Gold Price Forecast: XAU/USD eyes US ADP report and Fed Minutes for next push higher

- Gold price turns defensive near $2,650 early Wednesday, awaiting US ADP and Fed Minutes.

- The US Dollar pauses upswing alongside Treasury bond yields despite a softer risk tone.

- Gold price looks north amid a firm break above 50-day SMA and as RSI regains positive territory.

Gold price is consolidating the previous rebound near $2,650 early Wednesday, awaiting the US ADP jobs report and the Minutes of the US Federal Reserve (Fed) December meeting for the next leg higher.

Gold price turns lower amid hawkish Fed expectations

Following the latest upbeat US economic data releases, Gold price fails to sustain at higher levels, courtesy of the hawkish expectations surrounding the Fed. The JOLTS survey showed Tuesday that US job openings in November climbed to 8.098 million, outpacing forecasts for a 7.7 million growth and higher than October's 7.839 million print.

Markets have priced out an interest rate cut by the Fed this month while the odds for a 25 basis points (bps) reduction in March stand at only 37%, according to the CME Group’s FedWatch Tool. The US Treasury bond yields continue to ride higher on the Trump trade optimism and hawkish Fed bets, limiting the upside attempts in the non-yielding Gold price.

US President-elect Donald Trump takes office on January 20, and his proposed tariffs and protectionist policies are seen as inflationary, calling for higher interest rates and a stronger US Dollar.

However, the US Dollar has paused its previous upswing, lending some support to Gold buyers. Nevertheless, China’s economic concerns and sagging physical Gold demand from India will continue to act as headwinds for the bright metal. Domestic Gold prices have surged due to the rapid depreciation of the Indian Rupee (INR) to record lows, making Gold purchases expensive for locals.

If risk aversion gathers pace amid renewed geopolitical tensions in the Middle East or tariff threats from incoming US President Donald Trump, global stocks will likely come under fresh selling pressure, lifting the haven demand for the Greenback and Gold price.

However, the upcoming US ADP Employment Change data and the Fed Minutes appear as the main event risks for Gold price in the session ahead. The US private sector is seen adding 140K jobs in December after reporting a 146K job gain in November. Surprisingly strong jobs data and hawkish Fed Minutes could reverberate hawkish Fed bets, negatively impacting the non-interest-bearing Gold price.

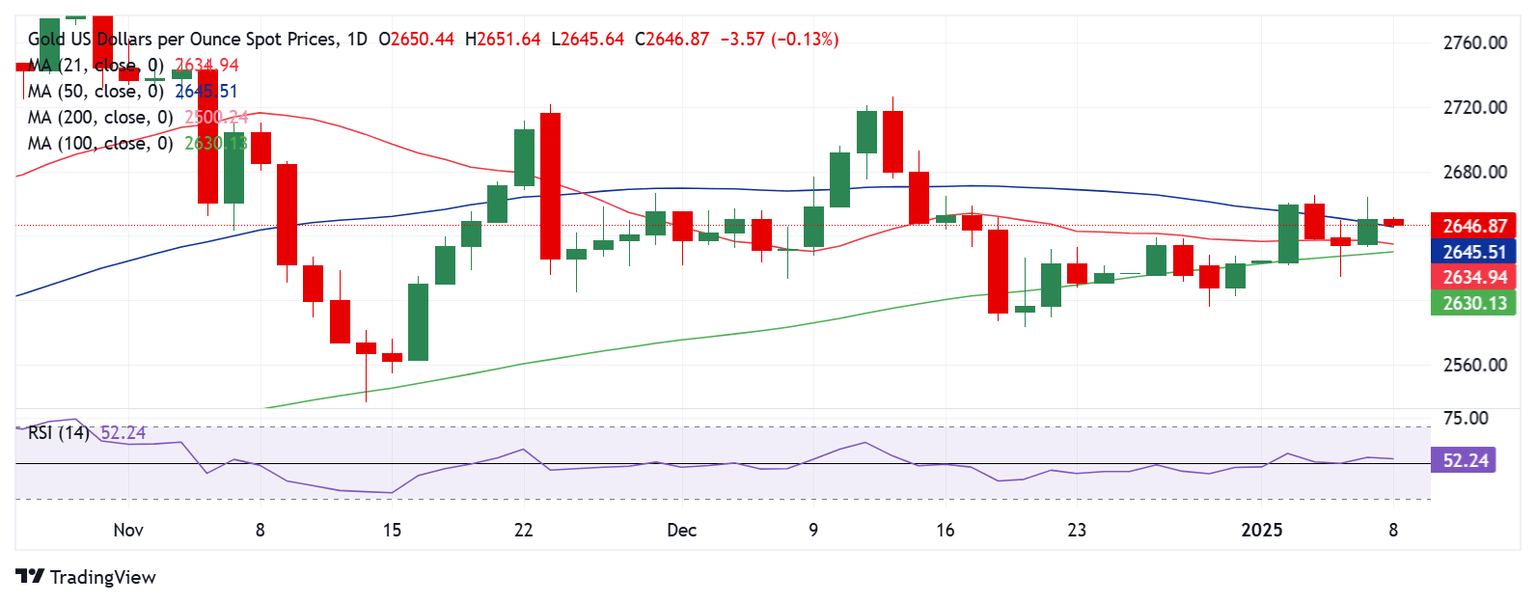

Gold price technical analysis: Daily chart

The daily chart shows that the 14-day Relative Strength Index (RSI) holds modestly flat, just above the 50 level, suggesting that the Gold price upside remains intact.

At the moment, Gold price defends the 50-day Simple Moving Average (SMA) at $2,646 after closing above that barrier on Tuesday.

Gold buyers must take out the strong resistance at $2,665 to revive the recovery from the previous month’s low of $2,583.

Further up, the December 13 high at $2,693 and the $2,700 level will challenge bearish commitments.

Conversely, if the 50-day SMA resistance-turned-support caves in, the next downside cap aligns near $2,634, where the 21-day SMA and the 100-day SMA close in.

A breach of the latter could expose Monday’s low of $2,615. The last line of defence for Gold buyers is seen at the December 30 low of $2,596.

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.Next release: Wed Jan 08, 2025 19:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.