Gold Price Forecast: XAU/USD faces a double whammy, $1850 support at risk?

- Gold undermined by stronger US dollar on growing coronavirus fears.

- Vaccine optimism lifts risk assets, weighs on yieldless gold.

- Technical chart warrants caution for XAU/USD bulls.

Gold’s (XAU/USD) extended its downside consolidation phase on Wednesday and fell over 1%, having closed the day well above the key $1850 level. Gold faced a double whammy amid a broadly stronger US dollar, as its haven demand remained intact due to surging coronavirus cases in the US. On the other hand, vaccine optimism lifted expectations of a quicker economic turnaround and boosted the appeal of the risker assets at the expense of the non-yielding gold. Further, a less urgent need for a fiscal stimulus also remained a drag on the precious metal.

Looking ahead, the narrative is unlikely to change, as markets are pricing in the COVID-19 vaccines to be rolled out by the year-end, which could drive the higher-yielding Treasury yields higher and therefore, the greenback. The risk remains to the downside for gold traders even if the virus situation worsens internationally. The focus also shifts to the fundamentals, with the US weekly jobless claims and CPI due on the cards alongside speeches by the Heads of the key global central banks, the Fed, the ECB and the BOE.

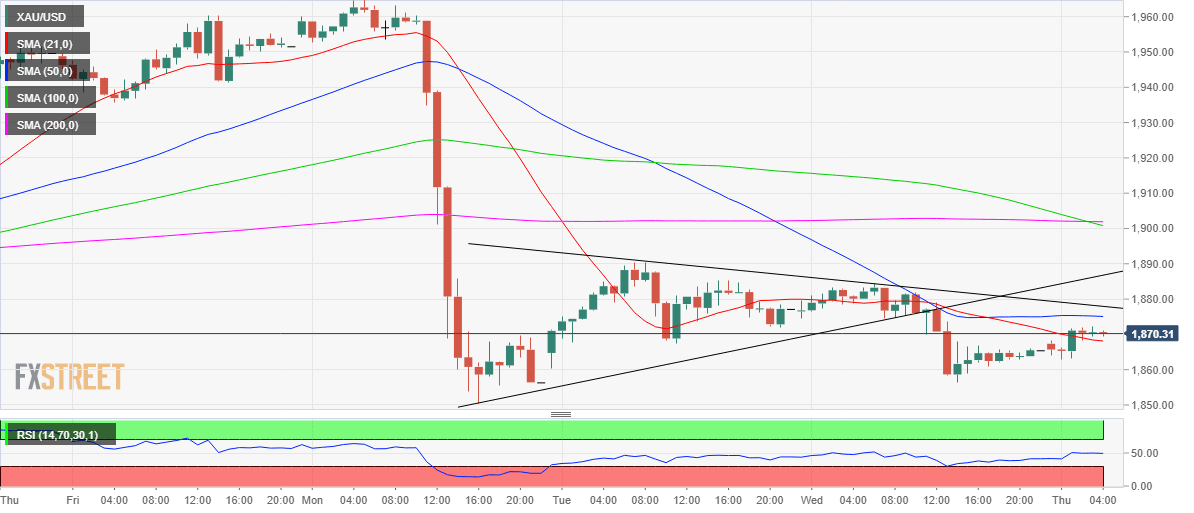

Gold: Short-tern technical outlook

Hourly chart

Gold’s hourly chart confirmed a symmetrical triangle breakdown on Wednesday. The price is attempting a minor recovery but remains vulnerable amid a bearish crossover spotted on the said timeframe.

The 100-hourly moving average (HMA) pierced the horizontal 200-HMA from above, suggesting that the downside appears more compelling and a retest of the critical $1850 support is likely on the cards. A breach of the last could see the $1800 level at risk.

Alternatively, 50-HMA at $1875 offers immediate resistance, with the $1901 level emerging as the tough nut to crack.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.