- The US Dollar loses momentum along with the Trump-led rally.

- Geopolitical jitters dominate the backdrop at the beginning of the week.

- XAU/USD manages to make a U-turn and reclaim the $2,600 barrier.

After six consecutive days of losses, Gold prices manage to regain some balance and trim part of the recent intense pullback, reclaiming the $2,600 mark per troy ounce and above in quite a positive start to the new trading week.

The favourable backdrop in the precious metal also appears propped up by another negative day in the US Dollar (USD) as market participants keep re-assessing the recent Trump-infused strong rally, while the lack of a clear direction in US yields across different time frames also gives the yellow metal fresh legs.

However, the resurgence of the geopolitical factor, precisely from the Russia-Ukraine war, seems to be mostly behind the wake-up call in the metal, particularly after Biden’s administration “authorised” Ukraine to use US-made weapons to strike Russian territory.

Moving forward, it should be a week dominated by data releases surrounding the real economy worldwide, where the publication of preliminary PMIs is expected to take centre stage. In addition, opinions from central bank officials are also seen keeping investors entertained, especially after Fed’s Chair Jerome Powell suggested last week that the central bank is in no rush to cut its interest rates further given a resilient US economy.

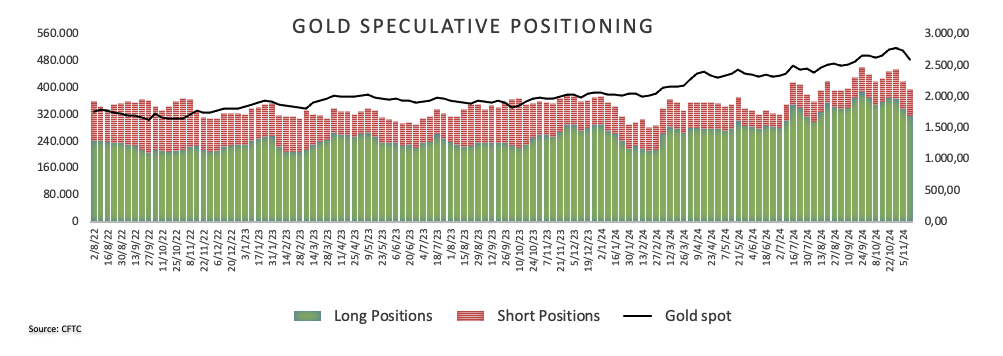

On another front, non-commercial players (speculators) have reduced their net long positions in Gold to about 236.5K contracts, a level not seen since early June, according to the CFTC Positioning report for the week ending November 12. This retracement also came in tandem with the second straight drop in open interest, aligning with the recent decline.

XAU/USD short-term technical outlook

The daily chart for XAU/USD shows that it bounced from a bullish 100 Simple Moving Average (SMA) near $2,550, a region close to the November low ($2,536). However, the initial hurdle above $2,600 coincides with a Fibo retracement of the yearly rally and is expected to offer decent resistance.

In the near term, and according to the 4-hour chart, the ongoing upward correction seems poised to continue. The Relative Strength Index (RSI) rebounded but met resistance around the 55 level, while the Average Directional Index (ADX) around 32 is not supportive of a strong trend.

Initially, on the upside, emerges the 55-SMA at $2,630, which precedes the more significant 200-SMA and the provisional 100-SMA at $2,679 and $2,684, respectively. On the other hand comes $2,536.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Upside appears capped at 0.6300 on Trump's tariff fallout

AUD/USD struggles to build on the previous day's rebound and remains below the 0.6300 mark early Wednesday, anticipating US President Trump's tariffs announcement later in the day. However, buyers continue to draw support from China's stimulus optimism and RBA's prudence on the policy outlook.

USD/JPY holds losses below 150.00 as traders await Trump's tariffs

USD/JPY stays defensive below 150.00 in Wednesday's Asian trading as traders turn cautious ahead of Trump's reciprocal tariffs announcement. A cautious market mood and BoJ Ueda's comments underpin the Japanese Yen, keeping the pair under pressure amid a subdued US Dollar.

Gold risks a sharp pullback if Trump’s ‘reciprocal tariffs’ disappoint

Gold price regains traction on ‘Liberation Day’, having found fresh demand near the $3,110 region. The further upside in Gold price hinges on the highly anticipated US President Donald Trump’s “reciprocal tariffs” later this Wednesday.

Solana traders risk $120 reversal as FTX begins $800M repayments on May 30

Solana’s price remained pinned below $130 on Tuesday, despite a broader market recovery. While Bitcoin, Ripple, and Cardano posted gains exceeding 3% over the past 24 hours, SOL lagged behind.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.