Gold Price Forecast: XAU/USD eyes acceptance above $2,500, as US jobs data looms

- Gold price takes a breather after a three-day downtrend, awaiting US jobs data.

- The US Dollar stays weak with Treasury bond yields, despite US and China woes-led risk-aversion.

- Gold price bounces off key 21-day SMA, a rebound in the offing amid bullish daily RSI.

Gold price is treading water below the $2,500 threshold in Asian trading on Wednesday, with sellers catching their breath after three consecutive days of decline and ahead of the highly-anticipated US Job Openings data for July.

Gold price awaits US jobs data for fresh cues on Fed policy

Gold price is consolidating the previous sharp bounce from eight-day lows of $2,473, as Asian traders react to the weak US Institute for Supply Management (ISM) Manufacturing PMI data, which raised concerns over a potential ‘hard-landing for the US economy.

The ISM announced on Tuesday that its headline US Manufacturing Index improved slightly to 47.2 in August from July’s 46.8 but remained in contraction while coming in below the estimated 47.5 print. Soft US data ramped up bets for a 50 basis points (bps) interest-rate cut by the US Federal Reserve (Fed) this month.

Markets raised odds of a 50 bps Fed rate cut on September 18 to 38% from 31% a day earlier, according to the CME Group's FedWatch Tool. Currently, the probability of such a move stands at 41%.

Increased bets of aggressive policy easing by the Fed is likely to keep the demand for the non-interest-bearing Gold price afloat, allowing buyers to regain control.

Additionally, Gold price could also draw support from hopes of fresh policy support measures due on the cards from China, following a string of disappointing business PMI data. On Wednesday, China’s Caixin Services PMI dropped to 51.6 in August versus July’s 52.1 and 52.2 forecast.

Looking ahead, if risk-aversion intensifies and bolsters the haven demand for the Japanese Yen (JPY), Gold price and US government bonds, the US Dollar (USD) could come under fresh selling pressure, courtesy of the JPY advance-led sell-off in the USD/JPY.

However, the US Job Openings Survey data could provide fresh hints in determining the size of the September Fed rate cut, which would have a significant impact on the US Dollar trades and the USD-denominated Gold price.

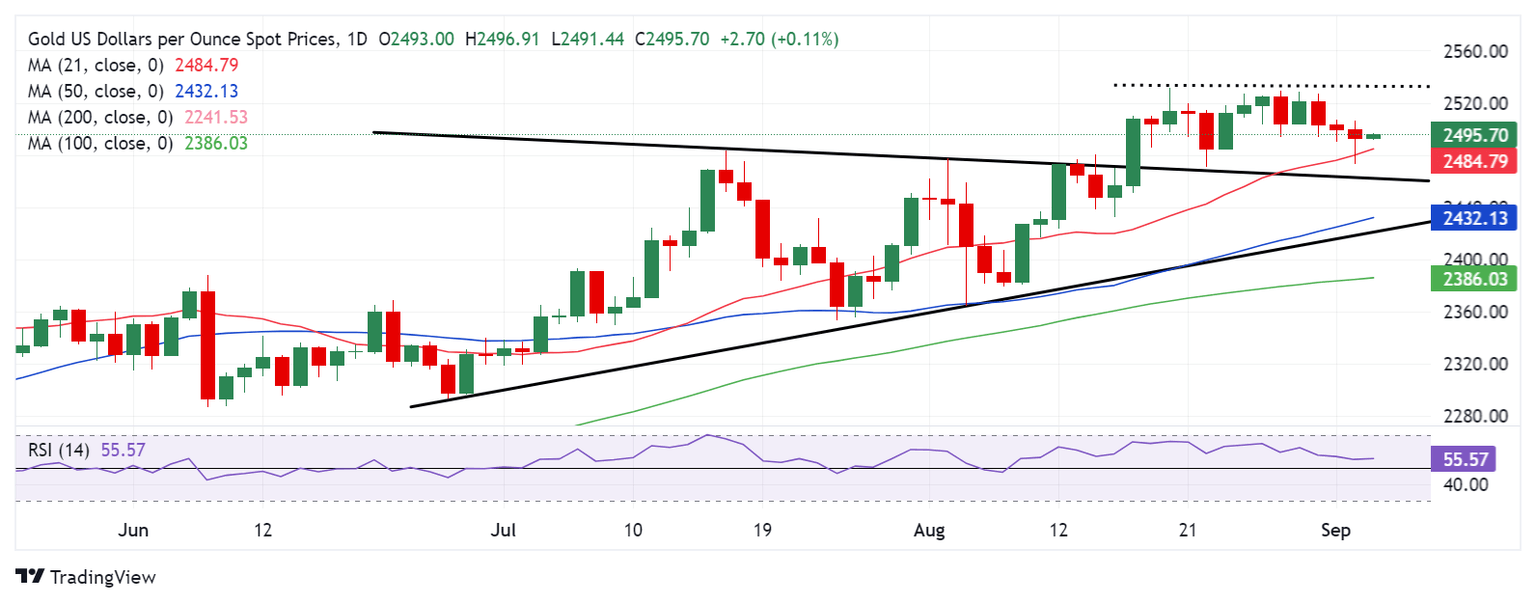

Gold price technical analysis: Daily chart

The short-term technical outlook for Gold price remains constructive so long as buyers hold above the 21-day Simple Moving Average (SMA) at $2,485.

The 14-day Relative Strength Index (RSI) has rebounded slightly while above the 50 level, suggesting that an upswing looks likely going forward.

On the upside, recapturing the $2,500 level on a daily closing basis is critical for Gold price to resume its upward trajectory. The next relevant topside barrier is seen at the record high of $2,532, above which the $2,550 psychological level will be tested.

If the corrective downside regains momentum, Goild price could challenge the 21-day SMA at $2,485 once again, below which the symmetrical triangle resistance-turned-support at $2,462 will come into play.

A fresh downtrend would initiate below that support level, with sellers aiming for $2,425 area, where the triangle support line and the 50-day SMA close in.

Economic Indicator

JOLTS Job Openings

JOLTS Job Openings is a survey done by the US Bureau of Labor Statistics to help measure job vacancies. It collects data from employers including retailers, manufacturers and different offices each month.

Read more.Next release: Wed Sep 04, 2024 14:00

Frequency: Monthly

Consensus: 8.1M

Previous: 8.184M

Source: US Bureau of Labor Statistics

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.