Gold Price Forecast: XAU/USD eyes acceptance above $2,000 amid bullish technical setup

- Gold price is trading on the front just shy of $2,000 amid thin trading on Black Friday

- The US Dollar eases, as Hamas-Israel truce begins, US Treasury bond yields recovery extends.

- Gold buyers stay hopeful on the back of a bullish technical setup on the daily chart.

Gold price is trading listlessly just shy of the $2,000 mark on Black Friday, in the wake of the lull that follows Thanksgiving Day. However, attention turns toward the S&P Global Preliminary Manufacturing and Services PMI data from the United States (US) for some fresh directional impetus on Gold price.

Gold price could break through $2,000 on Black Friday

Another day of range trading could unfold for Gold price, as American traders are mostly away enjoying their extended Thanksgiving holiday break. That said, thin liquidity conditions could trigger a volatility spike in Gold price, especially as we head into the weekly close. The end-of-week flows and reaction to the US PMIs are also likely to be the key catalysts impacting Gold price in the day ahead.

US S&P Global Manufacturing PMI is seen contracting to 49.8 in November, compared with a 50.0 figure registered in October. The Services PMI is expected to drop to 50.4 in the reported period vs. the previous reading of 50.6. Any fresh signs of weakening US economic resilience is likely to bolster the dovish Fed expectations, smashing the US Dollar further while providing the much-needed boost to Gold price.

In the meantime, the prevalent cautious market mood offers no incentives to Gold price. Expectations of the Federal Reserve (Fed) interest rate cuts next year continue to keep Gold buyers hopeful but the renewed strength in the US Treasury bond yields and easing geopolitical tensions between Hamas and Israel could keep any upside attempts in check. The first truce since the war between Israel and Hamas started on Friday morning, which means fighting in the Gaza Strip is set to cease for four days in exchange for Hamas releasing 50 of 240 people it took as hostages.

Gold price technical analysis: Daily chart

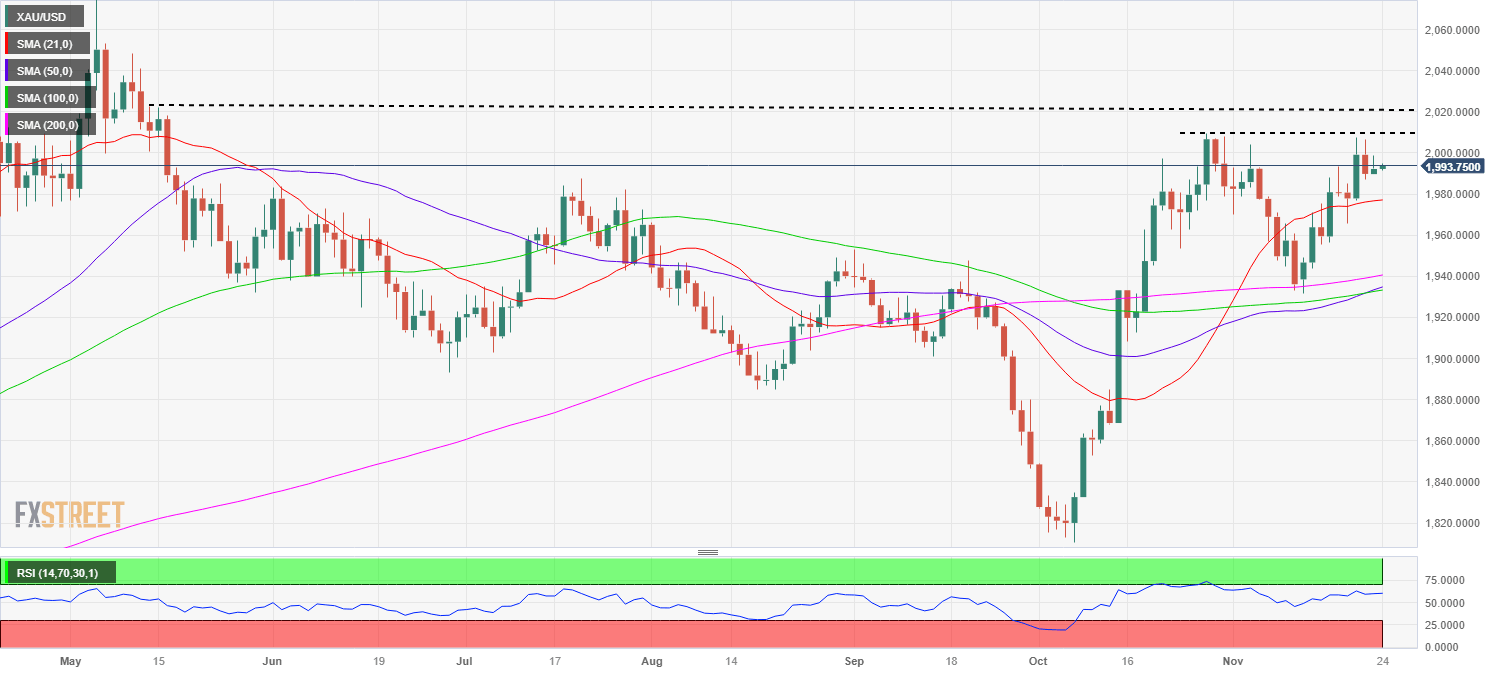

The path of least resistance appears to the upside for Gold price, as portrayed by a bullish technical set up on the daily chart.

Wednesday’s 50-day Simple Moving Average (SMA) and 100-day SMA Bull Cross confirmation combined with a bullish 14-day Relative Strength Index (RSI) keep the door open for further upside.

However, Gold price needs a daily closing above the $2,000 threshold to sustaining a meaningful uptrend, with the immediate resistance seen at the multi-month high of $2,009. Fresh buying opportunities are likely to emerge above the latter, calling for a test of the mid-May high near $2,020.

On the flip side, the immediate support is seen at the 21-day SMA of $1,977, below which the $1,955-$1,950 region could come to the rescue of Gold buyers.

A convincing break below that confluence zone could threaten the November 14 low at $1,944, beolw which the ascending 200-day SMA at $1,941 will be aimed for.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.