs in prices. Meanwhile, the Relative Strength Index (RSI) indicator gains downward traction but stands at around 80. Finally, the 20 SMA maintains its bullish slope, providing dynamic support at around $2,132.50.

Support levels: 2,145.60 2,132.50 2,119.90

Resistance levels: 2,165.00 2,180.00 2,200.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.